Monday Mining Metrics: The Polar Vortex & Bitcoin Mining

Bitcoin Mining Update: 12/1/2025

Turning Taxes into Bitcoin — Live Webinar

Today is the last day of our Cyber Monday promotion. BUT… If you register for Blockware’s free live webinar below, you can still lock in a discounted electricity rate of $0.072/kWh.

Bitcoin mining can feel complicated and overwhelming. During this 1-hour live session, our team breaks everything down step-by-step so you can gain total clarity around the mining value proposition:

✅ Tax Savings

✅ Accumulating Bitcoin at a Discount

The second half of the webinar will include live Q&A, so bring your best questions.

👉 Register here:

https://mining.blockwaresolutions.com/webinar

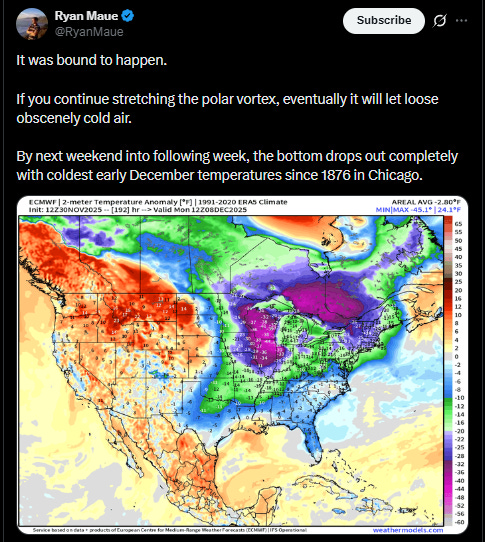

The Polar Vortex & Bitcoin Mining

A record-breaking cold front is expected to impact the United States over the coming weeks. Since roughly 35% of global Bitcoin mining hash power is located in the U.S., extreme weather events meaningfully impact both:

• Network hashrate

• Short-term miner activity

Temperature extremes affect mining across three dimensions:

1. Individual Miner Level

Miners are computers — and computers do not operate efficiently in extreme temperatures. Excessive heat or cold can reduce performance or force shutdowns if environmental thresholds are exceeded. While facilities implement cooling and heating systems, extreme conditions still impact uptime.

2. Facility Level

Facilities manage climate controls, ventilation, and load balancing, but prolonged extreme weather strains infrastructure and can push operational costs higher or force temporary curtailment.

3. Grid Level (Most Important)

The largest impact comes from energy grid stress events.

During heat waves and winter storms, electricity demand spikes sharply. In response, many miners temporarily curtail operations — either:

• Contractually (load-shedding agreements)

• Economically (surging power prices)

Miners reduce consumption so power can be routed back to residential and commercial users during peak demand.

This curtailment shows up directly in the Bitcoin network hashrate.

