Blockware Intelligence Newsletter: Week 133

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 5/18/24 - 5/24/24

🚨Buy The Latest-Generation of Bitcoin Mining Hardware🚨

Blockware has partnered with a world-class immersion mining facility to bring you the opportunity to mine using the Whatsminer M66s.

288 TH/s (up to 330 EH/s when in “high performance mode”)

19.5 W/Th

Immersion has a few notable advantages over air-cooled mining:

Heat Resistance

Greater Up-Time

Longer Machine Lifespan

Superior Hashrate & Efficiency

To learn more about this limited-time opportunity, email sales@blockwaresolutions.com

Stamp Seed

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

River

Set up your on-ramp to Bitcoin with a reputable exchange giving you US phone support and top-tier customer service.

Sign up here: partner.river.com/blockware

Bitcoin: News, ETFs, On-Chain, etc.

1. BTC Pumping

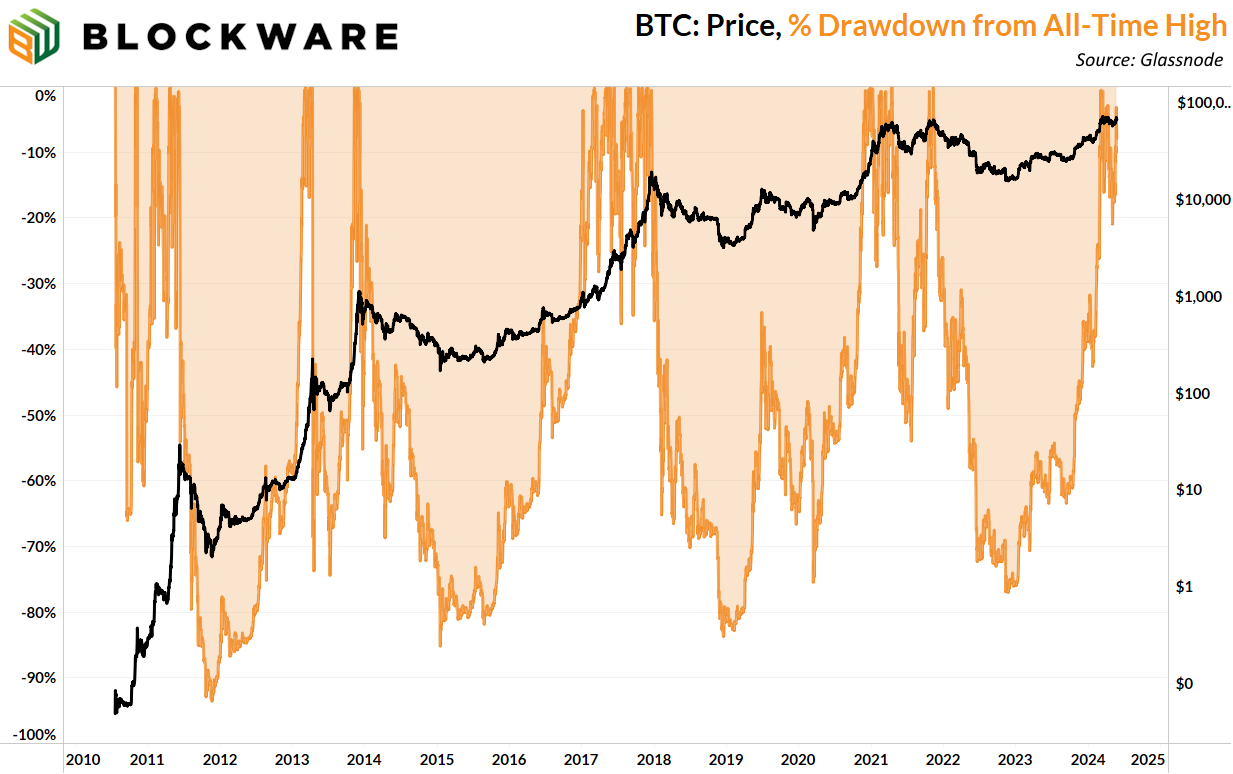

Bitcoin broke $70,000 for the first time since early April. After a pullback of over 20%, BTC now sits just 3% beneath its all-time high. If you’re new to Bitcoin, then get comfortable with pullbacks of this magnitude. These pullbacks shake out the weak hands and provide convicted Bitcoiners with the ability to add to their position at a discount. Note the parabolic bull market of 2017 had multiple drops of greater than 20%. Volatility is a small price to pay for the long-term outperformance of every other asset class.

