Monday Mining Metrics: Transaction Fees Declining and Difficulty Increasing

Bitcoin Mining Update - 7/10/2023

Monday Mining Metrics 7/10/23

The hype surrounding ordinals appears to have died down for the time being. The % of miner revenue derived from on-chain transaction fees is back under 2%; where it was before the mania began.

A lack of high fees means it could be a good time for Bitcoin users to consolidate UTXOs they have been accumulating during the bear market. Furthermore, we have yet to see the drop in fees have any significant effect on ASIC pricing, despite the corresponding drop in miner revenue.

Spot ASIC Pricing

Below are the lowest current listing prices on the Blockware Marketplace for a variety of popular ASIC models:

Antminer S19j Pro (+0.0%)

$1,564 (0.05166 BTC)

$17 / T

Antminer S19j Pro+ (-2.2%)

$2,700 (0.0892 BTC)

$23.0 / T

Antminer S19 XP (+0.0%)

$5,400 (0.1784 BTC)

$38.3 / T

Whatsminer M30s++ (+1.7%)

$1,475 (0.0487 BTC)

$14.7 / T

Whatsminer M50 (+0.0%)

$2,680 (0.0886 BTC)

$22.5 / T

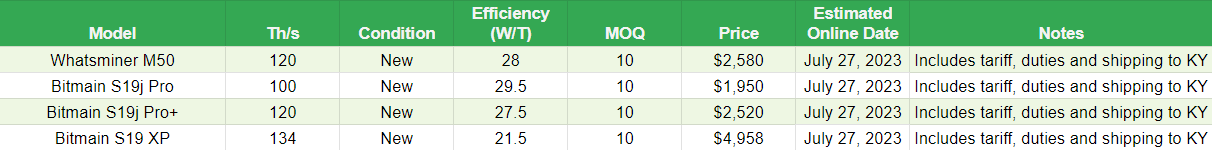

Bulk ASIC Pricing

Contact sales@blockwaresolutions.com or reach out here.

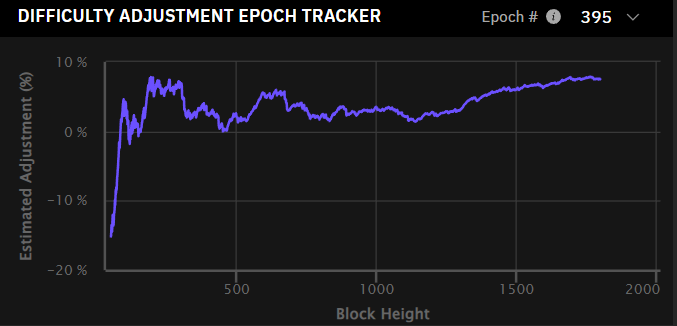

+7% Difficulty Adjustment Incoming

After a month of flat and decreasing difficulty, a 7.49% increase is projected to occur on Wednesday of this week.

While this is a significant increase, most of it is recovering the previous -3% difficulty adjustment. The likely scenario is miners in hot climates were curtailing their power usage as part of demand response programs, and they have now plugged the machines back in.

It is reasonable to expect that we may see another negative difficulty adjustment in the coming months as the summer heat persists.

Paywall and I’m gone ✌️❤️