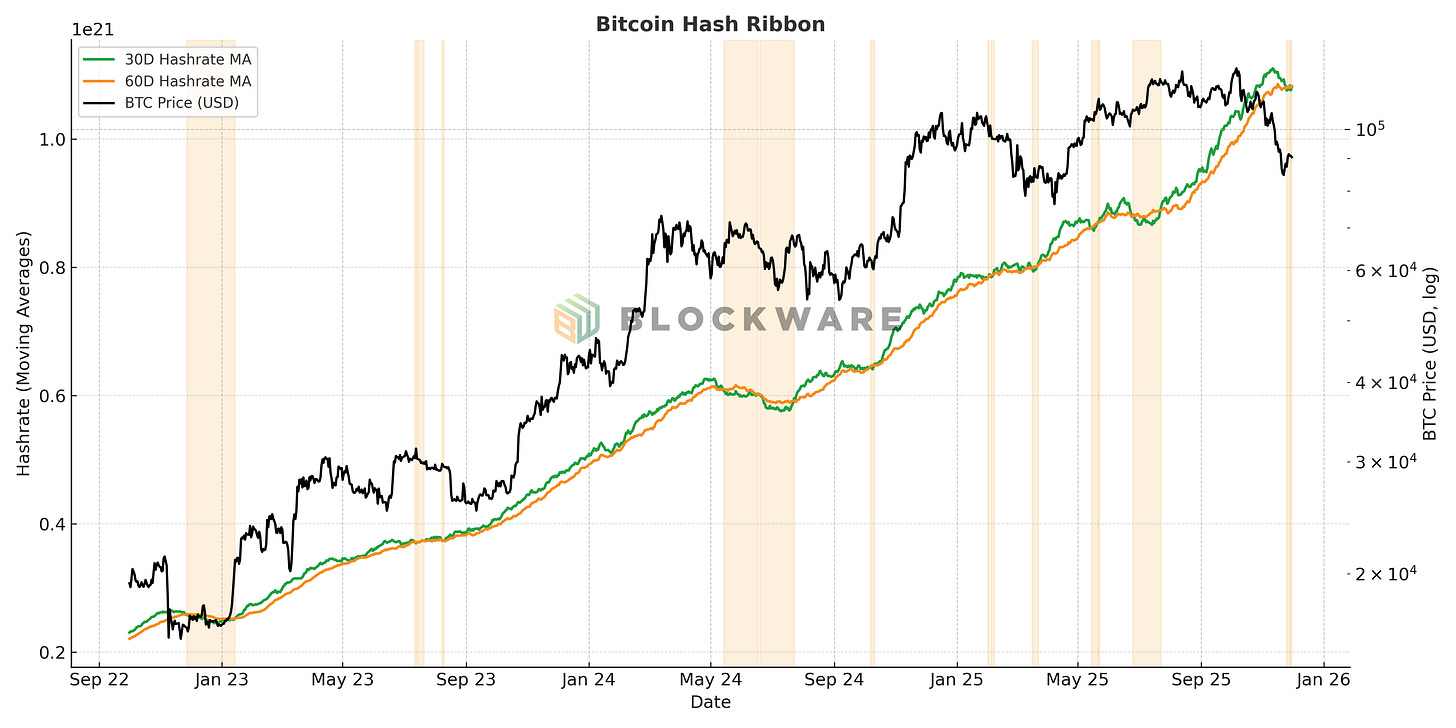

Hash Ribbon: Tracking Miner Stress

The chart below shows:

BTC/USD — Black

30-Day Hashrate Moving Average — Green

60-Day Hashrate Moving Average — Orange

A “Hash Ribbon” signal occurs when the 30-day MA crosses below the 60-day MA, indicating that miners are unplugging machines at scale.

This typically occurs for three reasons:

• BTC Price drops make inefficient operations unprofitable

• Post-halving revenue compression pushes marginal miners offline

• Weather-induced grid stress leads to curtailment

Over the last three years:

Dec 2022 / Jan 2023 → BTC price drawdown

July 2023 → Weather-induced curtailment

June 2024 → Halving + weather curtailment

Sept 2024 → BTC drawdown + weather impact

Jan 2025 → Weather-related curtailment

April 2025 → BTC price drawdown

July 2025 → Weather-related curtailment

Every signal can be traced to either revenue compression or energy grid stress — or both.

