Recovery

On-Chain flows showing recovery from last week's crash

Dear readers,

Hope all is well and you had a great weekend. Just wanted to send out a quick weekend update. After hitting 30k last Wednesday, BTC came back down and retested the wick yesterday, reaching $31,111. This is a higher low and is looking like a potential double bottom forming. (BTC loves double bottoms)

Previously we had mentioned exchange flows had flipped bearish. Since Wednesday flows have flipped bullish again. Exchanges are down 42,647 BTC since the peak Wednesday. This is showing strong spot buying.

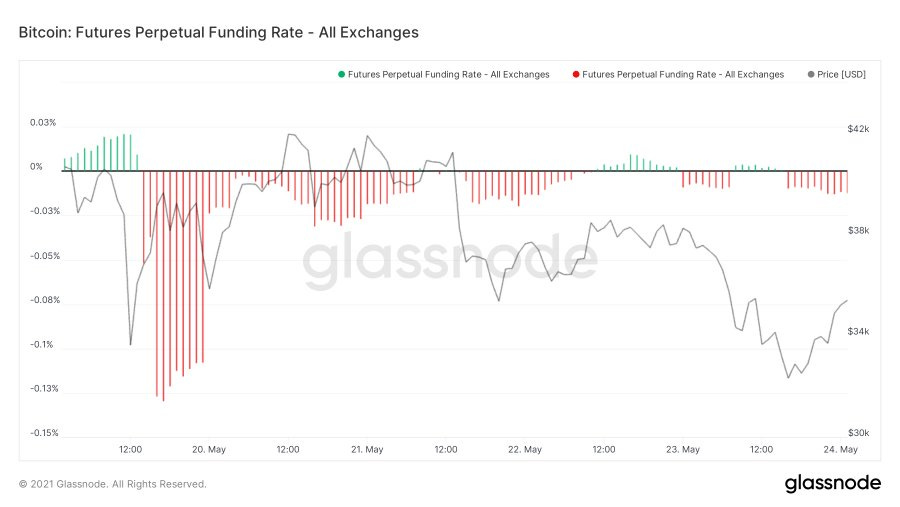

One interesting thing to note: funding rates are still negative. This means traders are still net short on perpetual futures right now. This is important for two reasons: 1. Price increase is being driven by spot buying (also shown by exchange outflows above) 2. If spot buying can push the price up high enough, we are potentially setting up for a short squeeze. Just something to keep in mind.

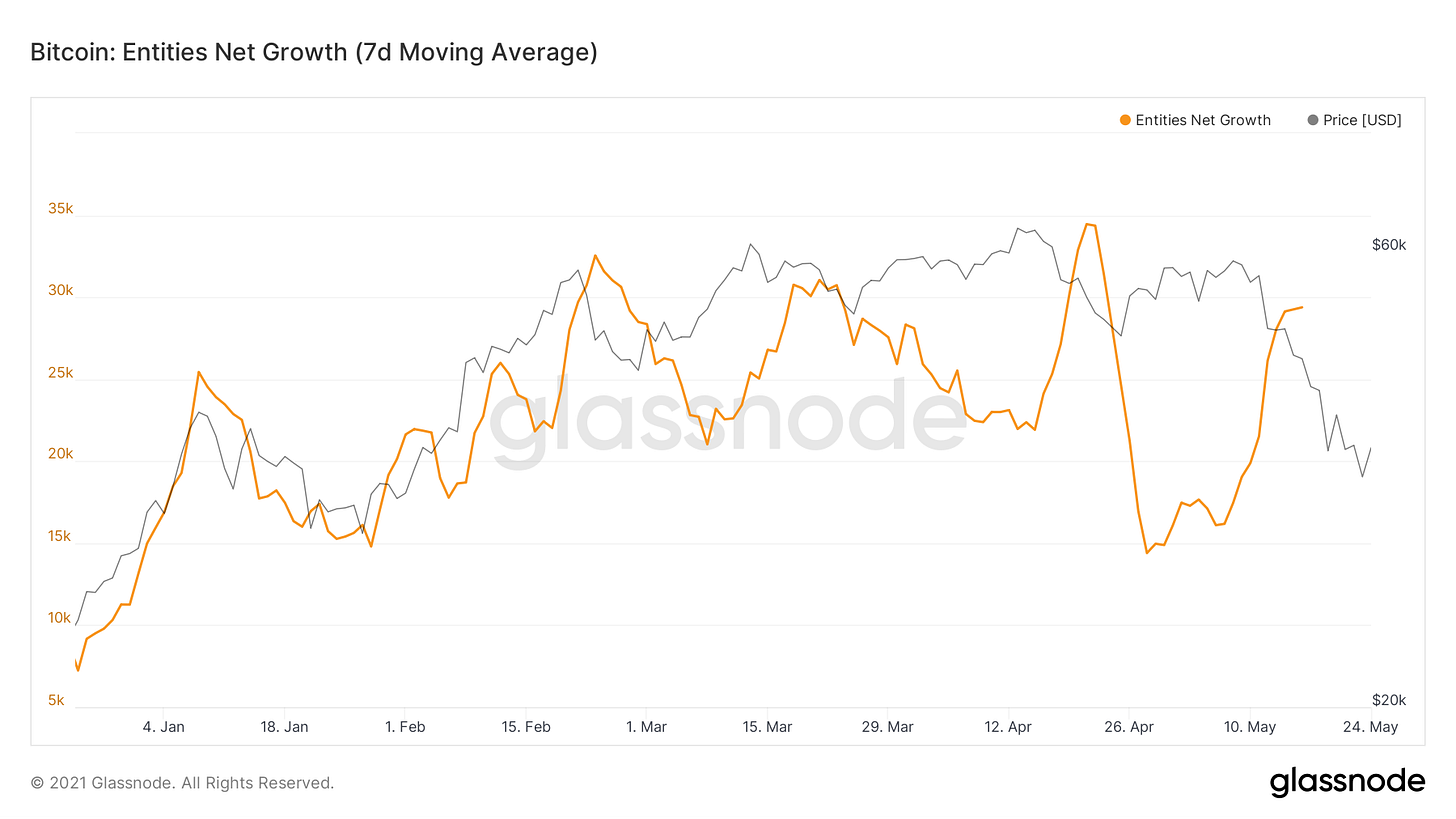

The number of new entities coming on the network is also growing, aka new investors. This is a good sign of recovery as well. New demand coming in attracted by lower prices.

Short-term SOPR also seems to be recovering. The market is no longer selling coins at a loss on aggregate once SOPR gets above the black line.

In conclusion, flows showing signs of a recovery, still remain cautiously optimistic in the short term. The reaccumulation process of coins sold Wednesday still may take some time, but if we get more Ray Dalio level announcements, that process may be sped up. Looking forward to touching base again on Friday. Have a great week, cheers!

Thank you for the information Will! Great stuff as usual.

Thanks so much Will, love your content, much appreciated🙏🏼