Monday Mining Metrics: Why $1,000,000 per BTC is Bearish

Bitcoin Mining Update - 9/8/2025

Monday Mining Metrics: Why $1,000,000 per BTC is Bearish

A 7-figure Bitcoin price sounds hyperbolic to the average person – how can 1 unit of internet money be worth a MILLION dollars backed by the full faith and credit of the United States Government?!?

The truth is, $1,000,000 per BTC is a very conservative long-term price target.

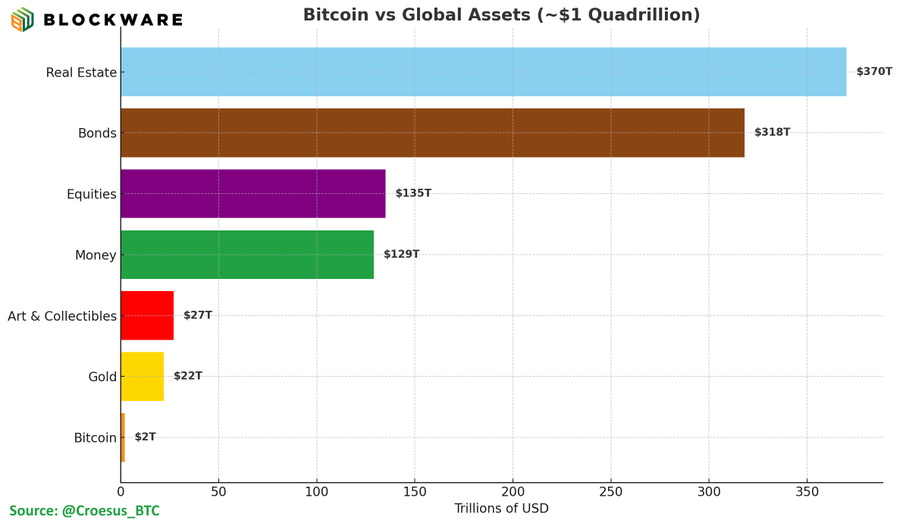

The ‘Total Adderessable Market’ framework, popularized by Jesse Myers, makes this clear.

Bitcoin’s Total Addressable Market is all assets people use to store value:

Real Estate ($370T)

Bonds ($318T)

Stocks ($135T)

Fiat Money ($129T)

Gold ($22T)

Other ($27T)

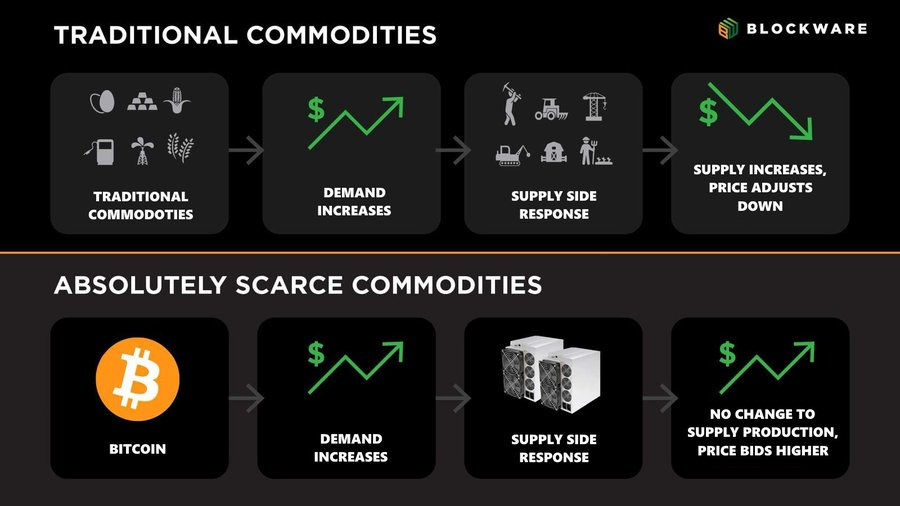

The total pool of ‘Store of Value’ assets is worth roughly $1 Quadrillion worth. All of these assets, except Bitcoin, have a reflexive supply. If demand increases, more supply can be discovered or created.

Developers can build more buildings.

Governments can issue more bonds.

Companies can issue more shares.

Governments can issue more currency.

Miners can dig up more gold.

BTC is the ONLY asset whose supply cannot increase in response to an increase in demand. No matter how much demand for BTC there is, the total supply of BTC will never exceed 21,000,000. Moreover, all 21,000,000 BTC will not enter the market faster or slower than the supply schedule set forth at Bitcoin’s genesis in 2009.

