Weekly On-Chain Overview

Overview of 6/25 - 7/1

Dear readers,

Hope all is well and you had a great week. It’s been yet another week of ranging for Bitcoin, with price trading in this current $30K-$40K range for over 6 weeks now. Let’s dive into this week’s on-chain overview for 6/25 to 7/1, hope you enjoy.

Here are some key takeaways from this week:

- Bitcoin continues to build up a big base of capital between $32K-$40K, over 15% of BTC’s money supply has moved in this current range

- Mean daily Hash Rate continues to trend down, reaching the lowest it has been since late 2019 at one point; >23 minute Block intervals at one point, Issuance slowed, Difficulty adjustment coming in the next few days

- Miners slightly selling over the last month (assumed to be part of the China miner migration)

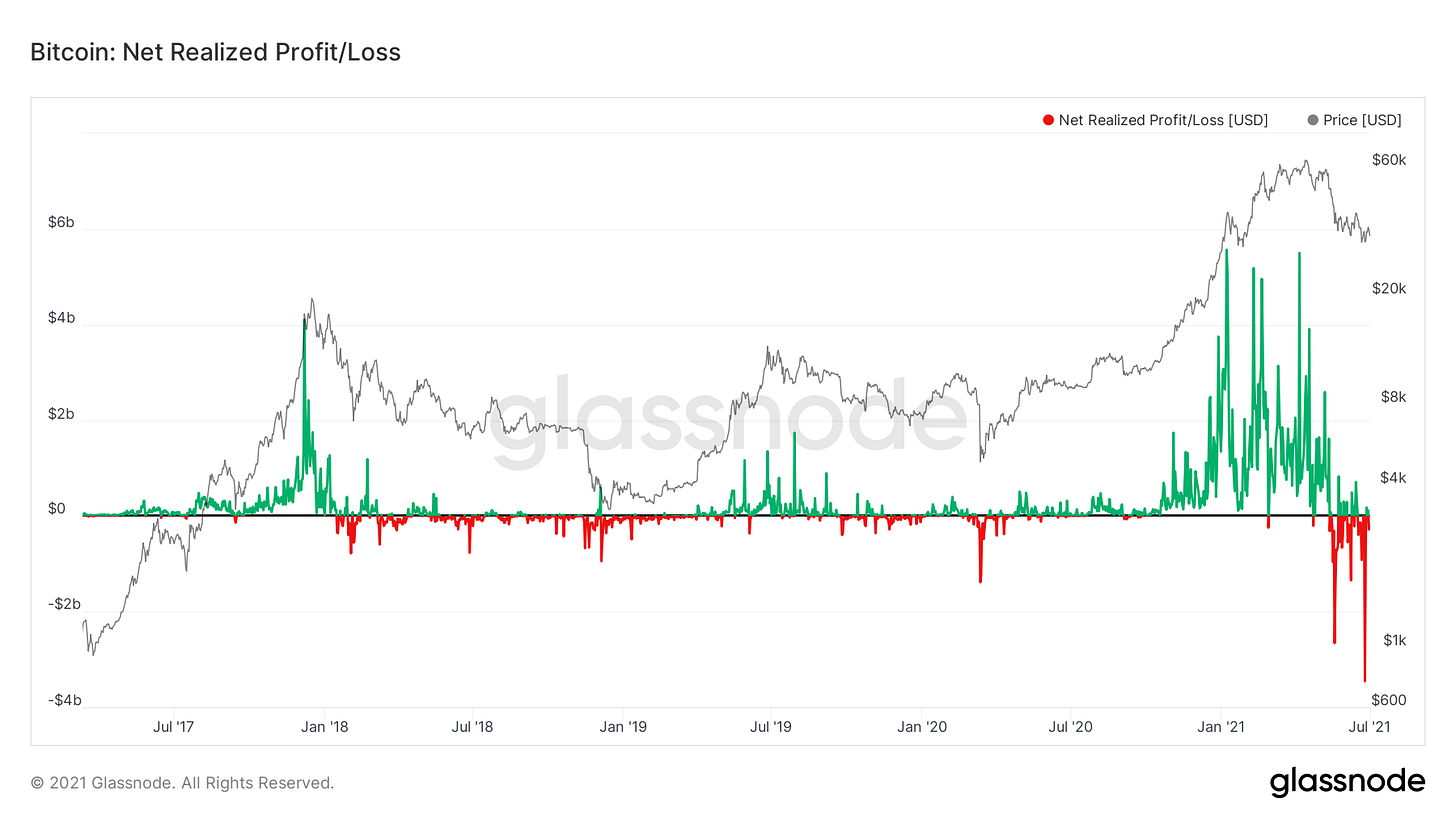

- Younger coins continue to sell, including the largest day of net losses in Bitcoin’s history (in USD terms)

- Still no major uptick in new whales, Retail adding aggressively (broken down in detail)

- Re-accumulation continues (looked at in detail)

- Exchange flows sideways bullish

- Stablecoins continue to slowly flow back in

- New users “W” shaped recovery continues, back over 36,000 new users coming on-chain a day

Given the amount of time we have spent in this range, there is now a clear third zone of on-chain volume for this bull market. 15.91% of Bitcoin’s money supply has now moved in this current range.

One of the most talked about phenomenon regarding Bitcoin lately has been the dramatic drop in hash rate. Hash rate continues to trend down, with a very small bounce on Wednesday the 28th. On the 27th it dropped to the lowest levels it has been since late 2019. Despite some minor impacts, the network continues to function as it always has and always will. Let us look at some of these minor impacts that the drop in hash rate has had on the Bitcoin protocol.

First, mean block interval has reached incomparably high historical levels. At one point this week, mean block interval reached as high as 23.3 minutes compared to the typical 10 minutes. This means the highly anticipated difficulty adjustment will take a bit longer than usual to come but should be here on Sunday (the 3rd).

