Monday Mining Metrics: Record Year for Bitcoin Miners

Bitcoin Mining Update: 8/4/2025

Monday Mining Metrics: Record Year for Bitcoin Miners

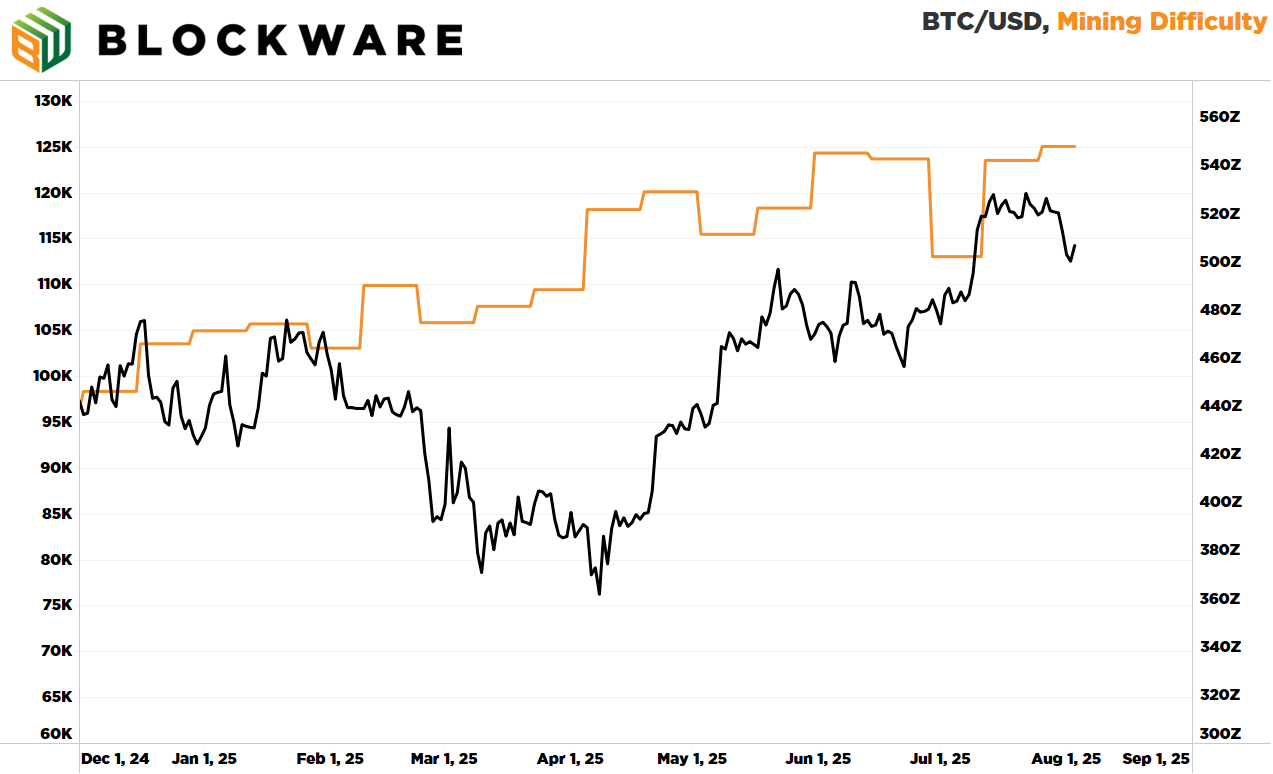

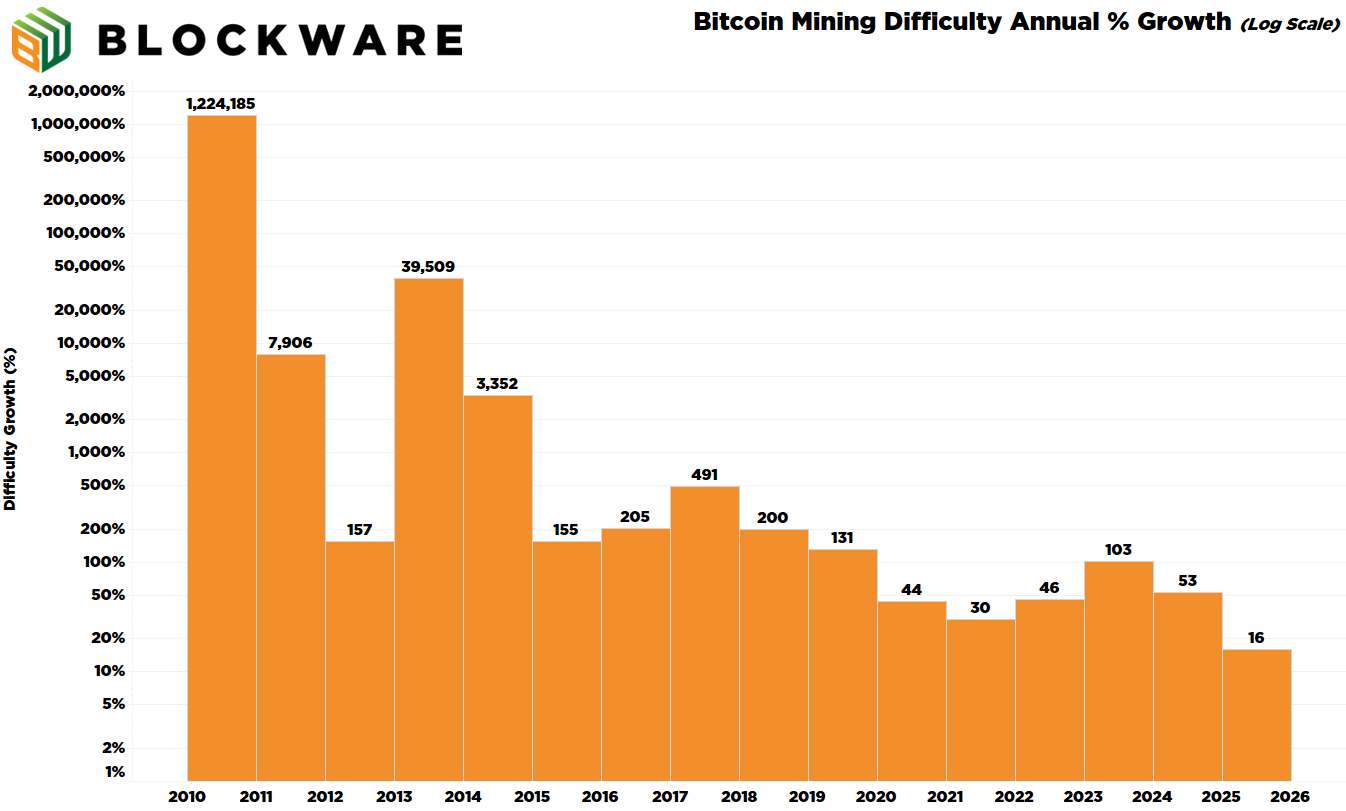

Since June 1st of this year, mining difficulty is up ~0.5%. Less than 1% net-growth in mining difficulty across a 2-month span adds credence to our on-going hypothesis about the slowing down of mining difficulty growth. This is bullish for Bitcoin miners as it means less competition for the 450 BTC that are mined daily. Mining growth will continue to slow down for three primary reasons:

Mining Hardware Reaching Moore’s Law Limit

Physical Infrastructure & Energy Production as the Bottleneck for Growth

Data Center Operators Diversifying into High Performance Computing / AI

Year-to-date, Bitcoin mining difficulty is up only 16%. 2025 is on pace to have the slowest growth for mining difficulty in Bitcoin history. Right now it’s barely 1/10th of the growth rate from 2023.