BTC needs to capture just a tiny fraction (2.1%) of its Total Addressable Market to hit a price of $1,000,000. 2.1% of $1 Quadrillion = $21 Trillion Market Cap = $1,000,000 per BTC.

Mark Moss, a popular Bitcoin-focused Entrepreneur and content creator, believes this could happen as soon as 2030. Check out this clip from his Bitcoin Mena 2024 keynote:

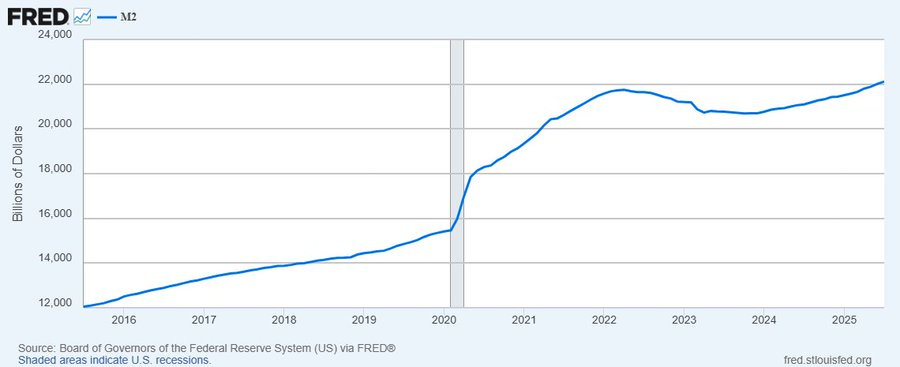

Capturing part of the TAM Pie isn't the only way BTC's market cap can increase. The entire size of the pie is growing as well. The supply of dollars has increased by ~7% per year since 1960. M2 has doubled in the past 10 years alone. As more units of currency enter the system, demand for Store of Value assets (including BTC) increases.

- Store of Value (SoV) TAM is Growing

- BTC's Share of SoV is Growing

Using the TAM framework, it's fairly conservative to believe that BTC will hit $1,000,000, and the current price of ~$110,000 presents an incredibly asymmetric opportunity.

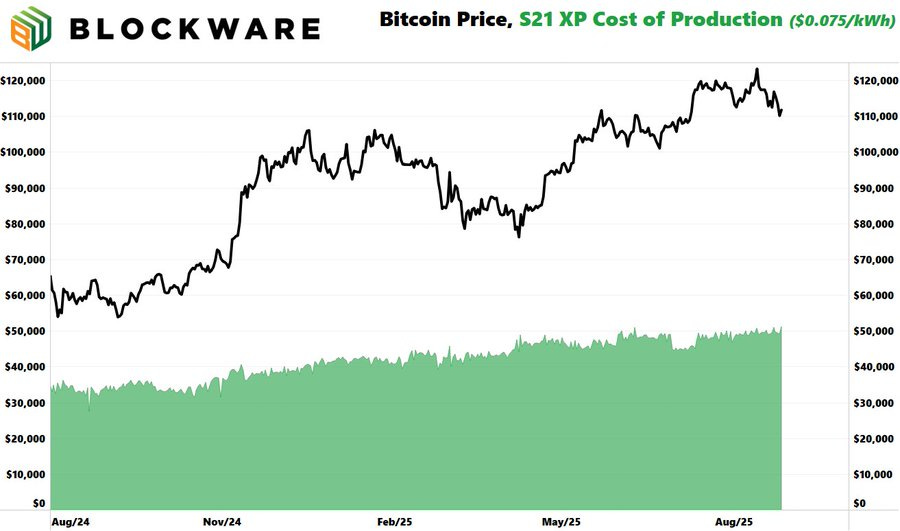

Mining with Blockware allows you to acquire BTC every single day (at a discount) while unlocking significant tax benefits (100% Bonus Depreciation). While BTC climbs to $1,000,000 before the end of this decade, Blockware’s hosted mining clients will continuously acquire BTC at a discounted rate.

- Acquire BTC Daily at a Discount

- Write Off 100% of the Cost of BTC Mining Hardware

Right now, Blockware clients mining with an S21 XP are Dollar Cost Averaging into BTC for ~$50,000 per coin 🤯

Schedule a free consultation to learn more: mining.blockwaresolutions.com/consult