Blockware Intelligence Newsletter: Week 55

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 9/10/22-9/16/22

Blockware Intelligence Sponsors

If you are interested in sponsoring Blockware Intelligence email: sponsor@blockwaresolutions.com.

NordVPN - Privately and securely browse the web. This is critical to handling your Bitcoin carefully. Use code: “Blockware” for a 30-day money-back guarantee.

Blockware Solutions - Buy and host Bitcoin mining rigs to passively earn BTC by adding blocks to the blockchain. Your mining rigs, your keys, your Bitcoin.

Have fun and learn more about our Bitcoin future at Pacific Bitcoin, the largest Bitcoin conference on the West Coast. Nov 10-11 in Los Angeles. Get 30% OFF tickets with code BLOCK.

Located in Europe or want to take a trip? Go to the Bitcoin Amsterdam conference Oct 12-14. Use code: BLOCKWARE for 10% off.

Summary

On Tuesday we saw the release of August’s CPI numbers from the BLS, which indicated that in comparison to last year, CPI inflation has risen by 8.3%.

The Fed Open Market Committee meets next week on Wednesday to determine the next increase to the Fed Funds Rate. The market is currently predicting that a 75bps hike is most likely.

The US average mortgage rate broke above 6% this week for the first time since the 2008 housing crisis.

With Treasury yields and the US Dollar Index spiking, the major equity indices appear to be breaking down towards their YTD lows,

Spot Bitcoin price also has seen extreme weakness following Tuesday’s hotter than expected CPI number, and could be on a collision course with its June lows.

On-chain data shows new waves of Bitcoiners becoming long term hodlers every 4 years.

Despite being in a bear market the number of entities on the network continues to grow at a rate congruent to the growth rate during a bull market.

Smaller entities (less than 1 BTC) are continuing to stack aggressively

Puell Multiple, MVRV Z-Score, and Mayer Multiple are all in the value zone

ETH / BTC tanks following the “Merge”; fails to break .08 resistance level

General Market Update

Following Tuesday’s announcement of August’s CPI data, it’s been a pretty brutal week across the traditional financial markets.

August’s headline CPI number came in at 8.3% YoY growth, this was down from 8.5% in July. But with the consensus analyst estimate at 8.1%, it’s not much of a surprise to see the reaction the markets have had.

Although YoY CPI was down in August compared to July, because the market is forward looking, it largely operates based on expectations. The aggregated expectation was that YoY CPI would decline by 40bps in the month of August, because it only fell by 20bps, we’re seeing a selloff.

US YoY Core CPI

Core CPI, or CPI minus the two most volatile pieces (energy and food), rose 6.3% YoY in August. This marked the first month of increasing core CPI since March.

August CPI Category Breakdown (Source: BLS)

Above you can see the specific categories included in CPI’s basket and how much they increased in price since August 2021. While each individual item doesn’t have an equal weighting on the final CPI number, we can see that energy costs are still driving CPI inflation.

Despite the US national average gas price now down over 25% from its peak in June, energy as a whole was up nearly 24% YoY in August, with oil (+68.8%) and natural gas (+33%) as the main drivers.

Keep in mind that energy is an input in the production of all goods or providing of all services. Notice how with energy prices rising dramatically over the last year, airline fares have risen (33%), and food prices have spiked (11.4% total).

In more positive news, the Producer Price Index (PPI) saw its second straight month of YoY declines, dropping from 11.3% in June, to 9.8% in July, and now 8.7% in August. The actual data point came in 10bps below the consensus analyst estimate of 8.8%.

Producer costs are a leading indicator for consumer costs, meaning that if production costs are rising, final good prices will eventually rise to catch up. But since PPI has been declining for 2 months now, it could be a signal that the prices of goods are likely to follow suit in the near future.

With the major inflation metrics not declining at the rate that’s largely expected, it forces the Fed’s hand in their rate hike schedule. The Fed Open Market Committee meets next week on Wednesday to decide what to do with the market interest rate.

FedWatch Tool (CME Group)

Based on Fed Funds futures data, CME Group’s FedWatch Tool is predicting a 78% chance of a 75bps FFR hike.

This tool is also predicting a 22% chance of seeing a 100bps hike. At this time last week (before August CPI) they gave a 0% chance of a 1% hike.

