Monday Mining Metrics: The Bullish Case for Mining

Bitcoin Mining Update: 7/21/2025

The Bullish Case for Bitcoin Mining

Do you think the Bitcoin price can increase faster than humanity can build new data centers? If yes, you should be mining Bitcoin.

Bitcoin mining profitability is primarily a function of the Bitcoin price and mining difficulty. It’s easy for the Bitcoin price to quickly increase — an imbalance between supply and demand can cause the BTC price to rise virtually overnight. During a 3-week period in Q4 2024, BTC went from $60,000 to $90,000; a 50% increase. A similar % increase in mining difficulty takes much longer as it requires the development of real world mining infrastructure and energy production assets.

Over the past year, the Bitcoin price is up ~75% but mining difficulty is up only 50%. The trend holds true in shorter time frames as well. Year-to-date the BTC price is up~26% but mining difficulty is up a mere 15%. This trend is likely to continue between now and the 2028 halving; resulting in a net-increase in BTC mining profitability.

Mitchell Askew, Head of Blockware Intelligence, explains below in a 2-minute clip from the ‘What Bitcoin Did’ podcast.

Click below to watch the full interview.

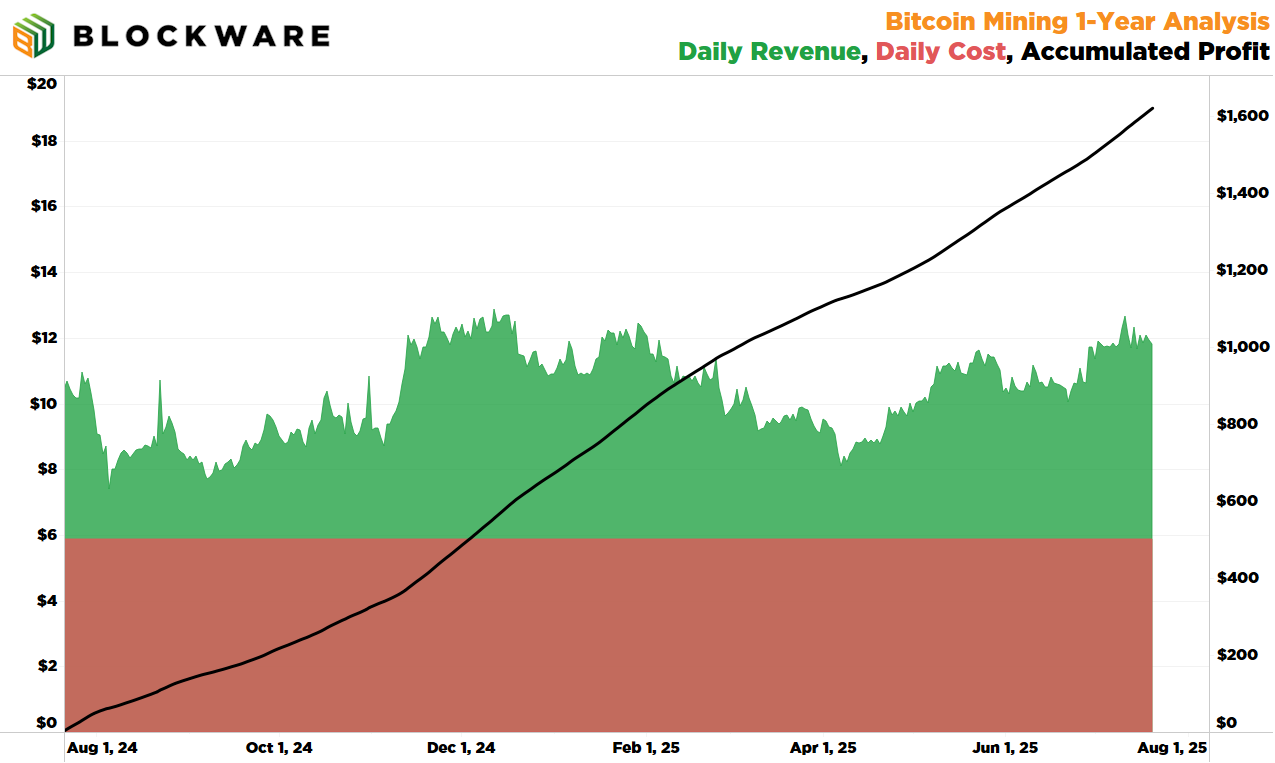

Mining Profitability: 1-Year Analysis

The chart below simulates the operation of an Antminer S21 starting on July 21, 2024; visually illustrating the profitability of Bitcoin mining.