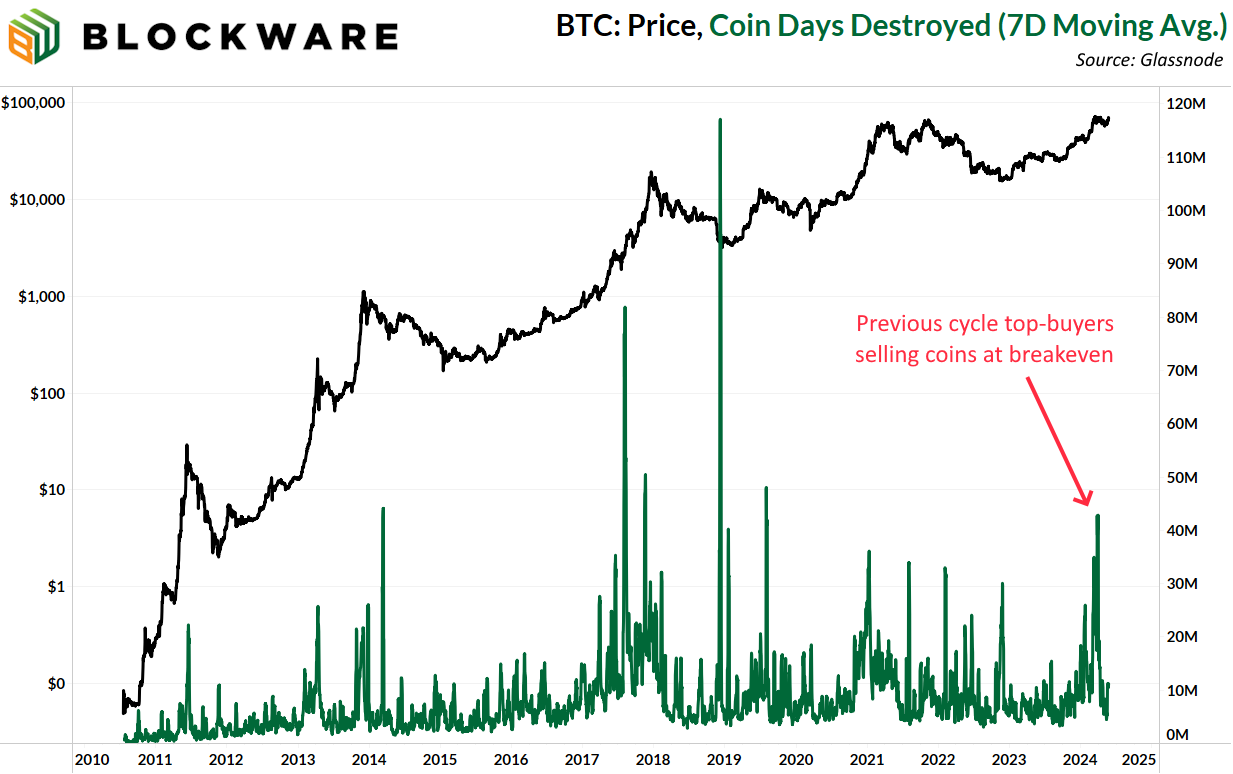

2. Coin Days Destroyed

Coin Days Destroyed is one of our favorite on-chain metrics. It is calculated by multiplying the amount of BTC moved on-chain by the number of days since each of those coins last moved. This allows you to see when there’s increased movement in coins that have been held for a long time.

CDD notably spiked in March of this year when BTC returned to its 2021 cycle high. Investors that bought near the top in 2021 sold coins as they were finally at breakeven, or in the green, on the coins they bought nearly 2.5 to 3 years ago. The activity from these old coins has since died down. The weak hands have been shaken and many of the coins now reside in the hands of convicted, price-agnostic HODLers.

3. Ethereum Spot ETF is Approved

The Securities and Exchange Commission has officially approved a spot ETF for Ethereum. This comes as no surprise given the precedent set with the Grayscale vs SEC case. This case ruled that it was "arbitrary and capricious" for there to be a futures Bitcoin ETF and not a spot Bitcoin ETF; setting the precedent for the same logic to be applied to Ethereum.

What does the approval of a spot ETH ETF mean for Bitcoin? Not much.

The smashing success of the spot Bitcoin ETFs has shown Wall Street that there is high demand for securitized "crypto" products, and they are seeking to profit from that. This does not change the fundamental differences between Bitcoin and the rest of the "crypto" assets, including Ethereum.

Immaculate conception, zero centralized leadership, proof of work, geographically distributed nodes, and a verifiably limited supply with a known distribution schedule. Bitcoin is still the only "crypto" asset that possesses these characteristics.

