Monday Mining Metrics: The Hyper-Bullish Case for Bitcoin Mining

Bitcoin Mining Update - 3/25/2024

The Hyper-Bullish Case for Bitcoin Mining over the next 10 years:

The exponential rate at which mining difficulty is growing continues to diminish & the exponential rate at which the #BTC price is growing increases as we undergo peak monetization via Wall Street adoption.

The growth of BTC mining difficulty during each 4-year epoch has dropped significantly. Meanwhile, we are about to incur the S-Curve of the adoption of BTC as a monetary asset (trillion $ institutions pilling in)

Supply inelasticity and marginal price-taking mean that the price can increase at an incredibly fast pace. Mining difficulty, on the other hand, cannot grow nearly as quickly due to the real-world inputs and energy production necessary to hash.

Price will increase at a much faster velocity than hashrate/mining difficulty. Incumbent Bitcoin miners will be the biggest winners during this era as the price of BTC separates itself from the cost of production.

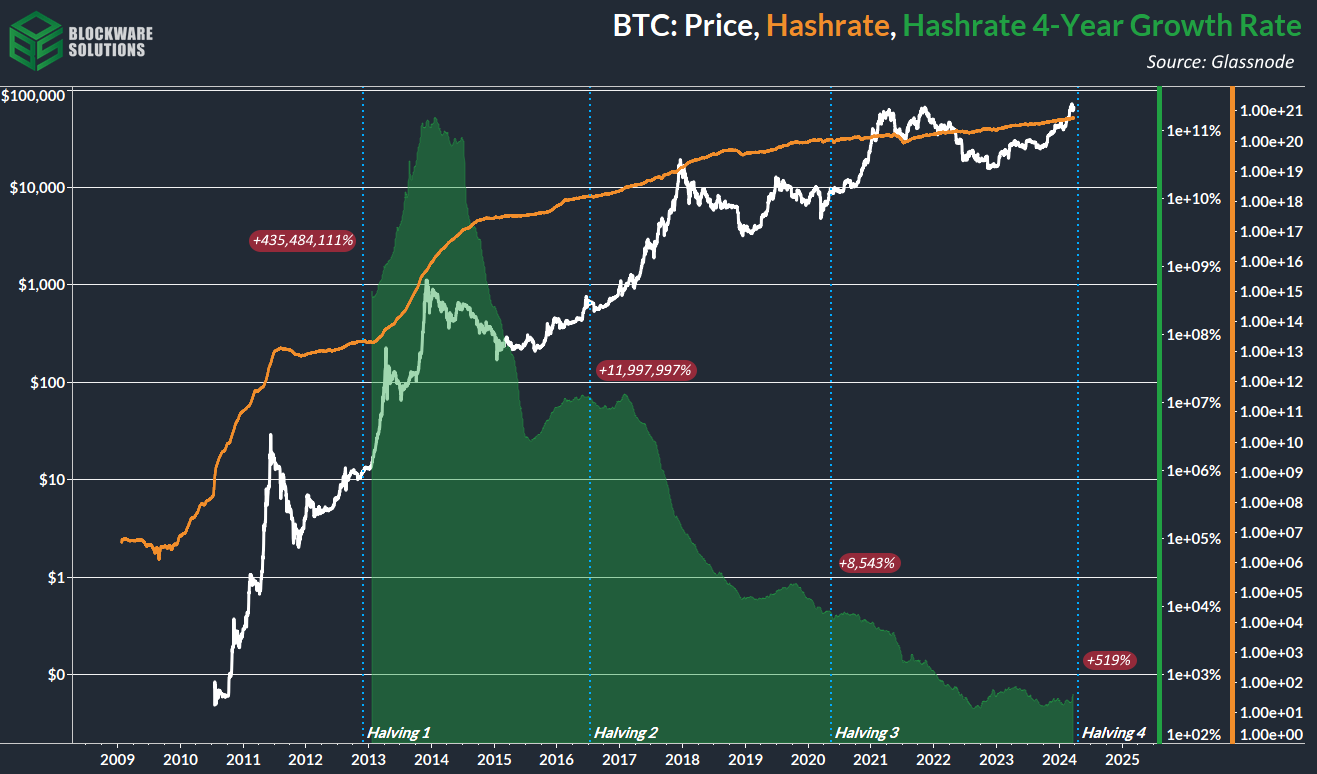

Notice the diminishing growth rate of mining difficulty for each epoch:

Epoch 0: +435 million %

Epoch 1: +11 million%

Epoch 2: +8,543%

Epoch 3: +519%

By 2035, 99% of the 21,000,000 will have been mined.

The next 11 years will be the glory days of #Bitcoin mining as BTC the asset undergoes peak monetization, while the growth rate of mining difficulty continues decelerating.

Mining Difficulty

Speaking of mining difficulty, the next projected adjustment is essentially flat. At the current pace of Bitcoin blocks, the 2024 halving should occur on April 20th, 2024.

Hashprice

With BTC back above $70,000 today, mining revenue is, of course, on the rise. Miners are earning ~10.8 cents per terahash per day.

Hashprice will take a tumble after the halving. However, our outlook for hashprice in 2024 remains bullish due to further appreciation in the price of BTC as well as a surge in on-chain demand driving up fee revenue for miners

Mining Update & Return of the Blockware Podcast

After a brief hiatus, the Blockware Team has returned to YouTube. Mitch, Danny, and Blake bring the heat in this signal-packed podcast.

They discuss the forthcoming ASIC supply squeeze, the Bitcoin halving, and expectations for this bull market.

Check it out!

Blockware Direct ASIC Pricing with Hosting

For those seeking to purchase ASICs in bulk (with or without hosting), contact sales@blockwaresolutions.com or reach out here.

We can help you secure all of the top ASICs currently on the market; Antminer S21s, S19 XPs, S19k Pros, and Whatsminer M50s.

All machines are new and payment includes tariffs, duties, and shipping.

Contact sales@blockwaresolutions.com or reach out here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.