Antminer S21 (200T, 17.5 W/T)

$5,200 Machine Purchase Price

BTC Sold Daily to Cover Electricity Expense (Surplus is HODL’d)

Electricity Rate of $0.07/kWh

In just 1-year, a single Antminer S21 has accumulated a net profit of ~$1,600 — an ROI of ~31%. Moreover, the daily profit margins of this miner are higher now than they were 1-year ago. Given the trends of BTC Price and Mining Difficulty, this miner’s profit margins will likely expand over the next 12-months as well.

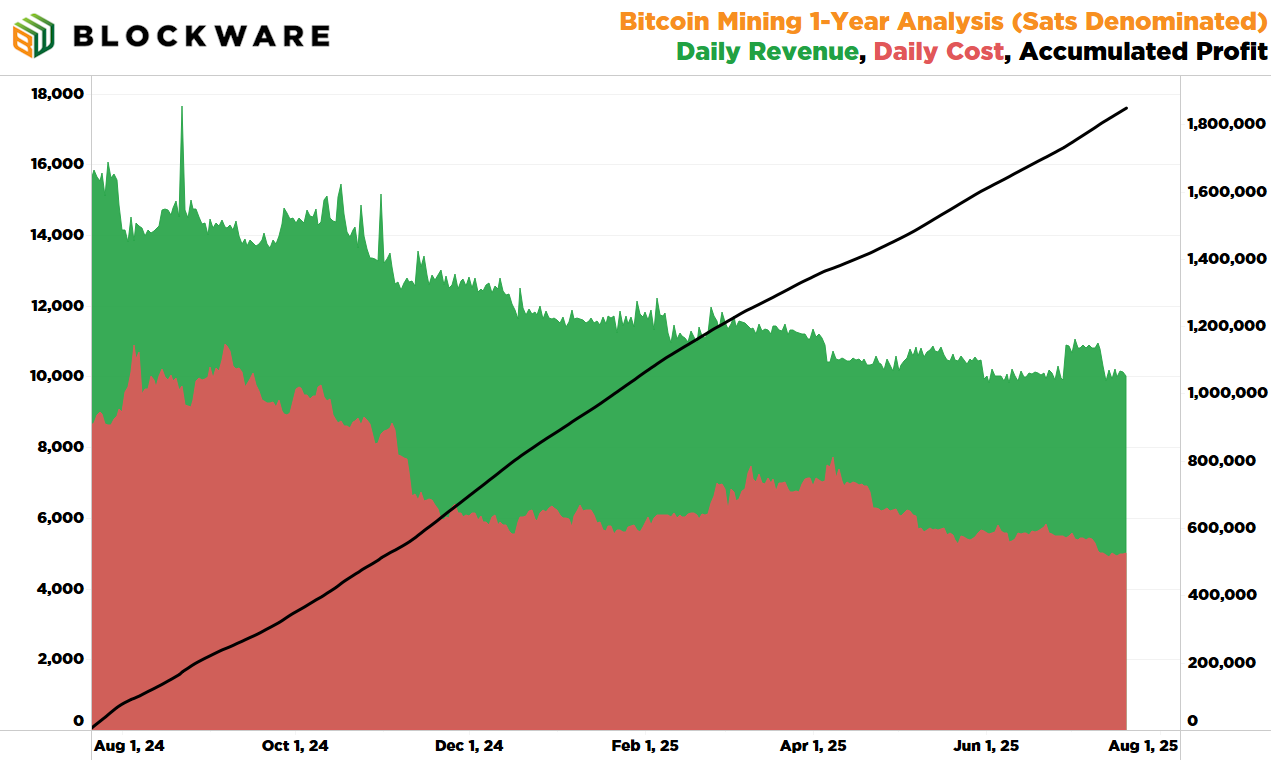

The chart below analyzes the performance of the same Bitcoin miner but measuring in BTC (sats) instead of USD. Even using BTC as the measuring stick the story remains the same: increasing profit margins and a high rate of return.

In Bitcoin terms this miner operating for 1-year returned ~25% of the BTC-denominated cost of the machine. If mining economics remain the same then this miner will earn more BTC over a 4-year period than an equivalent dollar-cost average strategy. However, a 100% BTC-denominated ROI could happen much sooner if BTC price continues to outpace mining difficulty.

Click here to schedule a free consultation with Blockware to learn more about Bitcoin mining.