Weekly On-Chain Overview: 7/9

Whales making a splash, Reaccumulation continues, and more.

Dear readers,

Hope all is well and you had a great week. Another week of ranging, although on-chain is showing some interesting developments. Let’s dive in.

Here are the key takeaways from this week:

- Supply continues to be reaccumulated by entities with little history of selling, this has vamped up heavily

- Exchange flows have returned to a clear trend of accumulation, down -17,794 BTC

- Hash Rate seems to have found at least a local bottom

- Grayscale premium getting bid up, but share unlocking on the horizon

- Finally, an uptick in positive whale activity

- Stablecoins flowing in

- New all-time highs in users coming on the network

- On-chain activity transfer is dead

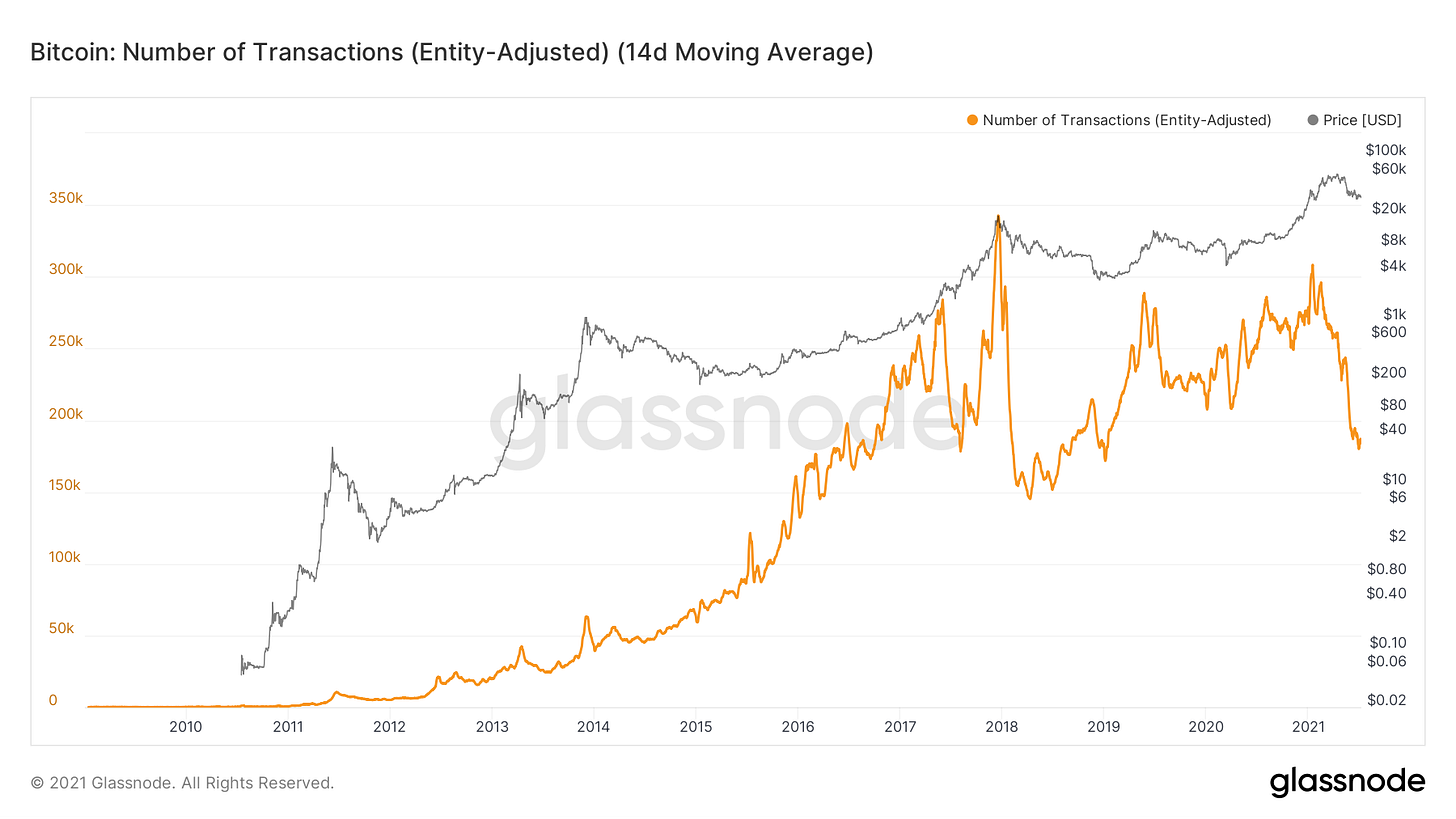

Firstly, let’s take a look at this chart representing the net growth of users, or “entities”, coming on the Bitcoin network. The growth of new users is now reaching new all-time highs, over 50,000 new entities coming on-chain a day.

Next we’re going to break down the re-accumulation that’s been taking place. This trend has done nothing but accelerate this week. There’s a few aspects to this: the amount of supply being replenished from the marketplace, the size of the entities absorbing that supply and the spending behavior of the entities absorbing that supply. We’ll go through this in the previously stated order.

Firstly we’ll look at exchange flows. Exchanges are down -17,794 BTC this week. Instead of just showing you the balance on exchanges chart you’ve seen a million times; here’s a variant of it that I created. Using Bollinger Bands, the signal looks at times that coins are either moved onto exchanges heavily or pulled off exchanges heavily. This just flashed the first “buy” signal in over 3 months, giving you another way to see the trend reversal into accumulation.

Next up we have the size of the entities that have been buying. Retail has been buying heavily for weeks now, but we finally got the uptick in whales that we were waiting for. There were 17 new whales birthed on the blockchain this week, while at the same time the overall holdings of whales increase up by 65,429 BTC.

Lastly, we have the spending behavior of the entities that are buying. Entities that have a very low history of selling are continuing to absorb more coins from speculative traders, with the liquid supply ratio jumping. This force continues to grind upwards against price. Given no capitulation event, in my humble opinion it is a matter of “when” the re-accumulation process will be finished rather than “if”. Once the process completes the market would experience a supply shock.