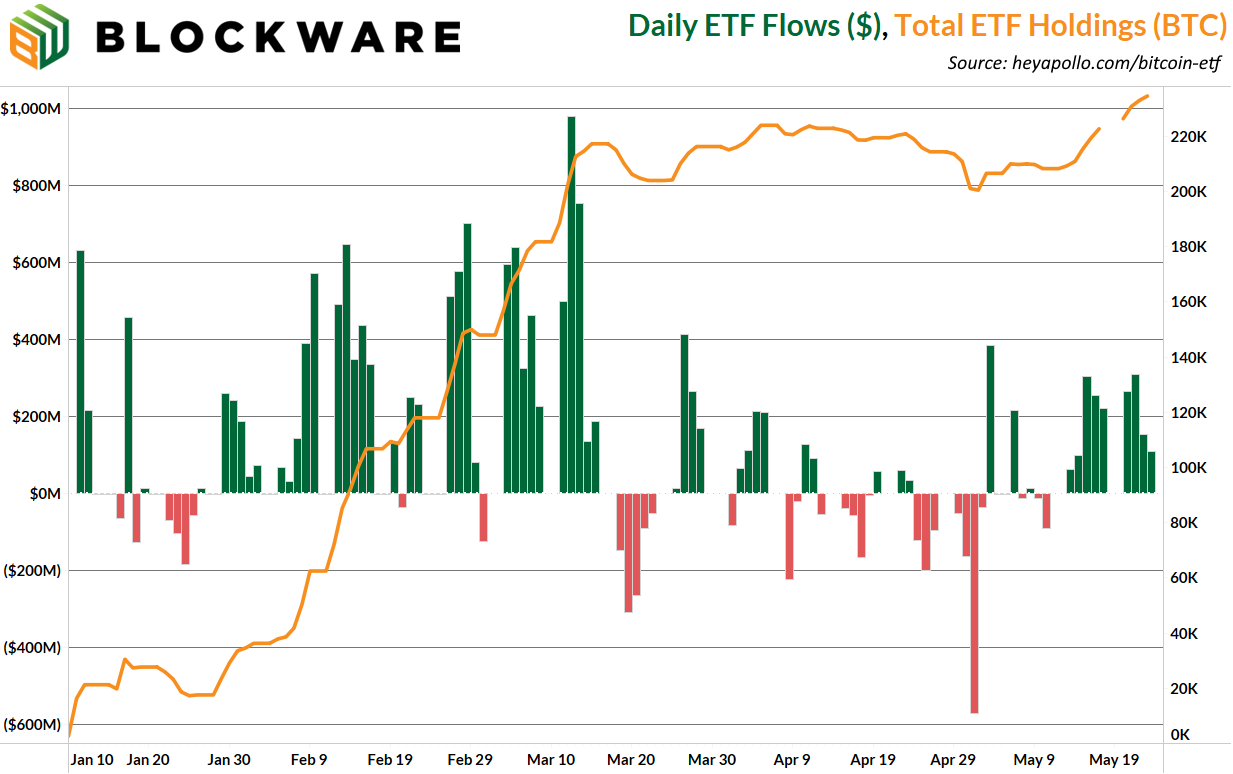

The spot Bitcoin ETFs broke every ETF record on the books, amassing over $30 billion in assets under management in less than two weeks post-launch. To date, the nine new spot Bitcoin ETFs hold over 220,000 BTC worth over $14.7 billion. It's a far cry to expect the spot ETH ETF to have anywhere near this level of capital inflows.

The last notable event for Ethereum was its "merge" to a proof of stake protocol back in September 2022. Since that moment, its price performance relative to Bitcoin has left much to be desired. Including the recent pump in anticipation of ETF approval, ETH is still down 28% in Bitcoin terms since its last major "bullish" event. Will the ETF approval result in a similar outcome? Only time will tell.

Ironically, the juxtaposition of these two events, the switch to proof of stake, and the approval of a spot ETF, highlight a major security vulnerability for Ethereum. ETF custodians amassing a large % of the ETH supply will give them centralized control over the protocol and the ability to censor transactions. The spot Bitcoin ETFs do not present this same risk due to its proof of work consensus mechanism, having large amounts of Bitcoin does not grant someone control over the protocol.

4. Bill FIT21

The waves of positive political momentum for Bitcoin keep coming. This week the US House of Representatives passed the Financial Innovation and Technology for the 21st Century Act. Better known as FIT21. This bill establishes additional “regulatory clarity” that many investors have been requesting for years. This bill provides a guideline for determining which crypto assets are commodities and which are securities, and what regulations financial institutions must follow accordingly.

This bill received an optimistic amount of bipartisan support, with 208 Republicans and 71 Democrats voting in favor of the bill. While 133 Democrats did vote nay against this bill, compared to just 3 Republicans, it is amazing to see how quickly the political winds have shifted. Politicians in both major parties are realizing that the risks of “anti-Bitcoin” or “anti-crypto” vastly outweigh the rewards.