Due to this, issuance has slumped, meaning less Bitcoins are being issued to miners than they previously had been. This reached as low at 362 BTC issued on Sunday, with the expected issuance after last year’s halving to be 900 BTC per day. This of course will go back to normal after difficulty adjusts.

Because of this in combination with lower prices, the Puell Multiple, the daily issuance of BTC divided by the 365 DMA of issuance (in USD terms), has dipped into the “buy” zone. Every instance of the Puell Multiple dipping into this zone has served as an excellent time to accumulate Bitcoin. These prior instances include: the 2012 bear market low, the 2015 bear market low, the 2018 bear market low, and the March 2020 (covid) crash.

One last note on miners. It has been widely spread that miners have played a big role in the price decline over the last few weeks, as supposedly miners have needed to sell BTC in order to cover the costs of migrating out of China. However, according to Glassnode, miners have reduced their holdings by 5,269 BTC since May. Most of this selling came at the beginning of June and is nothing that the Bitcoin market cannot easily absorb.

Most selling continues to come from short-term holders, including a big capitulation event this week from these younger entities. Looking at Short Term Holder SOPR, which measures the profit that coins carry, these entities sold at massive losses on Friday the 25th. This drop in STH SOPR rivals other major drawdown in Bitcoin’s history, only falling behind two drops in the 2018 bear market and of course March 2020.

In raw dollar terms, this was the largest day of realized losses in Bitcoin’s history, outpacing the previous record set in May. In total, $4,456,786,884 of losses were realized.

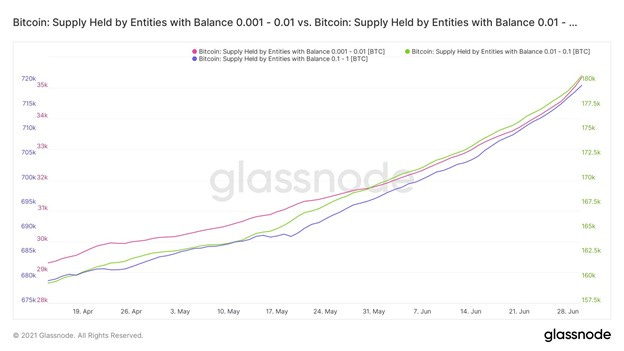

I have heard that retail is to blame for recent selling but looking at the data this is not the case. Retail continues to aggressively add to their holdings. Although the balance held by these entities (between >0.001 BTC and <1 BTC) always trends up, these balances have seen a sharper than normal spike. Keep in mind, I can only see data from on-chain, I can’t see inter-exchange flows.

Here’s the breakdown of buy/sell behavior of different cohorts since early June 5th to now (7/1 at time of writing):

Retail or Shrimp (0.001-1 BTC): + 4,396 BTC

Crab (1-10 BTC): +14,942

Octopus/Fish (10-100) BTC: +15,705

Dolphins/Sharks 100-1,000 BTC: -17,374

Whales/Humpbacks 1,000-10,000 BTC: -27,037

So in a general sense it appears smaller entities have been buying heavily while larger entities have been trimming their holdings. Looking at the age of coins being sold according to metrics such as coin days destroyed, dormancy, ASOL, liveliness it appears, in combination with the cohort data, young whales have done most selling over the last month. Let’s hone in on whales; which of course are the cohort that moves the market the most. The number of new whales has continued to trend down, something we’ve been tracking for weeks now.

With this being said, we can conclude that the vast majority of this big w shaped recovery in new users coming on-chain is retail; given that the number of whales is trending down, retail is buying, and whales are selling. Would be fascinating to know how much of this move up is coming from Latin American countries. The network is back above 34,000 new users coming on a day. Remember, this is not addresses, but rather uses heuristics to identify entities on the blockchain.

In regard to re-accumulation, illiquid supply change is still in the green and the liquid supply ratio; created with help charting from Willy Woo; continues to trend up. These indicators both suggest the same concept, supply continues to flow into illiquid entities. I think a good way to analogize what is going on to the following: a lot of liquid (no pun intended) has spilled out on the counter, the market is now slowly adding paper towels. The speed of the paper towels being added is represented by the slope in the liquid supply ratio, but as long as there is no more spill (capitulation where a lot of new supply becomes liquid), eventually the liquid (loose coins) will be absorbed by strong hands. With this being said, as we have talked about since we initially began ranging over a month ago, we will range until this re-accumulation is complete.

Exchange flows are also now looking sideways bullish; a change in trend from what we saw leading up to May’s big price drawdown. This also shows accumulation.

Lastly, we have the stable supply ratio oscillator, created by Willy Woo. This is showing stablecoins continue to slowly flow back in from the sidelines. This recovery resembles each other large Bitcoin price drop since the time stablecoins were first introduced; including late 2018, late 2019, March 2020, and September 2020. Another sign of recovery.

Looking forward to touching base next week guys, hope you have a great weekend as always. Key takeaways are at the top of the newsletter as usual. Enjoy the podcast this week with Checkmate, someone who has taught me a lot of what I know and provides a tremendous amount of value to the on-chain community. Willy Woo will be on the pod with me and Pomp next week, followed by David Puell the week after that. Want to provide all listeners some alternative perspectives and the chance to hear from the brightest minds I look up to in this still very small space. Cheers everyone!

Hi Will, thank you for the weekly update. Amazing as always.

I have been trying to contact you on Twitter about an idea about potentially building an index for Onchain. Much easier to talk to you on a call or through DM. I’m Danieljoe916 on Twitter. I know you are busy! Would really appreciate to hear your thoughts. Thanks Will!

Hi Will. Is there a way to DM you? I want to talk about using some of your analysis in a weekly round-up.