Monday Mining Metrics: The Great Capitulation

Bitcoin Mining Update - 7/8/2024

Crunch Time for Bitcoin Miners - The Great Capitulation Continues

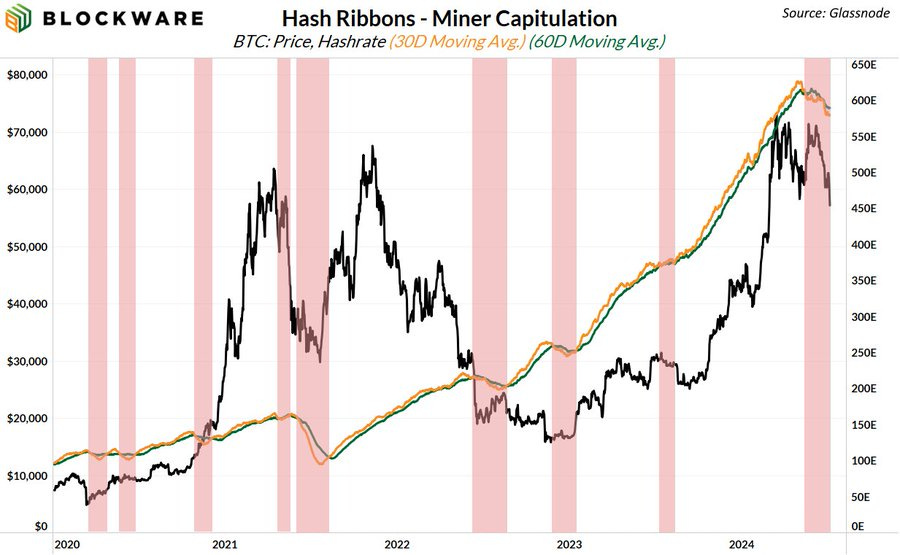

For nearly two months there has been a ‘miner capitulation’; the longest such period since 2022. A miner capitulation occurs when more hashrate is coming off the Bitcoin network than coming on. Capitulations are indicated by a series of consecutive negative difficulty adjustments and the flashing of the “hash ribbons” signal.

The capitulation is taking place as Bitcoin miners with outdated hardware and high electricity prices struggle to remain profitable following the 2024 halving and the recent decline in the price of Bitcoin. Fortunately for the bulls, miner capitulations have historically indicated local bottoms in the price of Bitcoin. Moreover, less competition bodes well for the other Bitcoin miners on the network.

After the 2020 halving, there was a miner capitulation that lasted nearly as long as the current one. At the end of that capitulatory period, the price of BTC was $9,000 per coin… six months later it was greater than $30,000. 2024 has been objectively good for BTC price action (+27% YTD), now is not the time to turn bearish.

🚨Limited Time Offer: Discounted Bitcoin Mining🚨

The miners that are sitting pretty right now have high-powered, efficient ASICs with low-cost electricity. To maximize the success of our clients, Blockware has owned and partnered data centers that have electricity prices well below typical residential and commercial prices.

Our standard rate is $0.078/kWh, but for a limited time we are offering $0.074/kWh.

For more information, reach out to sales@blockwaresolutions.com

This offer is exclusive to Whatsminer M66s’s purchased on or before July 12, 2024.

The M66s uses a liquid-immersion cooling solution instead of the traditional air-cooled design. Immersion ASICs boast a few key advantages:

Increased Hashpower

Increased Physical Lifespan

Decreased Downtime

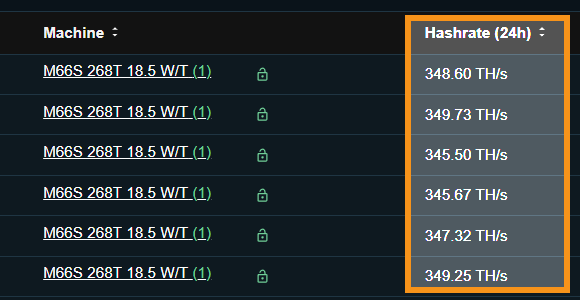

Liquid cooling allows ASICs to withstand the high temperatures of Bitcoin mining without overheating. Moreover, they have significantly higher hashrate. The M66s’s available through Blockware’s Marketplace are hitting nearly 350 TH/s. Comparatively, the latest-generation air-cooled ASICs reach ~200 TH/s.