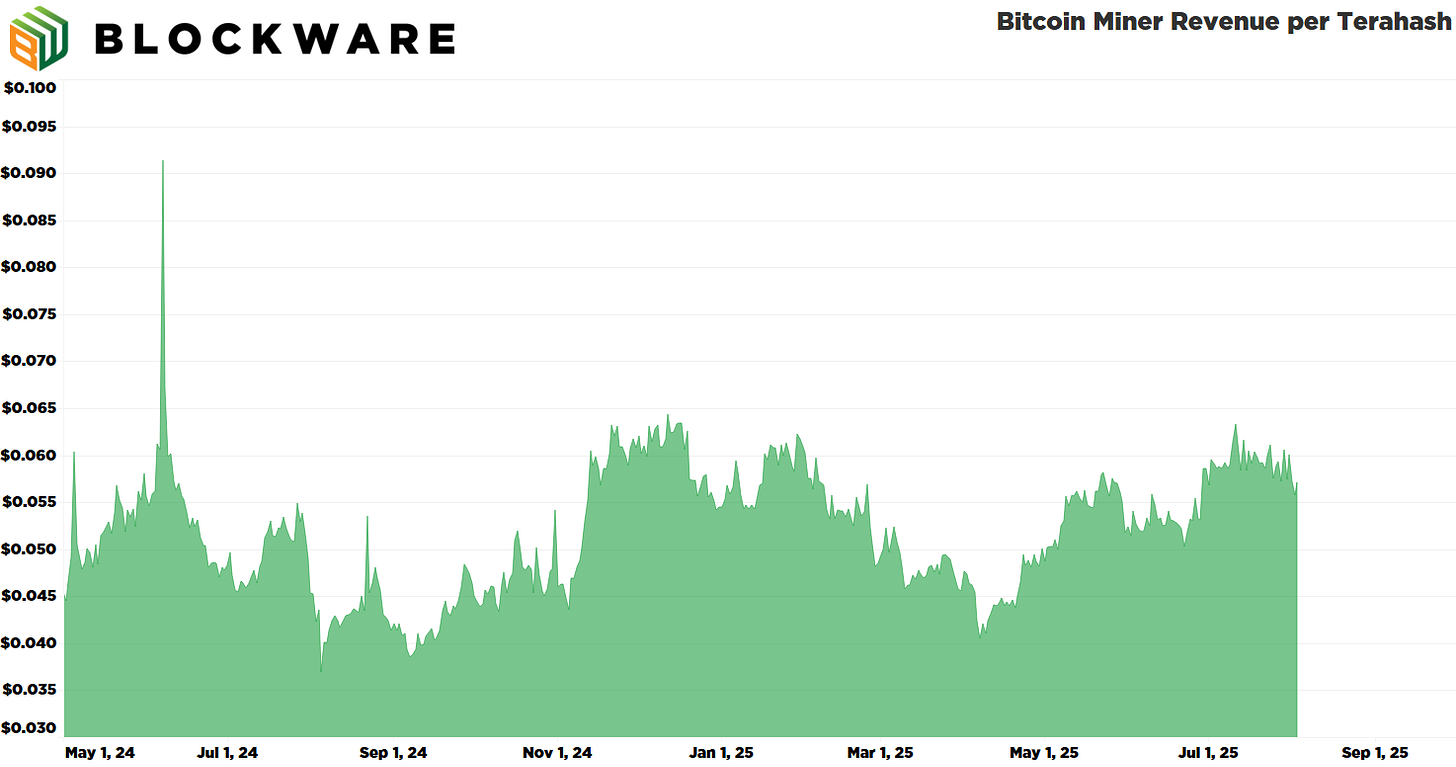

A slowdown in difficulty growth rate has allowed Bitcoin miners to remain consistently profitable since the last Bitcoin Halving in April 2024. Over the past few months, hashprice, measured in Dollars per Terahash per Day ($/TH/Day), has held steady between $0.057 and $0.060.

