Monday Mining Metrics: Why Bitcoin Mining Stocks Have Underperfomed

Bitcoin Mining Update - 5/5/2025

Your money can buy more Bitcoin than you think.

Slash your trading fees on the biggest exchanges like Coinbase, Binance, Bybit + more. Blockware has partnered with REF to offer you incredible trading fee discounts.

Get up to 54% off when you join REF here: theREF.io/a/blockware

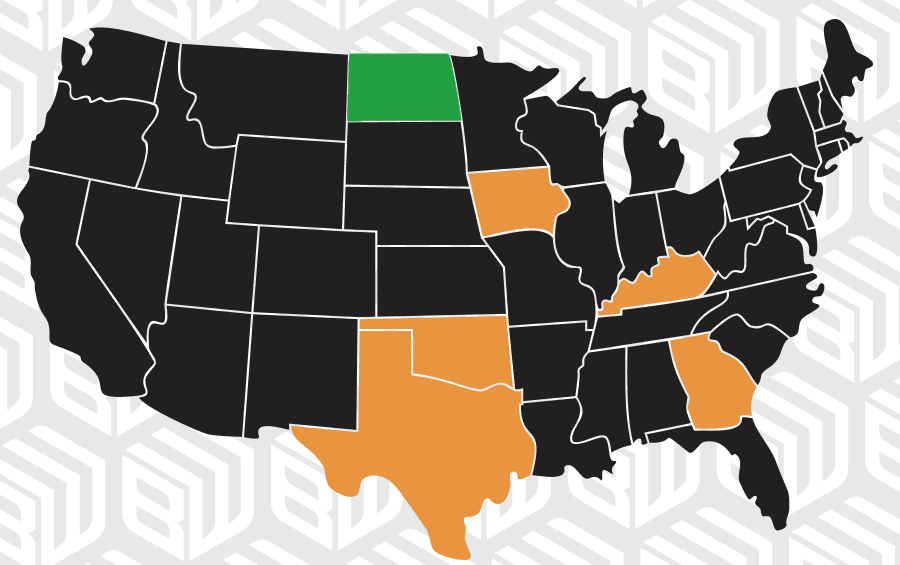

Blockware Expands to North Dakota

We’re excited to announce the launch of our newest partnered mining operation in North Dakota, USA. S21 Hydro's (335T, 16 W/T) hosted at this facility are available for immediate purchase on the Blockware Marketplace⚡️

This advances our mission to provide top-tier mining services while making the United States the undeniable leader in Bitcoin Mining.

Bitcoin vs Mining Stocks vs Hosted Bitcoin Mining

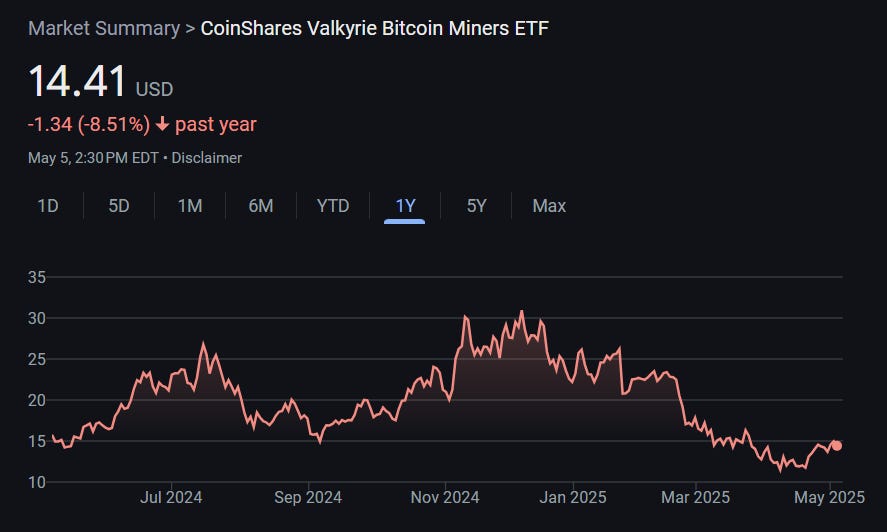

In light of the many ‘Bitcoin Treasury Companies’ that have emerged over the past year, the underperformance of many Bitcoin Mining stocks has been brought into question. $WGMI, the Bitcoin Miner ETF, is down almost 10% year-over-year.

Investors are attracted to BTC-exposed equities due to the prospect outperforming BTC itself – the new ‘benchmark rate.’ So with BTC up ~50% year-over-year – it begs the question:

“Why have Bitcoin Mining stocks underperformed?”