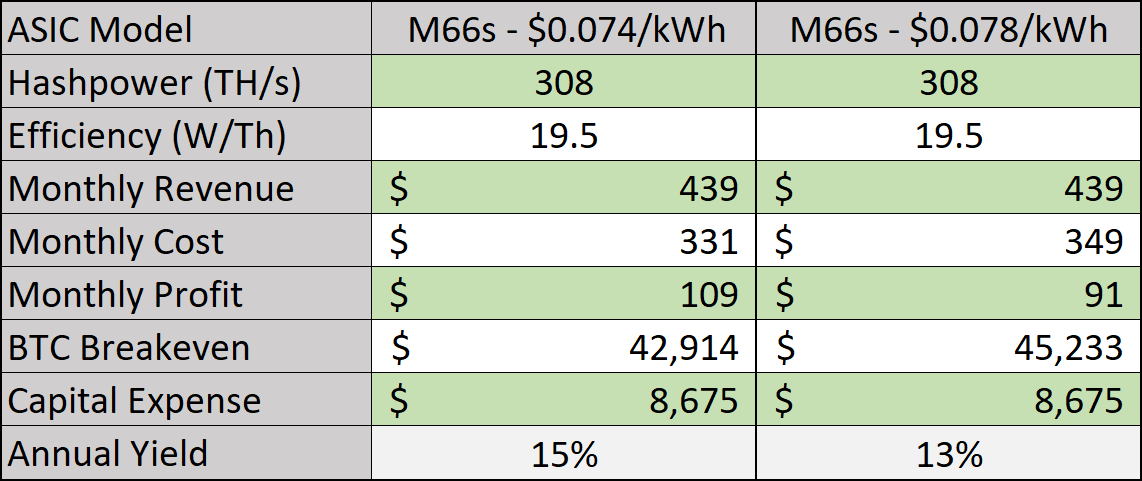

The chart below is a conservative estimate of the M66’s projected monthly revenue/cost structure; comparing a $0.074/kWh rate with a $0.078/kWh rate. Estimated profitability is due to go much higher if/when the BTC price begins to take off.

Profitability by ASIC Type

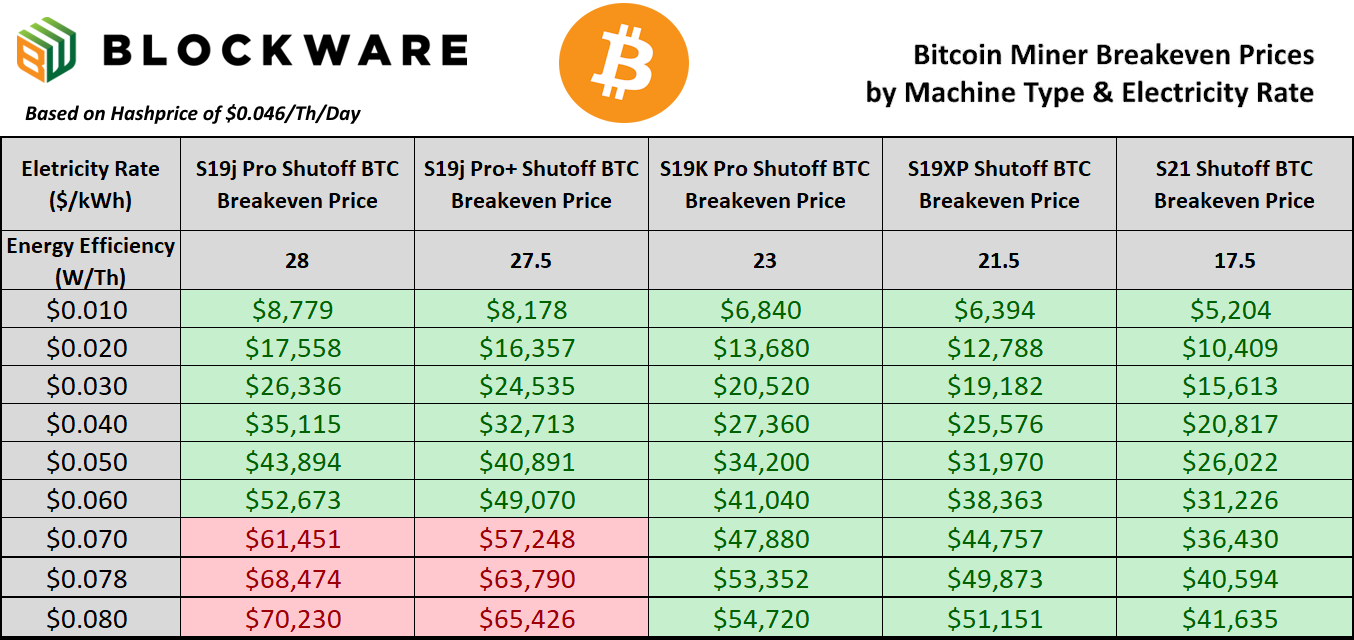

As BTC slips beneath $60,000, some machine + electricity combinations that were previously profitable are no longer (at least for now).

This is leading to a significant price discount for older-generation ASICs and a premium for new-generation ASICs. Depending on a miner’s risk tolerance, BTC price expectations, and available capital, it can be strategic to acquire older-generation, “out of the money” ASICs, due to the price discount. Should BTC rip, the older-gen machines will have shorter payback periods as well as potentially more capital appreciation.

Blockware Direct ASIC Pricing with Hosting

For those seeking to purchase ASICs in bulk (with or without hosting), contact sales@blockwaresolutions.com or reach out here.

We can help you secure all of the top ASICs currently on the market.

All machines are new and payment includes tariffs, duties, and shipping.

Contact sales@blockwaresolutions.com or reach out here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Thank You!