This bill still must pass through the Democratic majority Senate and the Democratic White House before it becomes law. But there is reason to be optimistic given the bipartisan support in the House of Representatives. We’ll be keeping an eye on this in the days and weeks to come.

You can read the full bill here

5. Anti CBDC Bill

The favorable legislation doesn’t stop there. The house also passed the “CBDC Anti-Surveillance State Act.” This bill effectively bars the Federal Reserve from issuing a central bank digital currency. However, the financial tyranny that people fear from a CBDC can still be achieved through alternative means.

Let’s dissect the wording in the summary from the top of the bill:

“To amend the Federal Reserve Act to prohibit the Federal reserve banks from offering certain products or services directly to an individual, to prohibit the use of central bank digital currency for monetary policy, and for other purposes.”

Firstly, this bill is an amendment of the Federal Reserve Act from 1913, and it only applies to the Federal Reserve. It does not stop other financial entities such as banks or stablecoin issuers from effectively creating their own versions of CBDCs. Although they wouldn’t be called CBDCs, they could have the same undesirable characteristics: the ability for the institutions to freeze or censor your funds, debasement via inflation, and zero financial privacy. In fact, all of these negative features are present within the current US dollar system. When pressured by authorities, every bank in the country will freeze your funds or invade your financial privacy.

The primary thing that a CBDC would enable that can’t already be accomplished is direct, programmatic monetary policy from the Fed. For example, they could easily issue a stimulus by directly adding dollars to everyone’s CBDC wallet. Moreover, they could programmatically freeze funds for specific periods of time or specific goods; something they may want to do in order to create a facade of lower inflation.

So this bill is objectively good, yes; nobody wants to see a CBDC become reality. But it doesn’t entirely eliminate all avenues of potential financial repression. Even without a CBDC the Federal Reserve still holds the levers of monetary policy, and the traditional financial system holds the vast majority of assets. The only way to have true monetary freedom is for people to continue to adopt Bitcoin in a grassroots manner, and take self-custody.

The bi-partisan support we saw with FIT21 was not present with this bill. Just 3 Democrats voted in favor.

You can read the full bill here

6. Metaplanet

Metaplanet, whom we discussed in the newsletter two weeks ago, is a publicly traded company on the Tokyo Stock exchange who has undertaken a corporate Bitcoin strategy similar to that of MicroStrategy. Given the egregious devaluation of the Japanese yen, Metaplanet has fled to a Bitcoin standard in order to preserve the purchasing power of their balance sheet and accrue value to shareholders. This strategy has already proved successful. Since their initial announcement on April 8th, Metaplanet’s stock is up 200%; surging as high as ¥120 this week. Metaplanet is particularly attractive for Japanese investors since they do not have a spot Bitcoin ETF; this gives them a vehicle to gain (leveraged) Bitcoin price exposure within their traditional brokerage accounts.