FFR, YoY CPI, and 2Y Treasury Yield (Tradingview)

Currently, with CPI at 40-year highs, and shorter dated Treasury yields spiking (more on this later), the market is signaling to the Fed that they have room to push interest rates.

We won’t speculate much on what we think the Fed will do on Wednesday, but what investors should keep in mind is what the market is expecting.

At this point, based on futures data and security price action, the market has priced in a 50bps hike, and most of a 75bps hike. The reaction the market would have to a 75bps hike is up in the air, but a 100bps one would likely cause an acceleration to the current sell off.

Moving on, there were a couple of news stories out of the White House that are worth noting.

With talks earlier in the week about union approval of a strike for railroad workers, the Biden administration announced a tentative deal on Thursday to avoid the strike. Obviously, with railroad workers not working, it would place extra stress on our already weakened supply chain.

According to the Federal Railroad Administration, approximately 28% of US freight movement is on trains. So clearly a railroad strike would be an inflationary pressure on the price of goods.

There was also news regarding the Biden administration weighing buying oil at ~$80/barrel to refill the strategic petroleum reserve.

This comes following their announcement in March to release 180 million barrels from the US’ emergency reserve in order to suppress oil prices. As a result, the reserve now sits at its lowest level in nearly 40 years.

The decision to refill the reserve stems from 2 main ideas; firstly, we now likely don’t have adequate reserves in case of a national emergency, and secondly, oil prices have been falling due to declining demand and a rising dollar, which disincentivizes production.

This week we’ve also seen increasing evidence that Wall Street firms are feeling recessionary pressures. The big news came on Monday with Goldman Sachs announcing a planned layoff of hundreds of employees.

This comes alongside a 50% decline in reported revenues across divisions in Q2, and a 41% decline in revenue from their investment banking division in July. This is roughly in line with JP Morgan’s expected 50% decline in IBD revenue for Q3.

Initial Jobless Claims (FRED)

Despite more announcements of layoffs from major companies this week, we’re continuing to see unemployment decline, as measured by initial jobless claims. As of last week, IJC sits at 213,000.

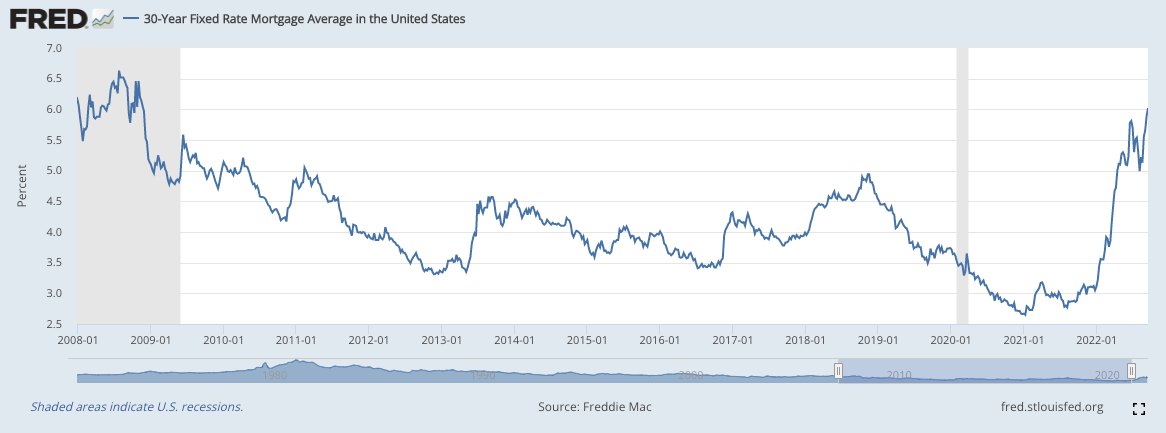

30-Year Fixed Rate Mortgage Average (FRED)

This week we’ve also seen mortgage rates crack above 6.0% for the first time since November 2008. This comes alongside a report from CNBC, that shows that YoY demand for mortgages is down 29% as of this week.

As discussed here last week, a decline in mortgage signings forces banks to raise interest rates on new or refinanced mortgages in order to retain interest revenue.