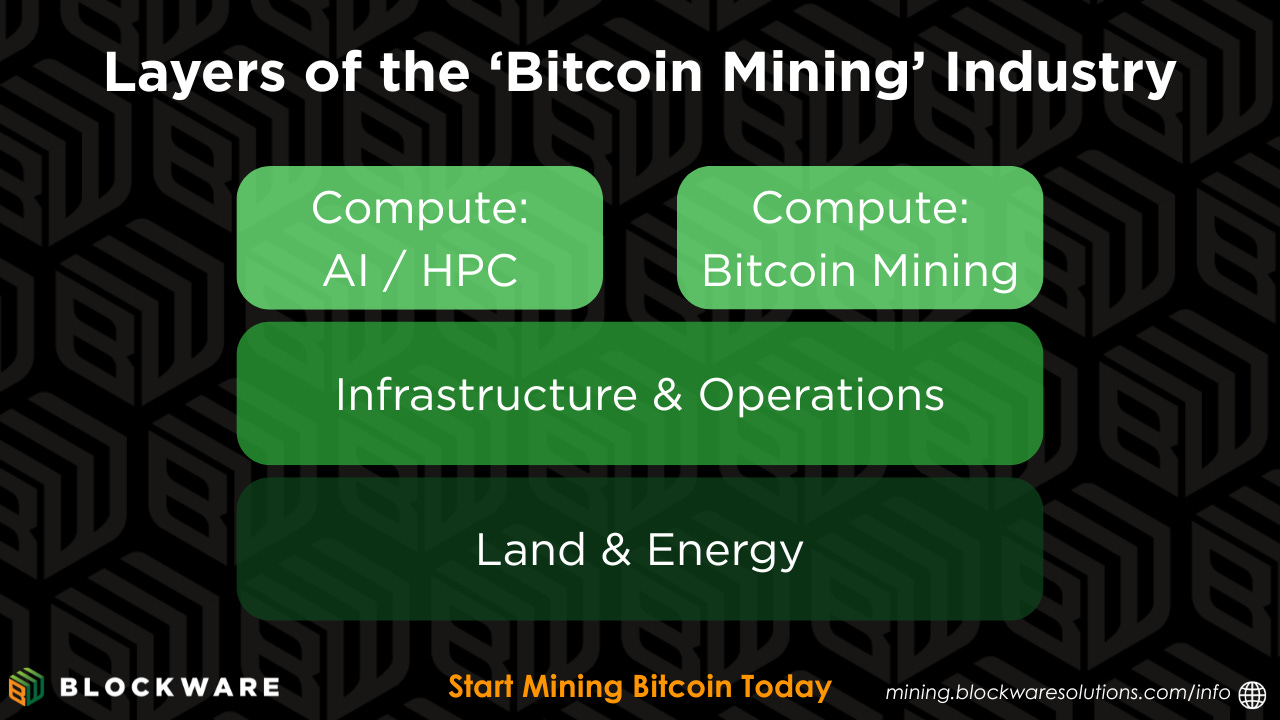

In order to understand the underperformance of mining stocks in the aggregate, you must understand the Layers of the Bitcoin Mining Industry.

1. Land and Power: Profitable Bitcoin requires cheap energy. The ideal location for a Mining operation is a rural community, in a stable political jurisdiction, with access to an abundance of cheap land and power

2. Infrastructure and Operations: Specialized infrastructure is necessary to keep machines from overheating. Large mining operations require a team on-site 24/7/365 for repairs, maintenance, networking, security, etc.

3a. AI/High Performance Computing: Renting compute to businesses and individuals for LLM's, Cloud Storage, etc. Steady, non-volatile cash flows.

3b. Bitcoin Mining (ASICs): Contributing compute to the Bitcoin network to secure the blockchain and verify transactions. Paid directly in BTC, volatile cash flows and operating margins.

When viewing the entirety of the Bitcoin Mining industry with this framework, the underperformance of many mining stocks relative to BTC starts to make sense. The component of the industry with the most direct correlation to BTC price action is layer 3b, the actual Bitcoin Mining. Many “mining stocks” hyper specialize in others layers of the industry – more so resembling energy companies / data center operators rather than a pure-play on BTC.

Check out the latest video on our YouTube channel where the Head of Blockware Intelligence, Mitchell Askew, provides a detailed breakdown of this concept:

The good news is that Blockware’s ‘Mining as a Service’ enables investors to get direct exposure to the compute layer of the Bitcoin mining industry. You can purchase ASICs which are hosted at our data centers and begin mining immediately. We handle the facility and operations, you get to mine the Bitcoin in exchange for paying for your miner’s electricity consumption.