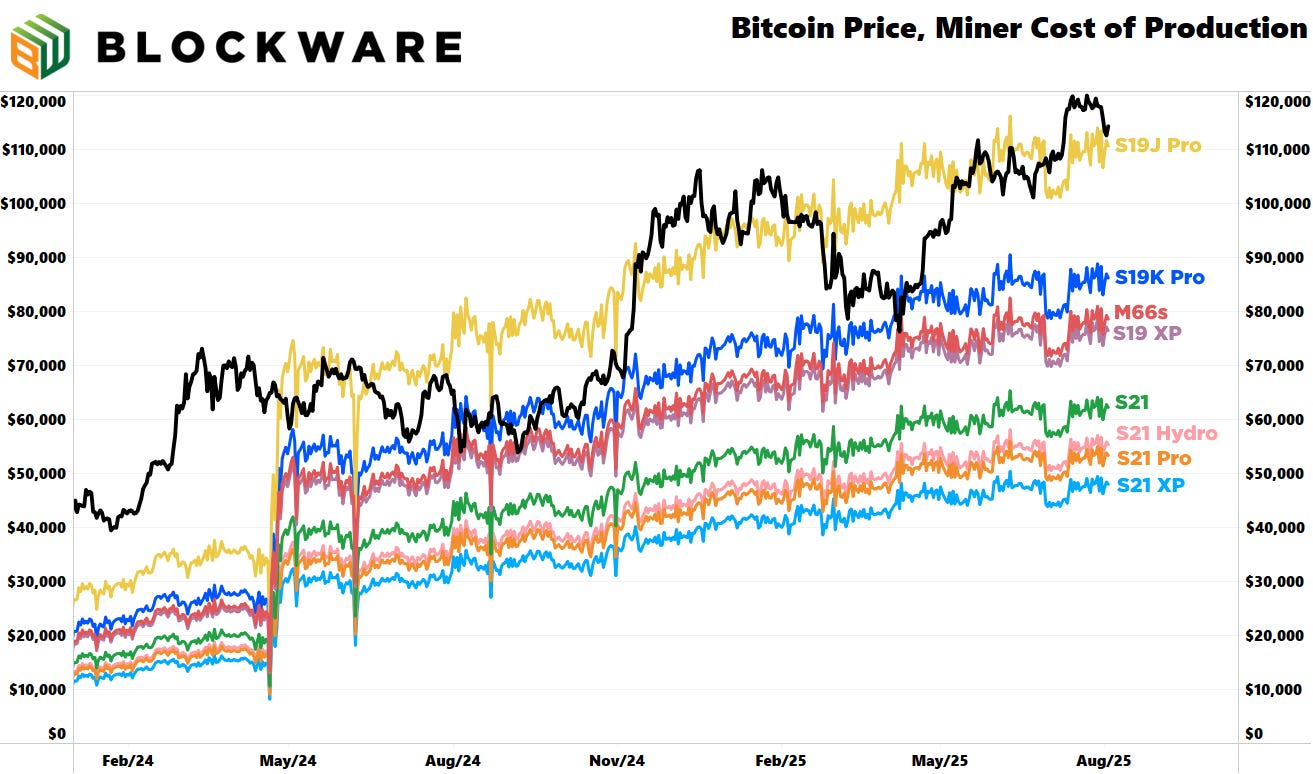

While BTC/USD steadily climbs higher into six-figure territory, Bitcoin miners continue to arbitrage compute and energy to produce BTC at a significant discount to the market price.

Right now an S21 XP hosted at Blockware's site is producing 1 BTC for ~$55,000 in electricity.

Sign up for a free 30-minute consultation to learn more about Bitcoin Mining with Blockware: mining.blockwaresolutions.com/consult

Besides producing BTC at a major discount to the market price, another benefit of Bitcoin mining is 100% depreciation of the hardware costs. Tax benefits + BTC accumulation; this is how generational wealth is created.