General Market Update

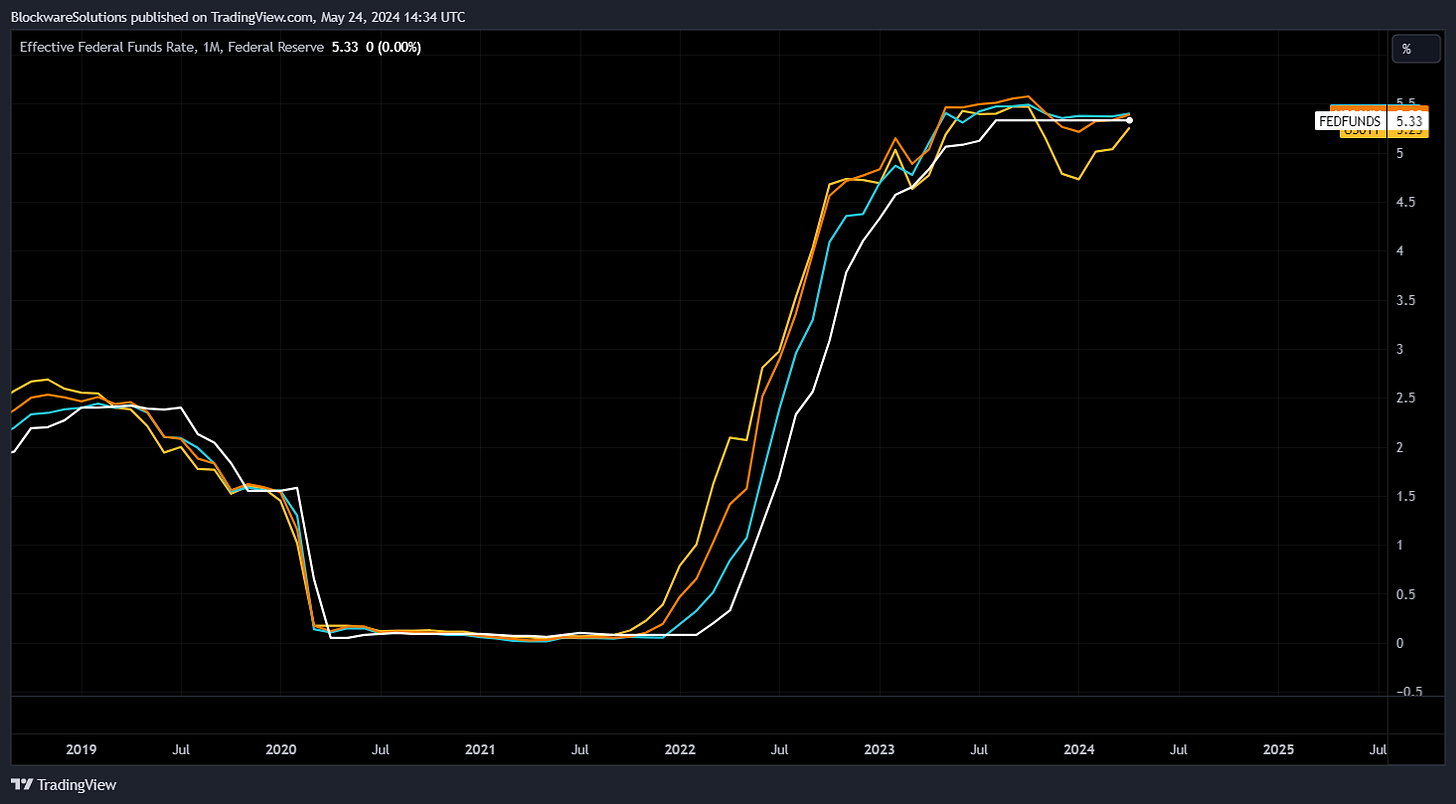

7. Fed Minutes

The transcript from the Fed’s latest meeting was released on Wednesday of this week. The most notable development from the meeting was a verbal acknowledgment from the Fed that rate cuts will likely come later than expected. Which, if you’ve been paying attention to the bond market, this is unsurprising. The Fed referenced the rising bond yields as well as the stubbornly high inflation. As we’ve discussed in previous newsletters, “higher for longer” is not actually bearish for risk assets given the fiscal dominance at play. Higher interest rates and bond yields means the government deficit spending will continue to grow, increasing liquidity in the economy. This is especially true given the heavy issuance of short-duration treasuries as of late; meaning that re-financing at the higher rates is going to come sooner than if issuance was primarily.