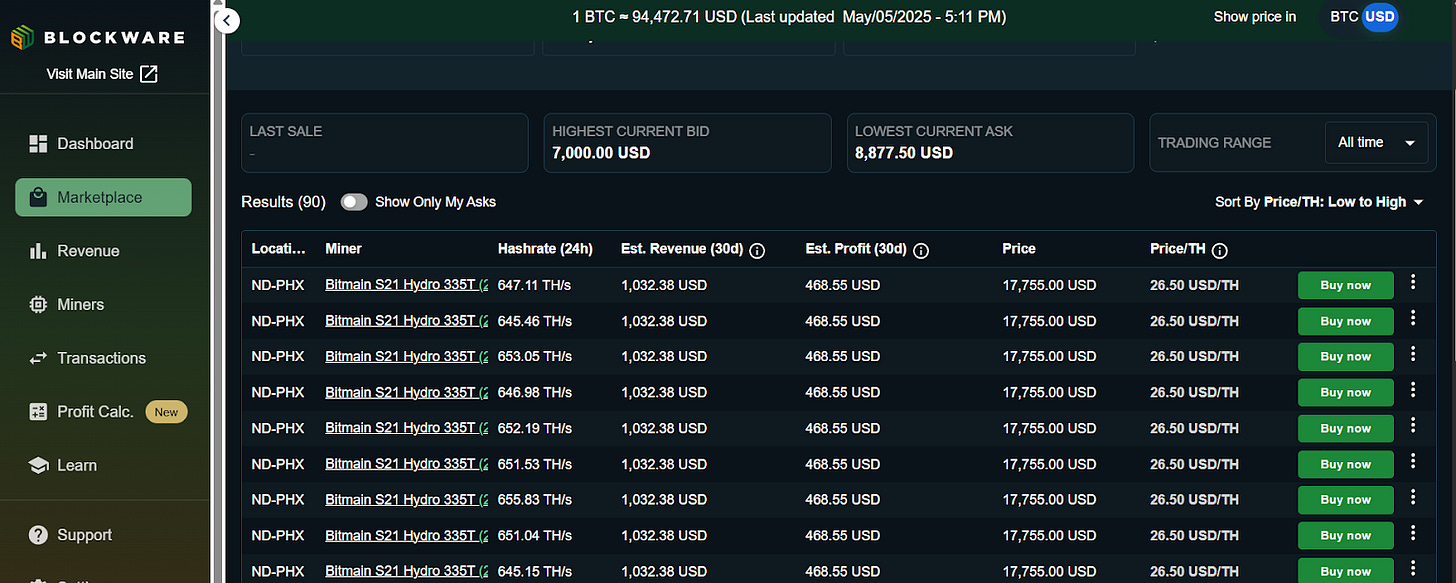

Click here to check out our Marketplace where you can see real-time analytics on our miners, and make an immediate purchase using BTC or fiat. The latest miner added to the Blockware Marketplace is the Antminer S21 Hydro. A single unit is profiting >$400 per month.

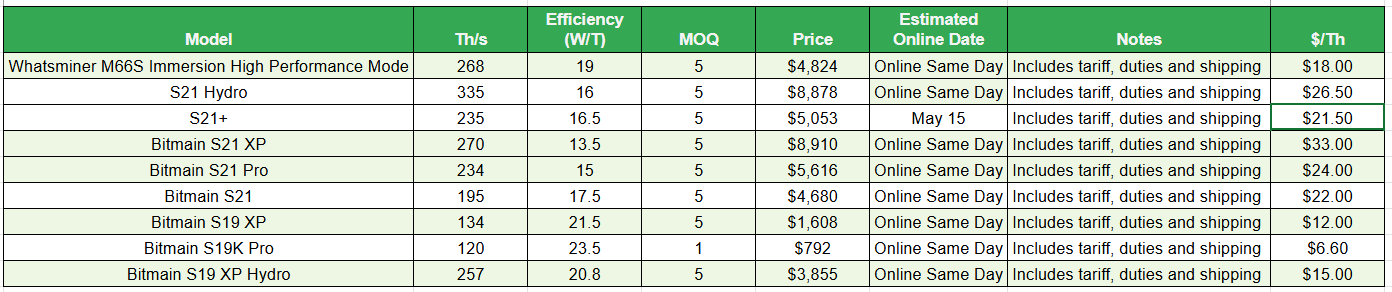

If you’d like a more hands-on mining experience, fill out this form on our website. One of our Account Executives will be in touch and they can walk you through our entire product and service offerings! The table below provides a full pricing list for all the ASICs available through Blockware at this time. For those seeking to purchase ASICs in bulk (with or without hosting), contact sales@blockwaresolutions.com or reach out here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does not consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.