The combination of a rising market interest rate (FFR) and declining demand for loans is what is driving the spike in mortgage rates. As discussed last week, this is likely to take the form of lower home prices at some point in the future.

In the stock market, the major indexes are down significantly this week and as of Thursday, the Nasdaq is on track for its worst week since June.

In this newsletter for the last 2 weeks, we have discussed that the most likely scenario for the indexes is that we would see an oversold bounce that would likely run into resistance fairly quickly before continuing lower. That is exactly what we saw between this week and last.

Nasdaq Composite 1D (Tradingview)

After jumping nearly 7% across 4 sessions, the Nasdaq ultimately ran into sellers at $12,270, which coincided with the 20-day SMA.

Tuesday’s 5.16% loss for the Nasdaq Composite marked its worst single day performance of this bear market, and the worst since June 11th, 2020 (-5.27%).

Speculatively, the index looks to be on a collision course with its June lows, but this likely will take a little bit of time, if it even happens at all. On Thursday, the index was able to hold the low from September 6th, but as of Friday morning we’ve gapped down below that level.

Be on the lookout for Friday’s close to see whether we can regain that $11,471.50 level or if we have more downside continuation.

Despite the weakness in the major indexes, several growth stocks are showing great relative strength. A few of the leading stocks at the moment are: ENPH, ELF, TNK, PLRX, ENVX, WOLF, STEM, FOUR, UBER, and CHPT.

Alongside the selloff in the equity indexes has been a continued, and intensifying, selloff in the fixed-income market. At the time of writing, the yield of the 2Y Treasury sits at ~3.92%, which is up roughly 35bps from last week. Comparatively, the 10Y’s yield is up about 16bps this week to ~3.47%.

This brings the 2/10Y spread (discussed here last week) back down to roughly -0.44, which is growing close to the YTD low of -0.48. The effects of the hotter than expected CPI number can be seen clearly in the yields of Treasury securities, as investors appear increasingly concerned about near-term economic conditions.

Furthermore, on Tuesday, the US Dollar Currency Index (DXY) had its largest single day increase (1.55%) since March 19, 2020 (2%).

With increasing Treasury yields and DXY placing macro pressures on equity present values, it's fair to say we’re far from out of the woods.

Crypto-Exposed Equities

Generally speaking, it’s been a relatively boring, but negative week for crypto-exposed equities with the breakdown we’re seeing from BTC.

The strongest of these names have mostly just chopped sideways this week, with the weaker names breaking lower. That being said, Bitcoin-equities generally look better than spot BTC from a technical perspective.

SI 1D (Tradingview)

Silvergate Capital (SI) has been a name that has stood out to us over the last few months. Although it currently looks as though a break below $82 is likely, its distance from its lows, and lack of strong sell volume makes it look better than most of the crypto industry group.

Above, as always, is the table comparing the weekly price action of several crypto-native stocks to that of their average, BTC, and WGMI.

Bitcoin Technical Analysis

To be frank, from a technical price structure perspective, BTC looks pretty weak.

BTCUSD 1D (Tradingview)

In this section last week, we discussed how it was probable that BTC would see short-term strength turn into weakness. While this reversal appeared at a slightly higher price than predicted, readers of this newsletter shouldn’t have been terribly shocked to see a reversal towards lower prices.

The 9.94% decline on Tuesday came on volume (Coinbase) that was nearly 68% greater than BTC’s 50-day average. This shows us that despite BTC’s value proposition as a debasement hedge, higher than expected CPI inflation still has an adverse effect on BTC price.

The fact of the matter is that Bitcoin, and crypto assets as a whole, are classified as risk assets. With unclear future expectations about their classification as securities, tax reporting standards, or even a potential ban of PoW mining, BTC’s grouping as a risk asset is unlikely to change for some time.

As a result, BTC’s price action has been fairly closely related to that of the equity indexes. Therefore, the same logic previously discussed with rising yields and DXY causing weakness in equities can be applied to BTC.

From here, BTC could find some support at a few levels. ~$18.9K-18.7K is the next zone to keep an eye on, a break below that would likely result in a test of the ~$17.6K YTD lows.

Bitcoin On-chain and Derivatives

Short Term Holder (STH) Realized Price and Long Term Holder (LTH) Realized Price are less than $1k apart now; being at $23.9k and $23.1k respectively.