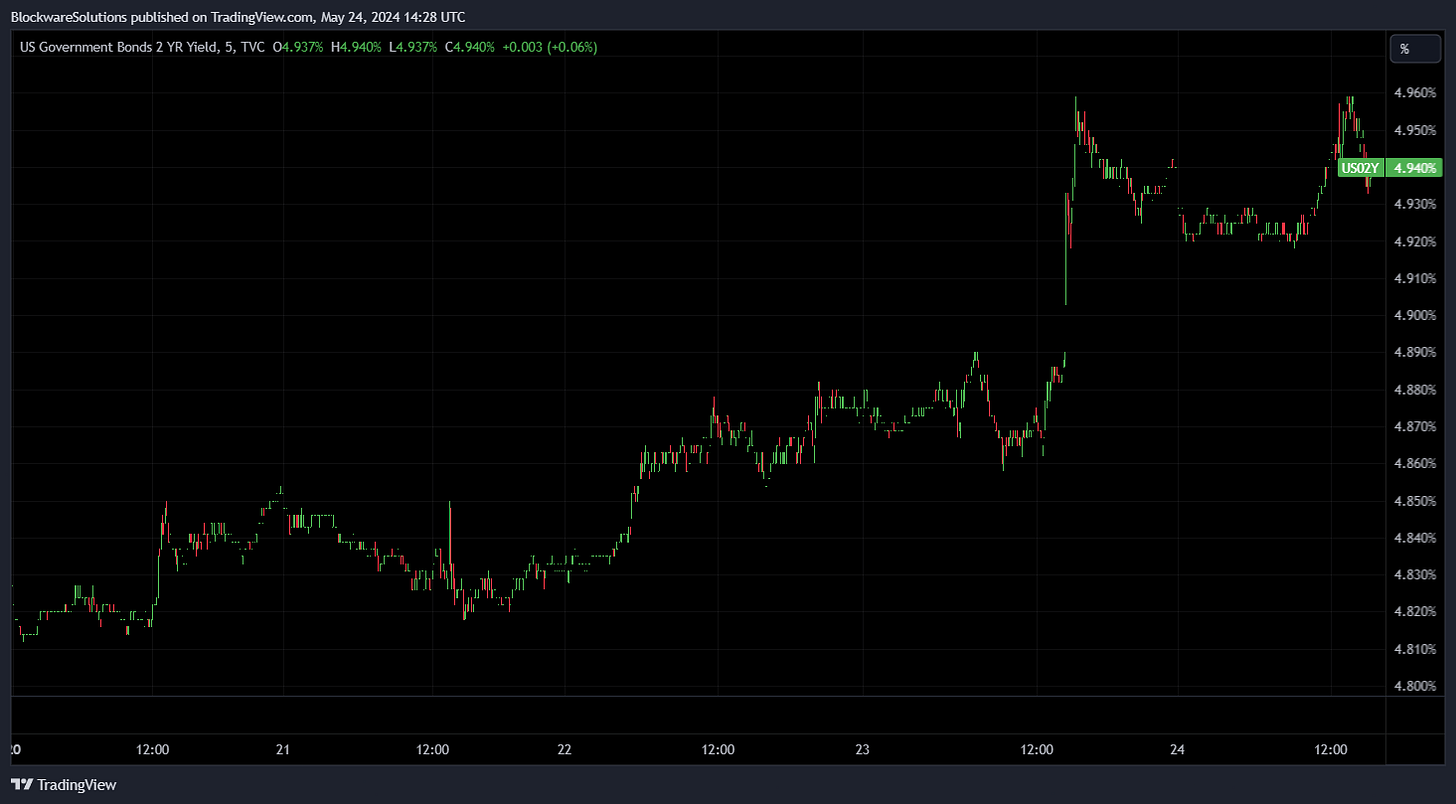

8. US Treasuries

Treasuries did not respond well to the release of the Fed minutes. The 2-year treasury yield is up 13bips (~2.5%) on the week and the 10-year is up 7bips (~1.4%). With persistently high inflation, investors are demanding a higher yield on fixed-income instruments. We’re seeing a rotation away from the treasuries and traditional portfolio theory. In an era of record-high debt-to-GDP, wartime government deficits, and 3% CPI being the new “normal”, fixed income is far less attractive than it once was.

In January, Goldman Sachs forecasted that 2024 would be “The Year of the Bond.” That prediction is not looking too great so far as bonds of all durations have been hammered this year. $TLT, the long-duration treasury bond ETF, is down ~7% year-to-date.

As mentioned, the treasury market is not pricing in cuts in the near term. In fact, cuts in 2024 have been all but priced out. The six-month treasury yield is higher than the Effective Federal Funds Rate. This shows us that bond investors do not expect the Fed to lower rates within the next six months. The 1-year treasury, which has gotten hammered this year, is still pricing in cuts.

