Monday Mining Metrics: Tax Saving Strategy Explained

Bitcoin Mining Update - 9/22/2025

Monday Mining Metrics: Tax Saving Strategy Explained

The Blockware team’s latest video provides a deep-dive on Bitcoin Mining as a tax saving strategy.

How does this work?

100% of the cost of Bitcoin mining hardware can be deducted in a single-tax year. This is a great way to offset W2 or Business Income.

Purchase Miners Hosted with Blockware

Deduct Cost of Miners

Generated BTC-Cash Flow with Miners

Who can do this?

In the United States, everyone! Blockware has clients all across the globe, but US-Based Miners specifically qualify for 100% depreciation.

What else?

In order to qualify for 100% depreciation, you must be able to demonstrate that 100 hours (or more) have been dedicated to your Bitcoin Mining business in 2025. Consuming educational Bitcoin content, strategizing with a member of the Blockware team, setting up a new Bitcoin wallet, etc. — any activity that you engage in related to Bitcoin mining — counts towards the 100 hours. There’s only 3 months left in the year, so if you’re not close yet, you better get started!

Produce BTC at a Discount

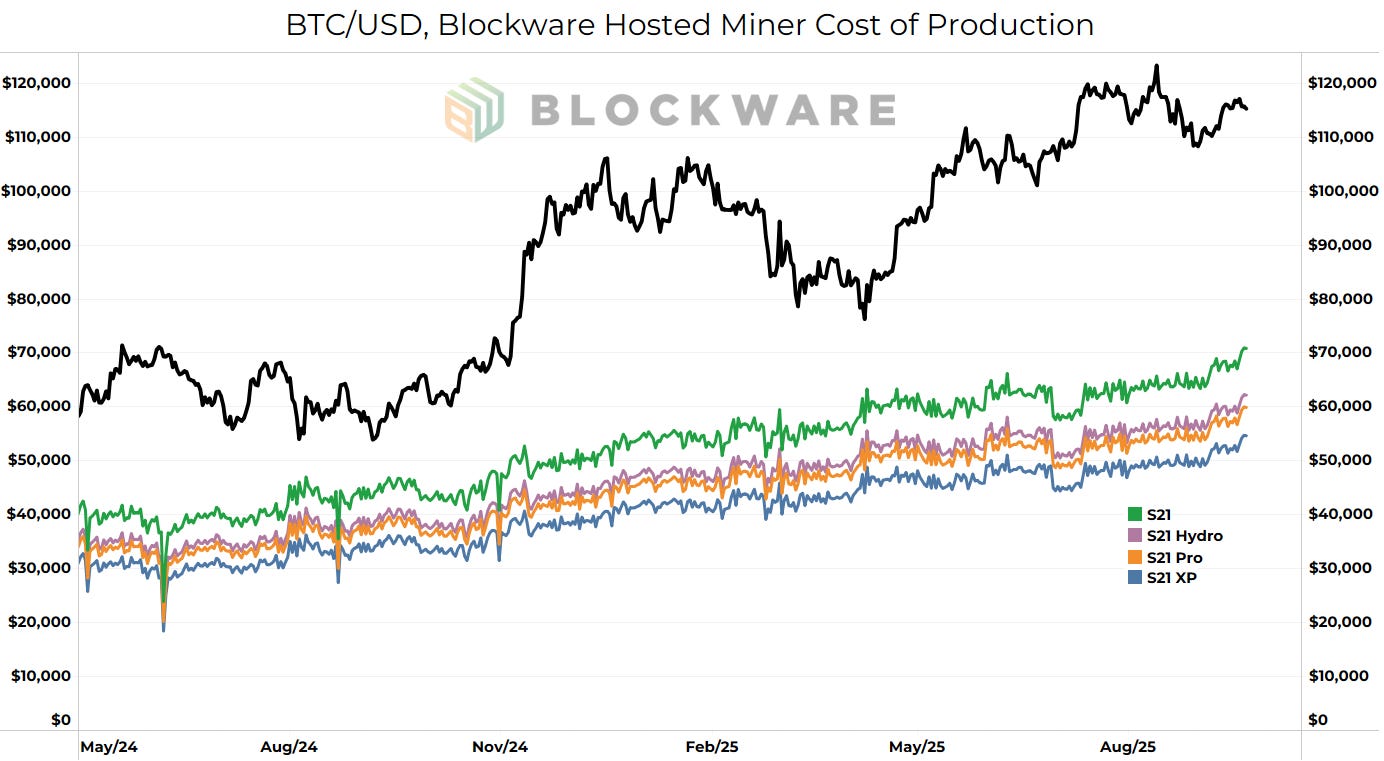

Mining difficulty is up ~4% this month, but miners hosted with Blockware are still producing BTC well below the current market price. Here’s the ‘Breakeven’ / ‘Cost of Production’ price per BTC for different miner types hosted with Blockware:

BTC — $113,000

S21 — $71,000

S21 Hydro — $62,000

S21 Pro — $60,000

S21 XP — $55,000