We have been keeping tabs on these metrics for the past few weeks as we eagerly anticipate them to cross.

STH RP going below LTH RP has only occurred previously during bear market bottoms. This crossover requires months of negative price action where new STHs, introduced to the market during a bull run, keep stacking after the bull market top which lowers their cost basis.

LTH RP is steadily up and to the right over time due to two factors. First, LTHs stack at all prices. LTHs understand the vital role that Bitcoin will play in the future of finance and no price is too expensive. However, the stacking done at current price levels does little to move the needle on the cost basis of individual long term holders as a large percentage of their stack comes from the extremely cheap price levels of past cycles.

The more impactful upwards pressure of LTH RP is the aging of STHs into LTHs. The threshold constituting a LTH is UTXOs that haven’t moved in 155 days or longer. Notice in the chart below that a few months following an upwards rip in the STH RP is a similar upwards rip in the LTH RP.

On the other hand LTHs on aggregate have a low cost basis as many have been stacking for more than one 4 year cycle. These LTHs stack at all levels regardless of how high the price goes. Thus, their cost basis increases steadily over time. Moreover, the LTH RP sees large spikes up in the ~155 days following a massive spike up in STH RP. We can interpret this as STHs aging into LTHs; breeding a new cohort of Bitcoin hodlers.

More on-chain evidence of STHs aging into LTHs can be found by looking at the net position change of both groups.

During the bull runs the STH net position change (purple) increases greatly while the LTH net position change (green) decreases in a similar quantity. Roughly ~155 days after these position changes we see the inverse. STH NPC goes negative while LTH NPC sees a large increase nearly identical to the decrease in the STH NPC. This is on-chain evidence new classes of Bitcoiners turning into long term hodlers.

This is significant because it shows that each cycle breeds a new cohort of LTHs. Bull runs cause Bitcoin to capture widespread attention. An unknown percentage of the new eyes begin to dig deep into Bitcoin’s technical, economic, social, and political impacts. The common colloquial is “classes.” ie. Bitcoin Class of 2013, Class of 2017, Class of 2021, etc. New classes of Bitcoiners means an increased number of people and capital bidding for a limited supply of 21,000,000.

An interesting juxtaposition of Bitcoin adoption between classes is shown by looking at the total number of entities on-chain. “Entities” are clusters of addresses that glassnode’s forensics team has estimated belong to a single individual or institution. The cumulative sum of entities' net growth gives a good estimate of the number of on-chain bitcoin users.

Below we have charted the cumulative sum of entities' net growth (orange) alongside its 90 day change (green) and 365 day change (blue).

As expected the biggest increases in users occur during hyperbolic bull runs. The 2017 bull run had the biggest increase in new users. What is interesting here is that while the initial adoption growth in the 2021 bull run was not as sharp as in 2017, the growth has persisted through the bear market.

The immediate rush of new users in 2017 followed by a sharp drop off in the growth rate seems to be congruent with the price action of that cycle. The 2021 cycle did not live up to expectations from a price standpoint; there was no blow off top. The lack of a blow off top could be the reason that the short term growth in users (green line) was not as intense as in 2017. However, the increased growth rate has not waivered since the end of the bull market mania. The 365d change in users (blue line) remains at extraordinarily high levels contrary to 2017 when it dropped off.

A high growth rate in the number of users despite being a bear market is incredibly bullish for the long-term future of Bitcoin.

These new entities are not just sitting idle during this bear market. They are STACKING HARD.

Below is the supply held by entities with .01 - .1 BTC. The degree to which these smaller users are increasing the size of their stacks is astonishing; and they are doing so while BTC is 70% below its all-time-high.

Many people view institutional adoption as the most important determinant of Bitcoins success. However, there’s a strong argument to be made that institutional adoption only occurs as a knock-on effect of successful adoption at the retail level

Bitcoin is an open-source protocol in which users (node operators) are in control; this is unlike centralized institutions. Institutions are slow to adopt emerging technologies; adoption on their part will only occur once they are unable to ignore the pressure from retail to do so. Moreover, large financial institutions benefit from the cantillon effect of fiat currency and as such they will not be leading the charge on Bitcoin adoption. Rather, Bitcoin adoption on the part of large financial institutions is actually them capitulating into the new system.