Bitcoin Mining

9. Hashprice (Miner Revenue per Terahash)

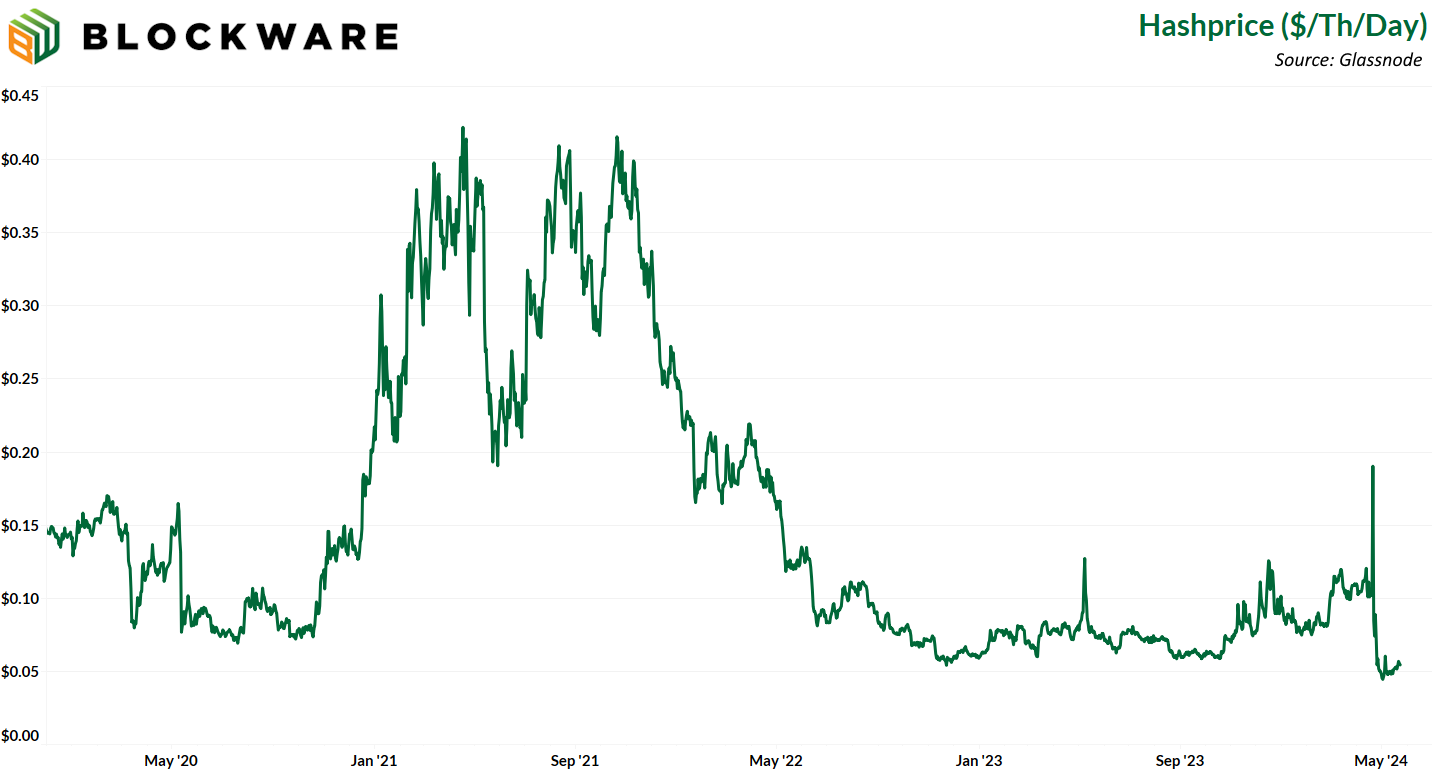

Mining difficulty increase by 1.48% this week, but that was not enough to insight a significant drop in hashprice. Miners are now earning ~$0.052 per terahash per day. Given the positive momentum we are seeing in the Bitcoin price, the halving very likely marked a local bottom for hashprice. The only scenario in which this is not the case will be if BTC continues to trade sideways for an extended period. Miners are continuously deploying additional capital, building new facilities, and expanding their mining fleets. Mining difficulty is up-only historically; the greatest opportunity for miners lies in bull markets when the Bitcoin price is able to outpace the growth in difficulty.

