Quick Update 9/8

What happened yesterday? Does this affect broader market structure?

Dear readers,

Hope all is well. Was a wild day yesterday, and now with the dust starting to settle, wanted to send out a quick update for you.

TLDR: This move was driven by leveraged speculators and not long-term investors which shape the broader underlying market structure.

Yesterday’s sell-off can be contributed to a cascade of leveraged long liquidations in the futures market. In total there were $3.22B of long liquidations (non Bitcoin-specific) across all exchanges.

In total, this wiped out ~$4.4B in Bitcoin futures open interest.

The cascade caused a drop in OI dominance (market cap/futures OI), leverage getting wiped out shown by futures estimated leverage ratio(dividing OI by exchange balances as a proxy for collateral), and also caused perpetual funding rates to go negative.

However, underlying investor activity did not change, but rather actually strengthened yesterday. Supply help by strong hands had a huge uptick, along with short-term investors (shown by the movement of coins from highly liquid to liquid) stepping in and scooping up coins yesterday as well. Exchange supply shock ratio also ticked up, reflecting the 4,674 BTC that moved off exchanges. Quite frankly there weren’t any inflows that stuck out enough to potentially cause a 20% crash, I think the market was just highly levered. Most of the outflows yesterday came from Okex and Bitfinex.

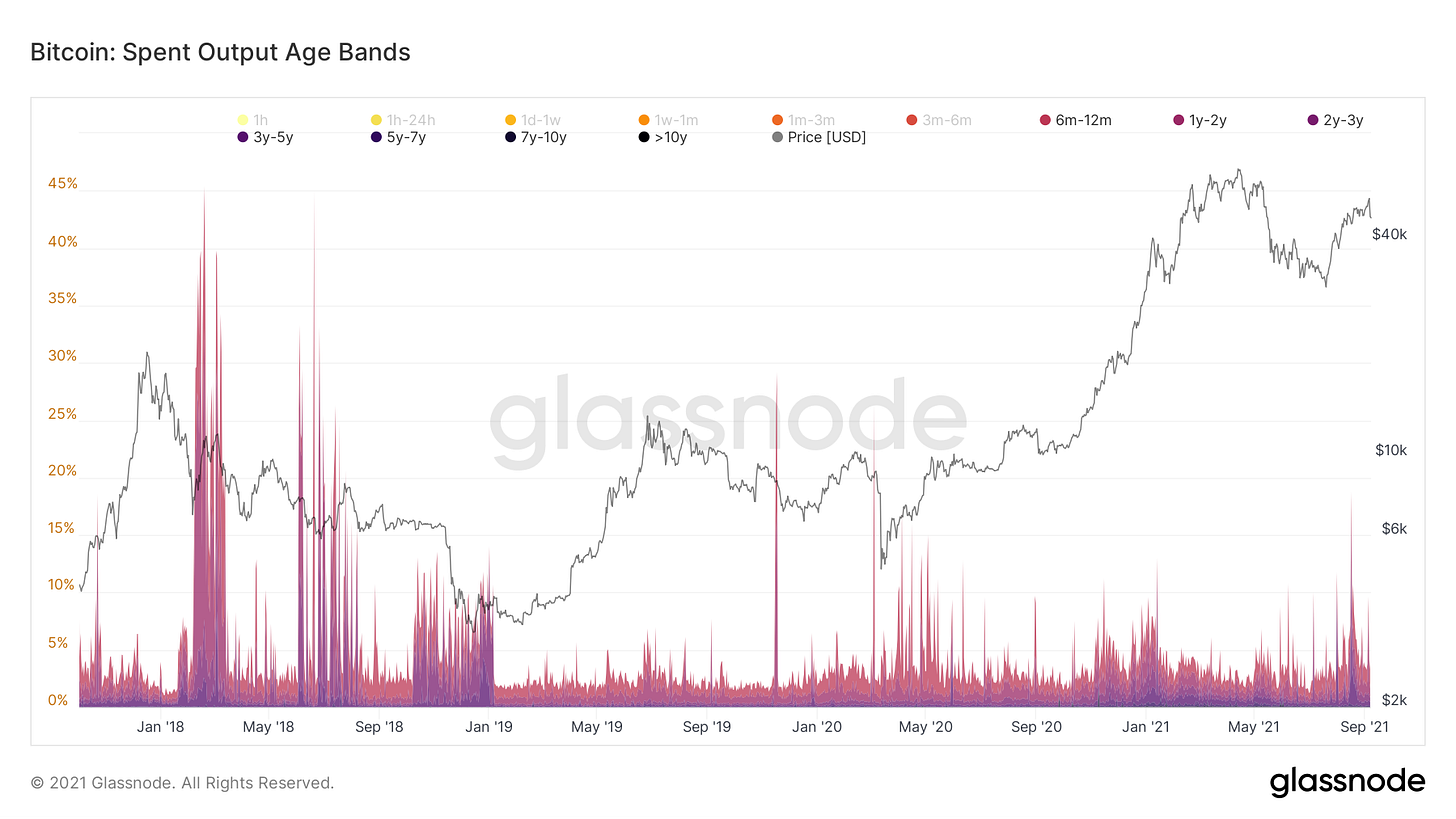

On a similar note, we saw a drop in the percentage of spent outputs aged over 6 months. This is another way of saying long-term holders sat strong throughout the correction and did not panic.

Lastly, we take a peek at our SOPR metrics to see the profitability of coins that are trading. aSOPR (SOPR adjusted for outputs <1hour) is on the 1 threshold, would preferably like to see it bounce. We touched on last week the fact that we would at some point get a reset, although I admittedly didn’t expect one this soon. Short-term SOPR has dipped below 1, while long-term SOPR is still in a state of profitability. This shows once again that short-term holders were the ones who did the selling yesterday and slightly sold at a loss, while long-term holders sat strong.

In conclusion, this wipeout was almost completely fuelled by over-leverage in the system. One thing I’ve learned for the future is to keep an eye on spot margin lending rates and also be warier of large increases in open interest even if funding rates aren’t astronomical.

Broader market dynamics have only increased, the bull market is not over. Remember we had 8 20%+ pullbacks from March 2020 to March 2021. I don’t see anything to be concerned about.

Looking forward to touching base Friday with the newsletter and video version on the YouTube channel. Got a new mic, camera, and will have the screen capture fixed this week as well. Cheers!

Enjoyed reading the analysis. Thanks. Just a reminder: you are known for reading the market as it is - without any bullish or bearish bias. Please keep that going..

Thank you for your service Will. Keep up the hard work. You're making the difference for us plebs out here in the dark.