To find out more about Bitcoin adoption, read our User Adoption Report.

Bitcoin has spent another week in the “value zone” for a few of the metrics that we observe frequently. These valuation metrics provide a good birds eye view of where we are in the Bitcoin cycle. Currently they all signal that we are likely at or near the bottom.

First, MVRV Z-Score. This measures the Bitcoin Price with the Realized Price (for all entities, not segregated between short and long term holders.) This metric is screaming “BUY NOW”.

Second is Puell Multiple. Created by David Puell, this metric divides the moving average of the daily issuance value for BTC by the 365-day moving average of the daily issuance value.

The daily issuance value is simply the new coins added to the ledger by miners each day multiplied by the BTC price at the time in which the new coins were mined. When the Puell Multiple is running hot that means the new daily issuance value today is high relative to the past year. When the Puell Multiple is low like it is now that means BTC is extremely cheap now compared to the past year.

Puell Multiple has only reached levels this low during bear market bottoms or during macro-induced capitulation events such as the covid crash of March 2020.

The Mayer Multiple is the ratio between the price and the 200-day moving average. The 200-day moving average is a good relative indicator of a bull vs bear market. As BTC price goes further below the 200-day moving average that is a good indicator that BTC is oversold.

The Mayer Multiple has now been in the “value zone” since May of this year. Of course the macro environment is uncertain which means the short-term outlook for BTC is also uncertain, but for anyone with a long time horizon these valuation metrics are begging you to dollar cost average in this range.

As mentioned in the paragraph above, (and as anybody who has been following BTC for the past year already knows), BTC has had a strong correlation with equities. The broader market has put Bitcoin in the same category as risk assets. The chart below shows BTCs correlation with the S&P 500.

Here at Blockware we understand that Bitcoin is a completely unique asset class and the fact it is behaving similarly to risk assets shows just how early it is. Bitcoin is a digital commodity that is decentralized, permissionless, and absolutely scarce. Bitcoin will do for money what the internet did for information.

Nevertheless, it is currently trading like a risk asset so keep that in mind before making any bold short term trades. The uncertainty of the macro makes the short term price of BTC uncertain as well. But, if you have no interest in short term performance and you are allocating capital with a long term time frame, now is a great time to get into BTC.

The highly anticipated Ethereum “Merge” took place this week. Some speculate this may be a "buy the rumor, sell the news" market scenario. Time will tell if that thesis is correct or if the merge was a positive catalyst for eth price action. After only 24 hours, ETH appears to be selling off against both the USD and BTC

As the merge approached, ETH / BTC made a run up to .08, a key level of resistance, before failing to break through. Over the coming months we will see if the merge can send ETH / BTC beyond this resistance level or if it will tank against BTC as altcoins have historically done during bear markets. Even if ETH does break past this resistance level it still has a ways to go if it wants to reach its previous BTC denominated all-time-high.

Bitcoin Mining

Mining Difficulty All-Time High

Despite the bearish price action and Bitcoin being well off its all-time high, mining difficulty just reached a new all-time high.

This increase can be attributed to three main factors.

1. Mining rigs that were capitulated this summer have been sold, relocated, and plugged in by more efficient miners likely with lower energy costs. Much of the hash rate that came off the network has likely turned back on now.

2. New generation rigs have now been released and shipped all over the world. This includes both S19XPs from Bitmain and M50s from MicroBT. These are the most energy-efficient rigs on the market and they pack a high hash rate (140 TH and 114 TH respectively).

3. Power curtailments are happening less due to extreme heat and stress on energy grids subsiding (Riot’s Whinstone facility in Texas).

