Monday Mining Metrics: Riot to Acquire Bitfarms

Bitcoin Mining Update - 5/28/2024

Riot Platforms Acquisition of Bitfarms

In an aggressive move, Riot Platforms ($RIOT) has offered to buy 100% of Bitfarms ($BITF) outstanding shares at $2.30 per share. According to Riot, this acquisition would make them the world’s largest publicly listed Bitcoin mining company.

$BITF is up 7% on the day, to $2.17 per share, as the market prices in the news and likelihood of the proposed deal being finalized. Riot is the largest holder of Bitfarms common shares with 9.25% of the float. They’ve expressed concerns about the integrity and commitment of current Bitfarms board members; believing that they are not acting in the best interests of Bitfarms shareholders.

In their press release, Riot cites the geographical distribution of Bitfarm’s mining facilities as one of the primary reasons for the proposed acquisition. Riot currently operates two mining facilities. Although they are massive, with their Rockdale facility being the largest known Bitcoin mine in the world, both facilities are located in the state of Texas. The acquisition of Bitfarms will provide Riot with more diversified operations, hedging its business from the political or geographical risks that are present with centralized operations.

Mining Difficulty to Hit New All-Time High

Mining difficulty is projected to increase by more than 6% at the next adjustment, approximately seven days from now. This will bring difficulty to a new all-time high, completing the recovery of the post-halving 5.6% negative difficulty adjustment.

With Bitcoin at nearly $70,000 per coin and likely to rise further, the mining industry is as competitive as it has ever been; in spite of the block reward being as low as it’s ever been.

We are entering the golden years of Bitcoin mining. Roughly 1,100,000 coins will be mined over the next twelve years, bringing the total circulating supply to ~20,830,000. After that, the remaining ~170,000 Bitcoin will get mined over the course of more than 100 years.

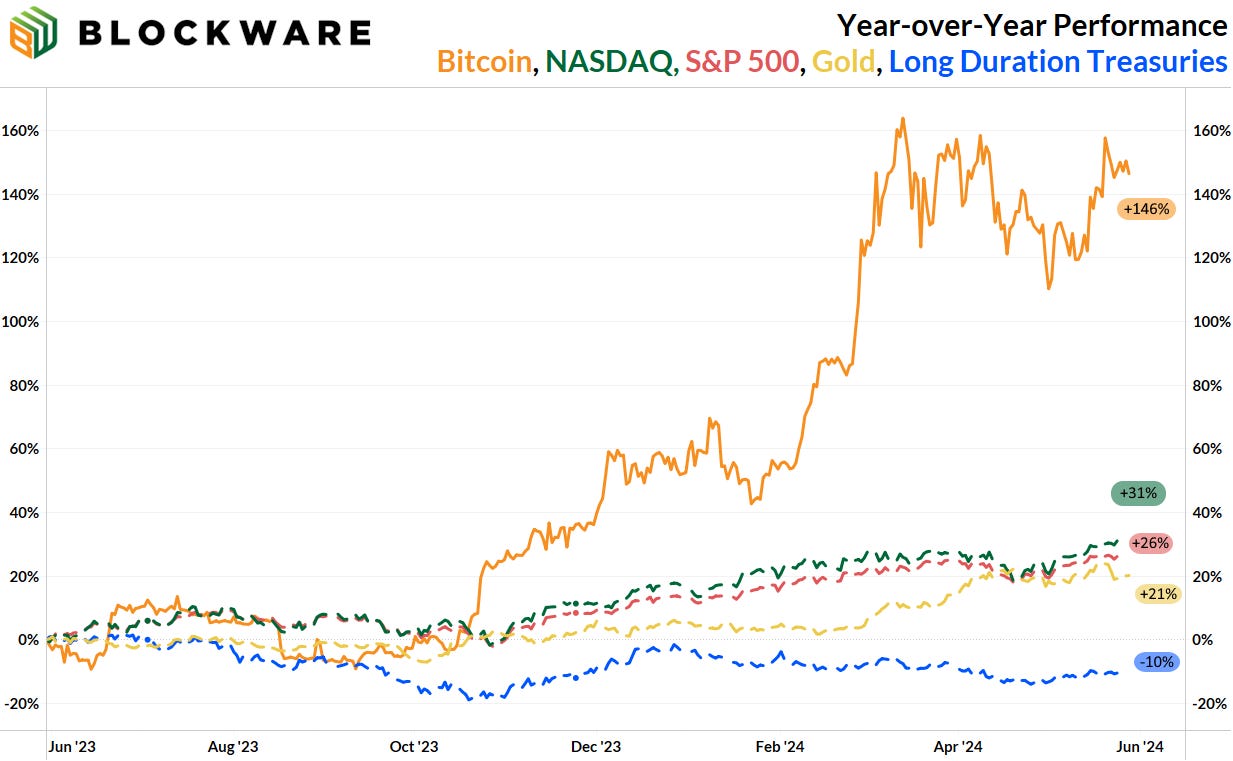

BTC Outperforming Other Assets

There is a heavy correlation across risk-assets in the current macro environment, and Bitcoin has been the best performer of the bunch. Over the past year, BTC is up ~146% while the Nasdaq and the S&P are up ~31% and ~26% respectively. Meanwhile, gold is up a mere 21%, and “safe-haven” US treasuries are down 10%.