10. Hashprice Year-Over-Year Percent Change

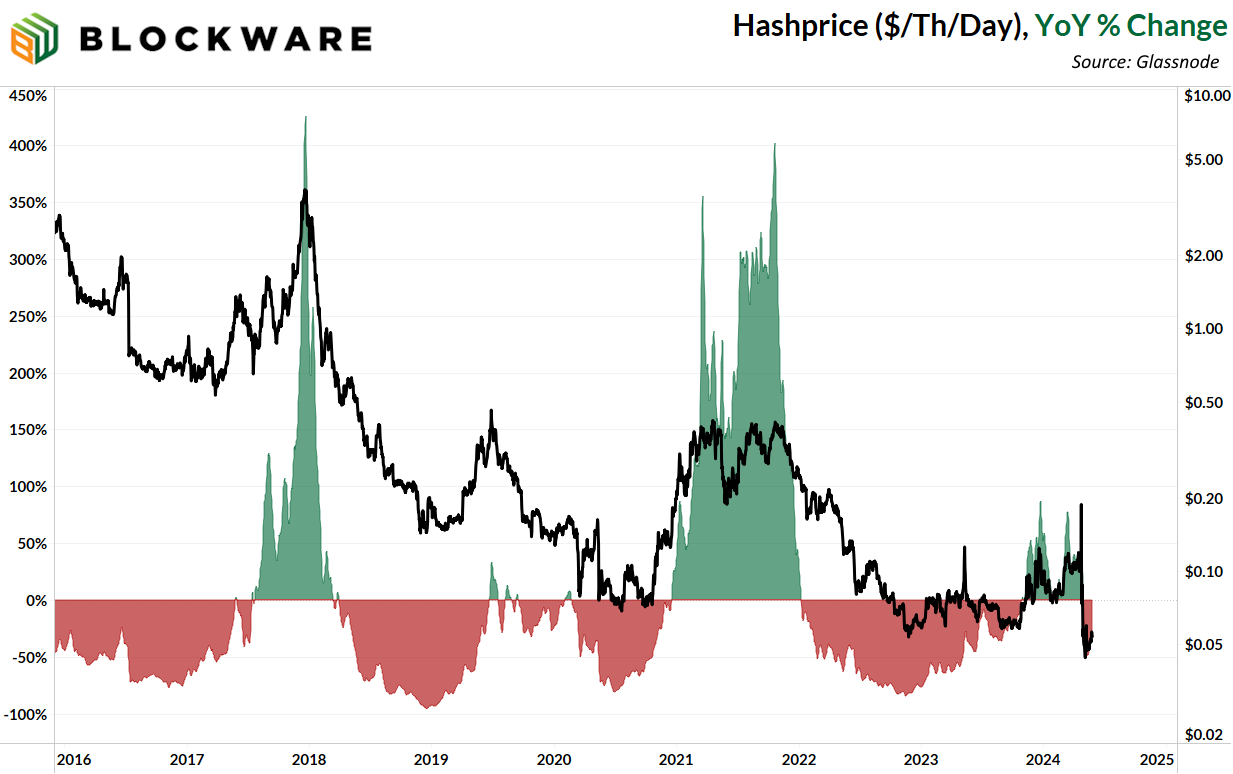

Miners build for three years to experience enormous profits every fourth year. During the previous bull cycles, hashprice grew by 400% on a year-over-year basis. Such rapid growth in miner revenue takes place because the Bitcoin price is able to increase much more quickly than mining difficulty. Growth in the former requires marginally extra bidding. Growth in the latter requires ASIC manufacturing, energy production, and facility development. The best time for miners is these 1-year windows in which BTC is ripping at breakneck speeds.

11. WGMI 0.00%↑

The Bitcoin miner ETF had a great week on the back of the bullish Bitcoin price action. At the start of the year mining stocks were going down despite Bitcoin soaring from $40,000 to $70,000. Investors were pricing in the drop in mining revenue from the halving. With the halving now in the rearview mirror, we may start seeing mining stocks perform as a high-beta play on Bitcoin as they did during the previous cycle.

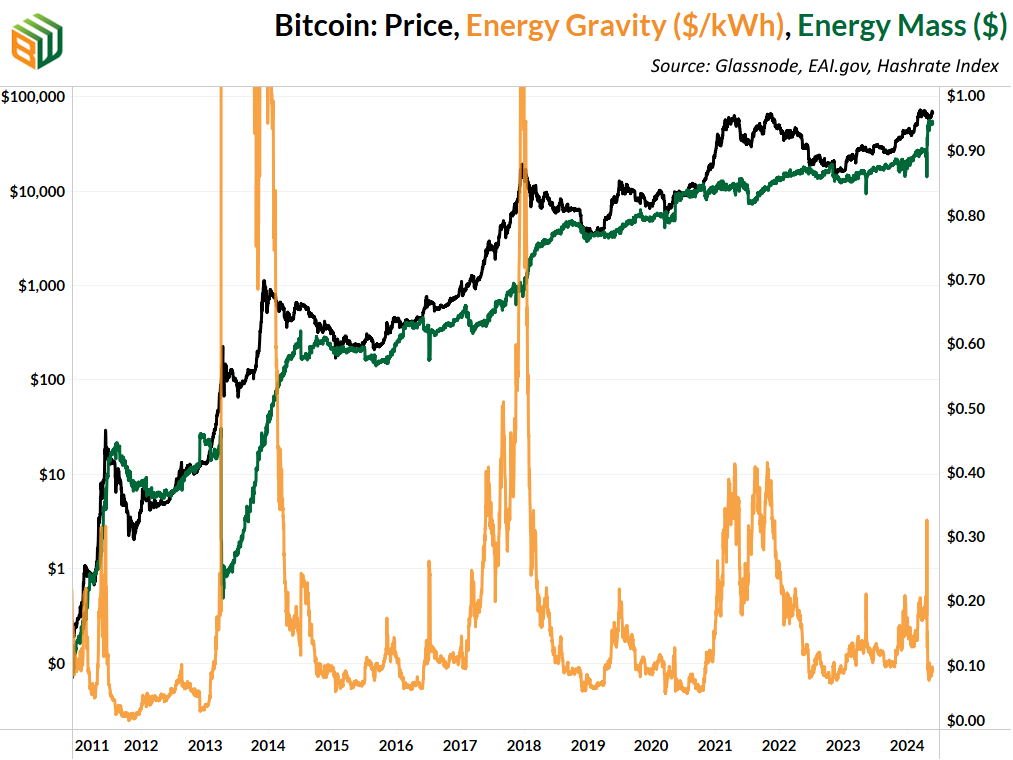

11. Energy Gravity:

At a typical hosting rate today, new-gen Bitcoin ASICs require ~$52,400 worth of energy to produce 1 BTC. The green line shows the average cost to mine 1 Bitcoin using the latest-generation Bitcoin mining rig. The orange line shows how many $ (output) miners are able to earn for each kWh of power (input). To learn more about Energy Mass & Energy Gravity, read our report at the link below.

Read the Energy Gravity report here.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.