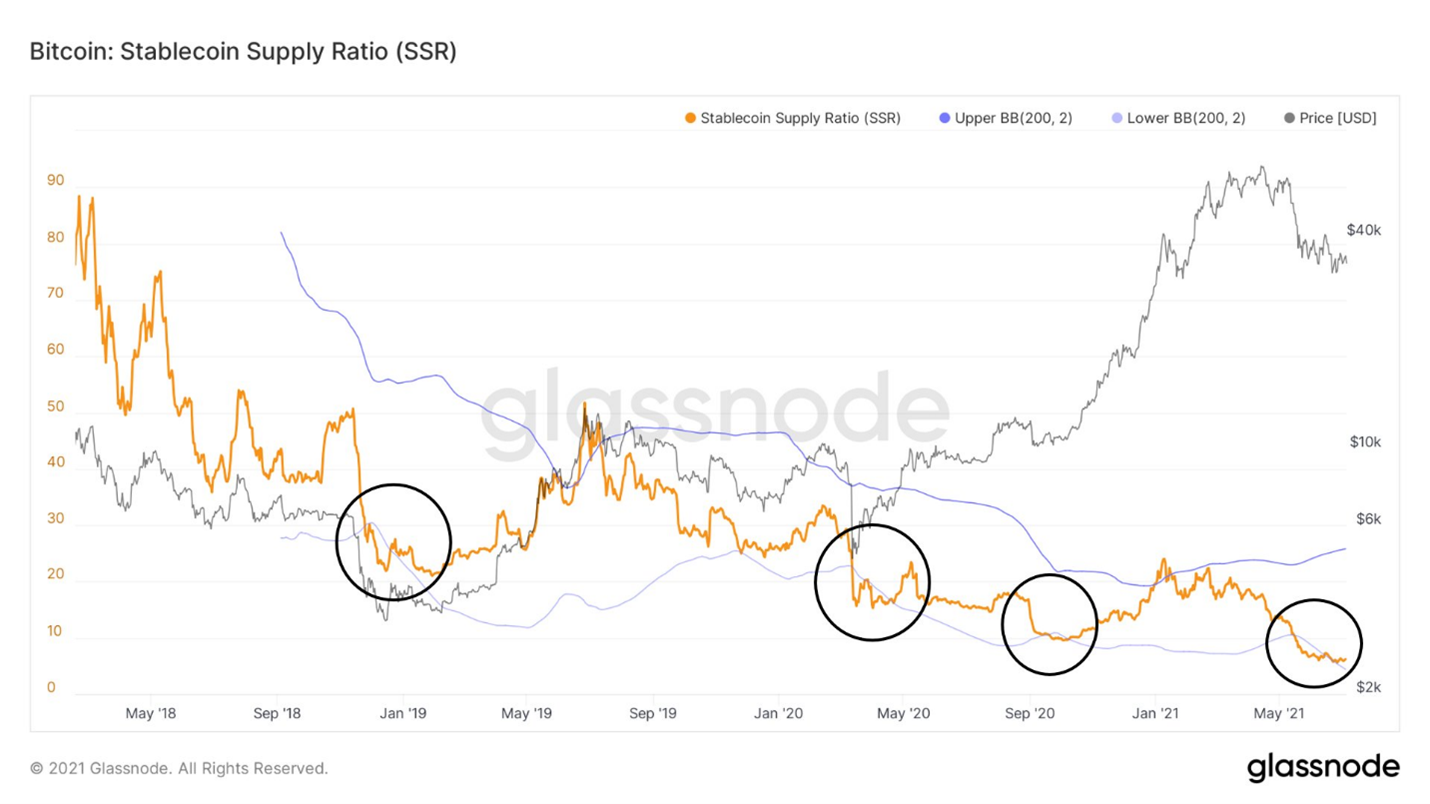

Next up we have the Stablecoin Supply Ratio Oscillator created by Willy Woo, using Bollinger Bands. This current recovery is resembling that of late 2018, March 2020, and September 2020 as well. Stablecoins are starting to flow back in from the sidelines.

Grayscale’s premium seems to be in an uptrend, another sign of capital starting to flow back into the market. Will be interesting to see how the upcoming unlock affects the premium. Someone like Lyn Alden could probably give you a much better explanation, but from my understanding these are the bull and bear cases I came up with. Bull: Anyone who was long the shares and shorting futures that sells their shares once unlocked will be covering those shorts as well. Bear: If the premium gets sold back down, institutional capital might flow into GBTC instead of spot BTC.

Hash Rate finally seems to have found at least a local bottom, trending actually slightly upward throughout this week. It’s a long road to full recovery but good to see this possible end to the hash crash. Miners also appear to be accumulating again slightly, adding 1,045 BTC to their balance this week.

Overall, on-chain activity is dead, shown by the number of Bitcoin transactions. If I had to build up a bear case and challenge my own opinion this is one of the charts I would use; however, a portion of this drawdown is likely from people using the Bitcoin network less due to slower block times.