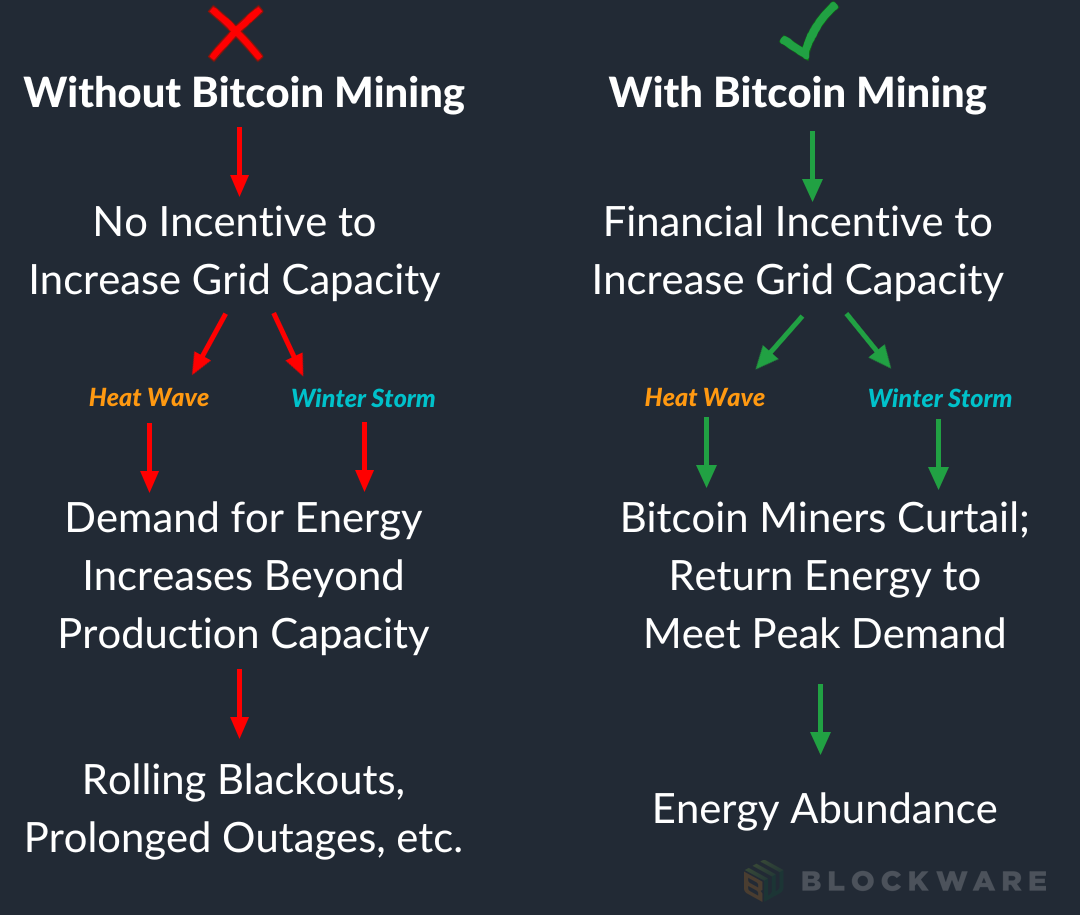

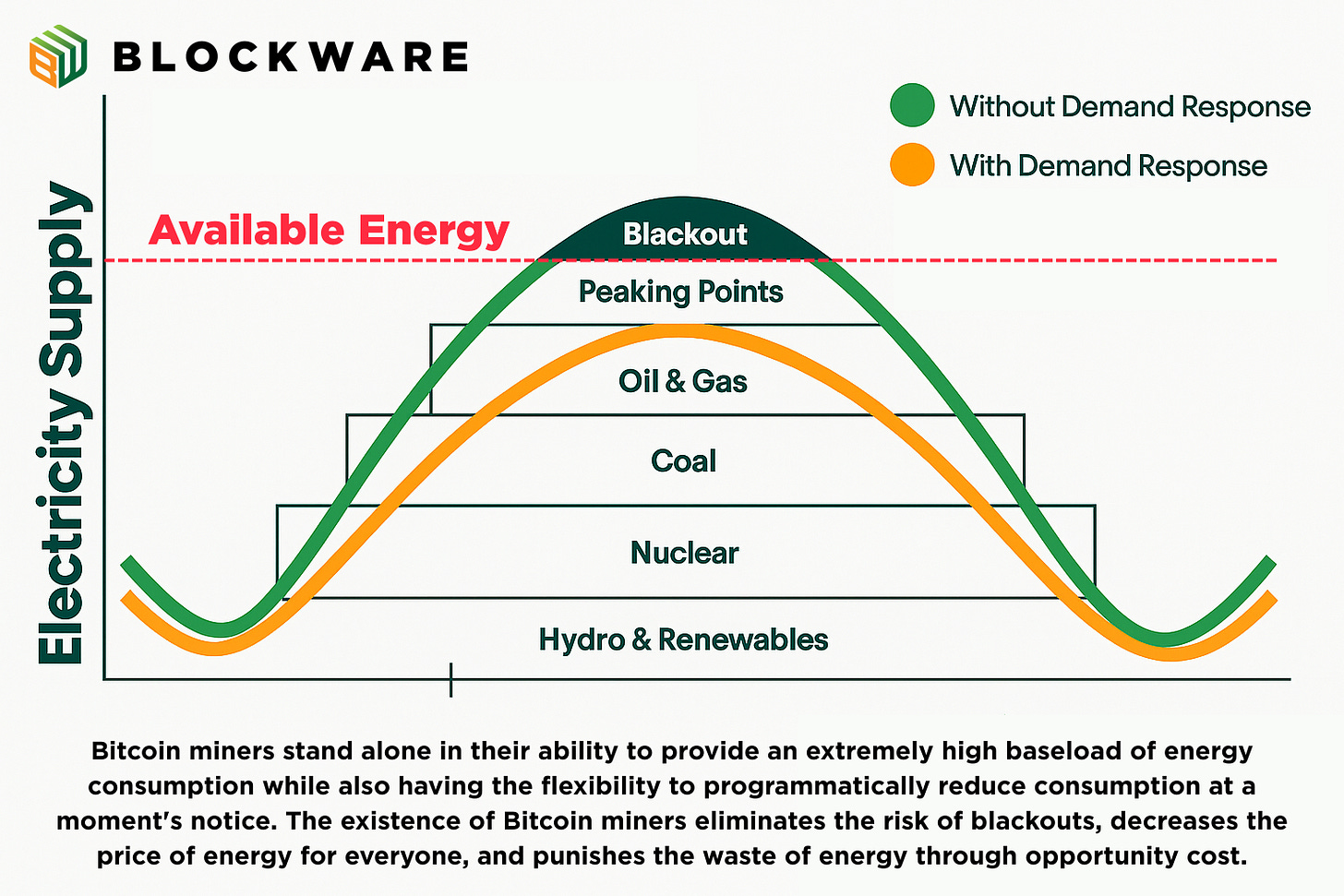

Why Bitcoin Mining Stabilizes Energy Grids

Bitcoin often gets framed purely as a financial asset — but its most underappreciated real-world contribution is grid stabilization.

Bitcoin miners act as a “buyer of last resort” for electricity producers.

This creates a powerful feedback loop:

• Utilities are incentivized to build additional generation capacity, knowing demand exists.

• During low-demand periods, miners purchase excess power that would otherwise go unused.

• During peak demand events, miners instantly curtail operations, returning power to hospitals, homes, and businesses.

This flexible demand mechanism:

✅ Strengthens grid reliability

✅ Encourages overbuilding of generation capacity

✅ Helps prevent blackouts during extreme weather

The flowcharts below provides a simplified breakdown of this relationship.

Practical Application for Bitcoin Miners

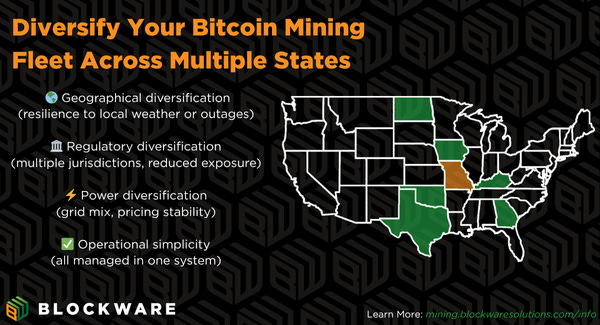

Knowing this, the rational strategy for Bitcoin miners is clear: Diversify operations across multiple grids and jurisdictions.

Relying on a single grid exposes miners to downtime during extreme events.

But diversification allows exposure to network hashrate dips; and these are the times when you’ll mine the most BTC per machine. When other miners curtail, your active machines receive a larger share of block rewards.

More uptime = more BTC.

Blockware’s Advantage

Blockware enables diversification by offering hosted mining across seven different U.S. states.

Clients can:

• Deploy miners across multiple facilities

• Reduce downtime risk from regional grid events

• Benefit from seasonal hashrate dislocations

All while maintaining the simplicity of a single operating partner.

Every miner, contract, payout, analytics dashboard, and power bill is managed directly through the Blockware Marketplace.

Final Reminder — Lock in $0.072/kWh

📌 Today is the final day of our Cyber Monday promotion.

But webinar registrants can still lock in the discounted electricity rate:

$0.072/kWh

👉 Sign up for the live session here:

https://mining.blockwaresolutions.com/webinar