Monday Mining Metrics: Save Millions with Bitcoin Mining

Bitcoin Mining Update - 9/1/2025

Monday Mining Metrics: Save Millions with Bitcoin Mining

This week on The Blockware Podcast, Mitchell Askew interviewed Arniel Sia, CPA and Founder of Open Path Finance. They dive deep into the tax implications of Bitcoin mining — bonus depreciation, offsetting W2 income, business income, capital gains, and more.

This 30-minute conversation provides a succinct yet detailed overview of how Bitcoin Mining is a unique and advantageous tool when it comes to minimizing your tax liabilities. Stack Bitcoin and reduce your taxes — what’s not to love?

Check it out!

BTC Mining vs Real Estate

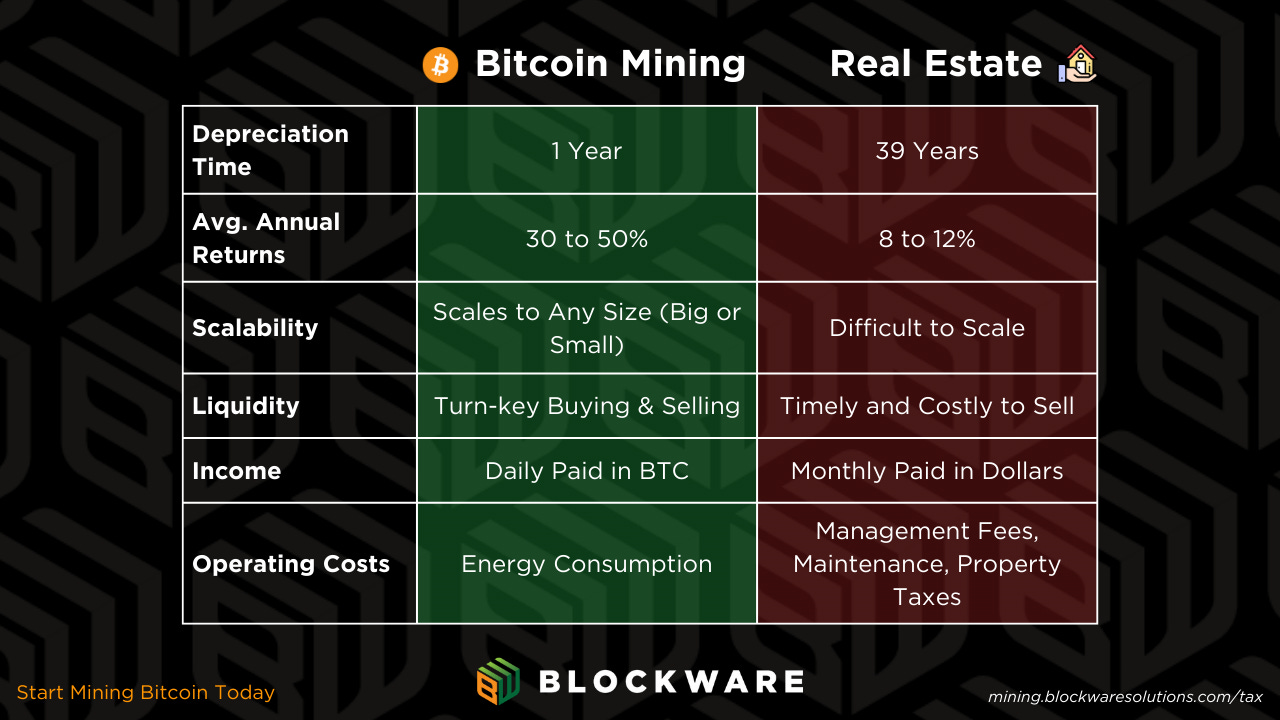

The best asset-class comparison for Bitcoin Mining is Real Estate:

Free Cash Flow

Depreciation to Offset Income

‘Hard Asset’ to Hedge Against Inflation

Click here to learn more about the tax benefits of Bitcoin Mining with Blockware.

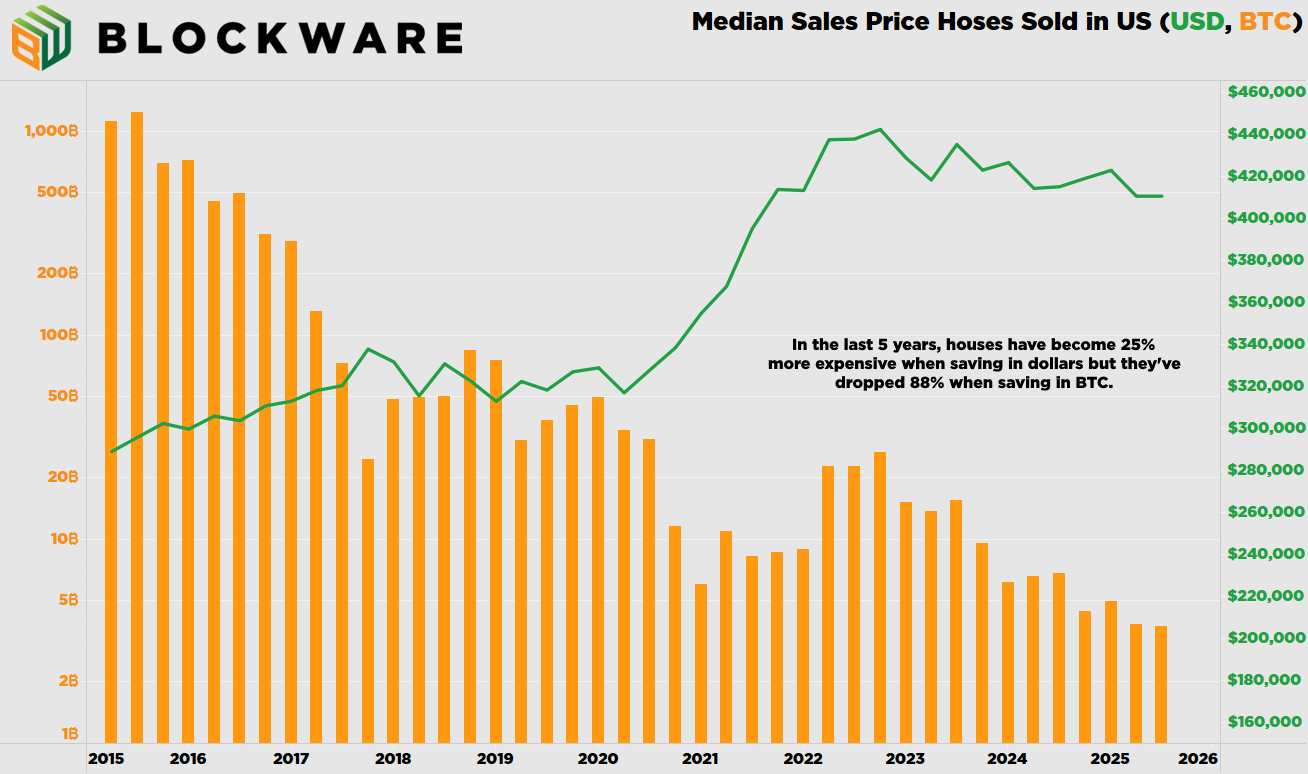

However, Bitcoin Mining outshines across the board: higher returns, faster depreciation schedule, more liquid, more scalable, fewer operational risks. Moreover, Bitcoin Mining allows you to accumulate the best performing asset of the past decade: BTC. Over the past 1 year, 3 years, 5 years, and 10 years, BTC has significantly outperformed real estate – with the average home value down ~88% in BTC terms since Q2 2020.