Hope you guys have a great weekend. Tomorrow’s podcast will be with Willy Woo; we had an awesome conversation. I’m going to listen back to it myself. Cheers!

SPONSORED BY: Masterworks

Tired of Dogecoin and Meme Stocks?

Give art a shot. Deloitte reports that the overall art market is expected to grow over $900 BILLION by 2026. But despite this new boom, few people know about an asset class that the super-rich have been investing in for decades. I recently found a little-known...but incredibly smart way...for everyday investors to diversify into fine art without breaking the bank. Meet Masterworks, the premier membership for investing in contemporary art. Contemporary art prices rose 14% per year from 1995 through 2020 - outgaining S&P 500 returns by 174%. That’s a huge difference—even in a record bull market. With results like that, it’s no surprise that over half of the ultra-wealthy allocate more than 10% of their overall portfolio to art.

But unless you have $10,000,000 to buy an entire Picasso yourself, you've been shut out of this exclusive asset class. Until now. Thanks to Masterworks you can invest in multi-million dollar works by artists like Warhol, Banksy and Basquiat at a fraction of the entry cost. Get started today and skip their waitlist with this private link.

*See disclaimer

Damn that are some bullish charts. I will be very surprised if we break down. The accumulation seems very strong.

No cognitive dissonance in this analysis! Thanks Will!