Bitcoin miners are not only capturing the upside of the rising Bitcoin price, but they can produce profits during periods of sideways consolidation.

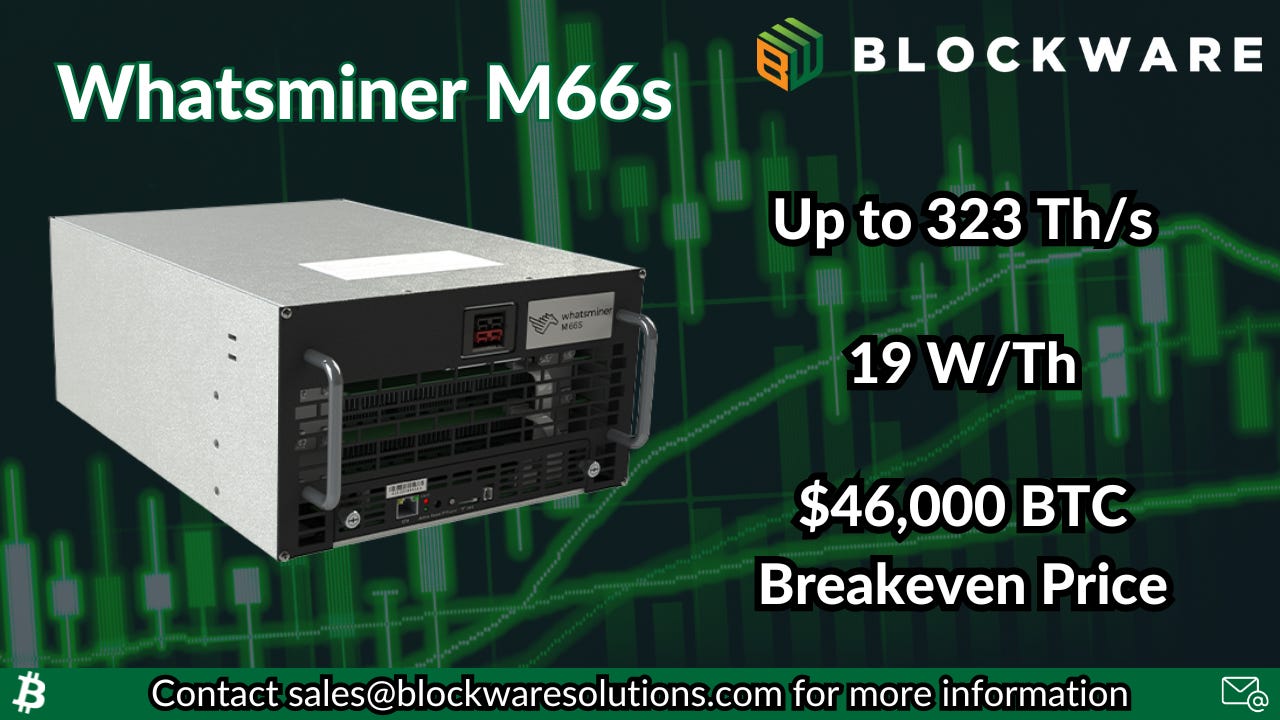

Next-Generation Immersion Mining

You’re running out of time to get into Blockware’s next batch of Whatsminer M66s. With mining difficulty ramping up, acquiring ASICs that are powerful, efficient, physically durable, and operate at a low electricity cost, are paramount for success.

The M66s, being an immersion machine, is much more powerful than your typical air-cooled ASIC. The M66s is sold as a 288 Th/s machine, but when operating in “high-performance mode”, it can reach up to 323 Th/s! Moreover, immersion machines have a much longer usable lifespan than air-cooled; which means future repairs and/or hardware upgrades are less likely.

Blockware Direct ASIC Pricing with Hosting

For those seeking to purchase ASICs in bulk (with or without hosting), contact sales@blockwaresolutions.com or reach out here.

We can help you secure all of the top ASICs currently on the market.

All machines are new and payment includes tariffs, duties, and shipping.

Contact sales@blockwaresolutions.com or reach out here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.