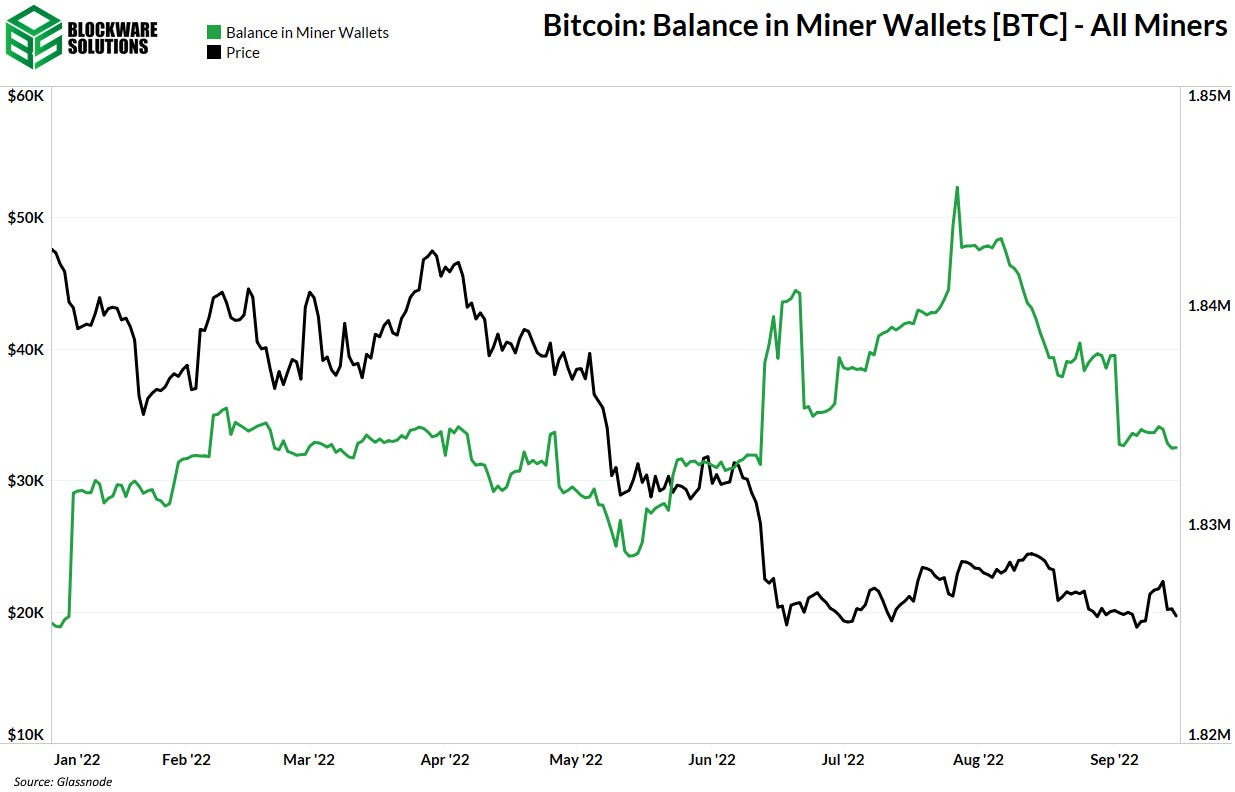

Misinterpreted Miner Balance Chart

Glassnode has a lot of great data and resources, but if you misinterpret what it is presenting, you can create misleading narratives. As discussed throughout the Summer of 2022, Bitcoin miners were capitulating from May to August. Hash rate and difficulty were dropping, public miners were selling more BTC than they were mining, and the general market sentiment was risk-off. This Miner Wallet chart appears to show the exact opposite. It shows miner balances were actually increasing significantly from May to August.

First, it is critical to understand the composition of this metric. A large majority of these coins are only early miners and Satoshi. This is not a good representation of active miner balances, as some may interpret it.

Second, tracking exact miner balances is nearly impossible. Hash rate is pointed to pools. Pools distribute BTC periodically to miners usually when certain withdrawal thresholds are reached. Miners then likely collect a majority of their rewards in their own cold storage wallet (not the pool’s wallet). This metric is mainly composed of early miners and pool wallets.

The recent increase in this metric can be attributed to “other” miners and the Poolin mining pool. Ironically, Poolin is having liquidity issues so it is difficult to know exactly what is happening with their wallets. “Others” (early miners) is likely just an old miner reshuffling UTXOs or something of that nature.

In conclusion, I would not take away much from this metric, other than the fact that it certainly does not disprove a miner capitulation has occurred as some may interpret.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Thank You!

shouldn't Mayer's Multiple be a bearish signal? the technical definition of a bear market is when price is below it's 200 day MA. and the futher away price is from the 200 day MA the severe the near market is.

price would remain below the 200 day MA in a bear market and Mayer's Multiple will keep flashing a buy signal. to me, that's sounds like catching a falling knife.