Blockware Intelligence Newsletter: Week 89

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 5/27/23-6/2/23

Blockware Intelligence Sponsors

Blockware Marketplace - Buy, sell, and trade hosted Bitcoin mining rigs.

Summary:

The Debt Ceiling Bill passed in both the House and the Senate, and is expected to be signed into law today.

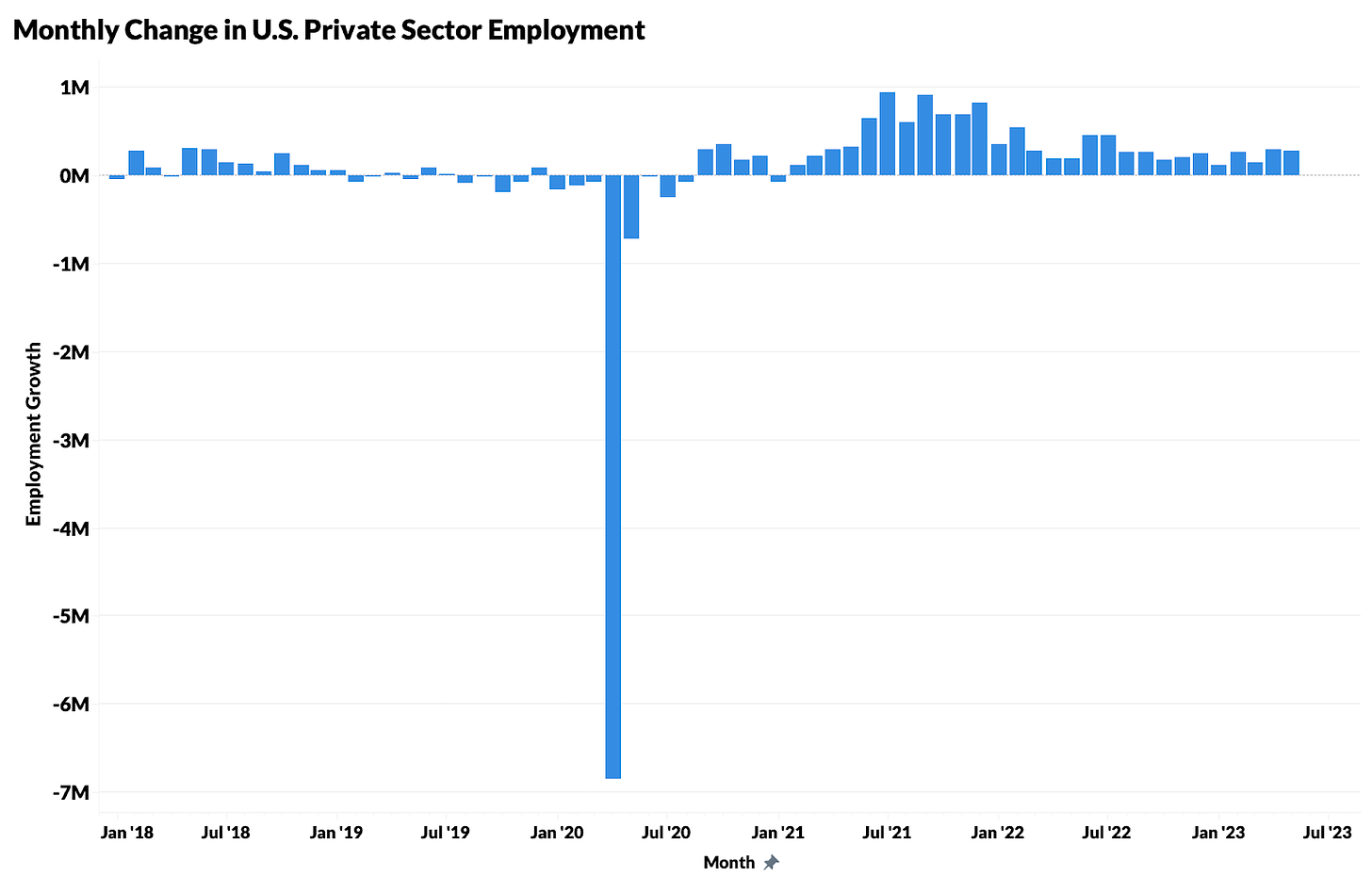

The private sector added 278,000 jobs in May, according to ADP.

The broader US economy added 339,000 jobs in May, as measured by Nonfarm Payrolls released this morning.

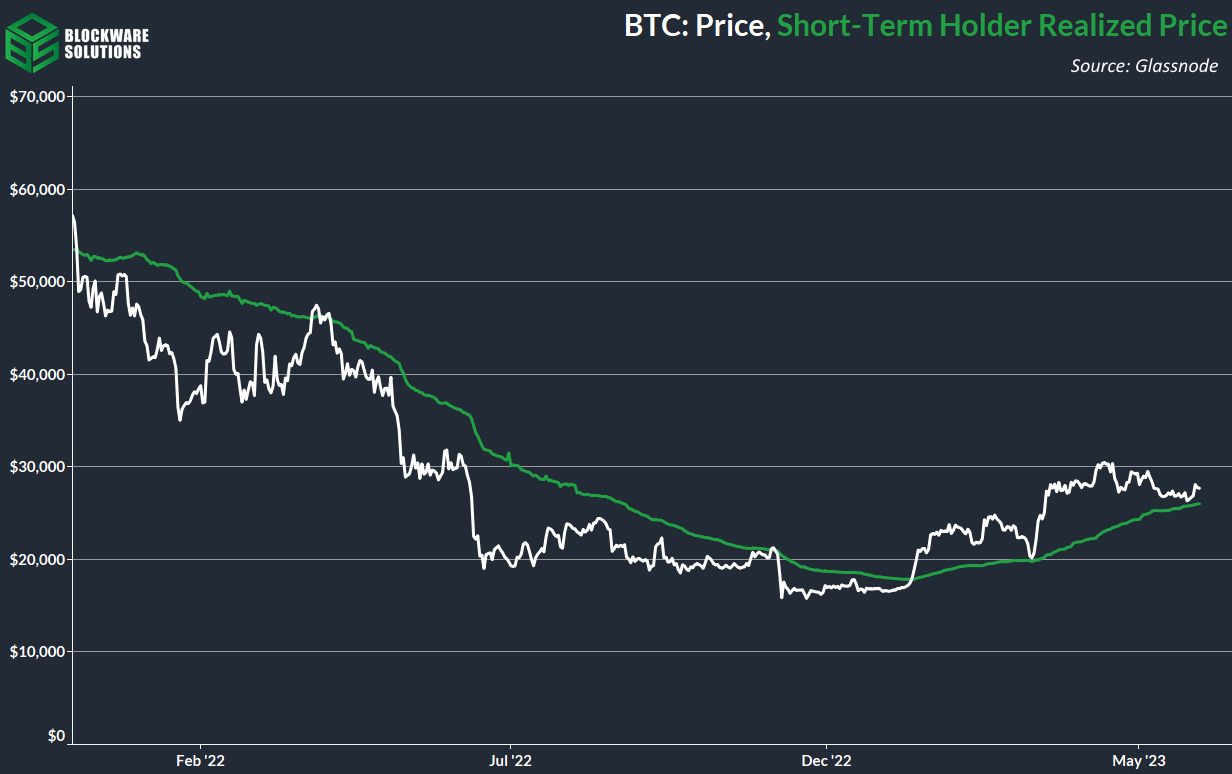

BTC holds support above short-term holder realized price.

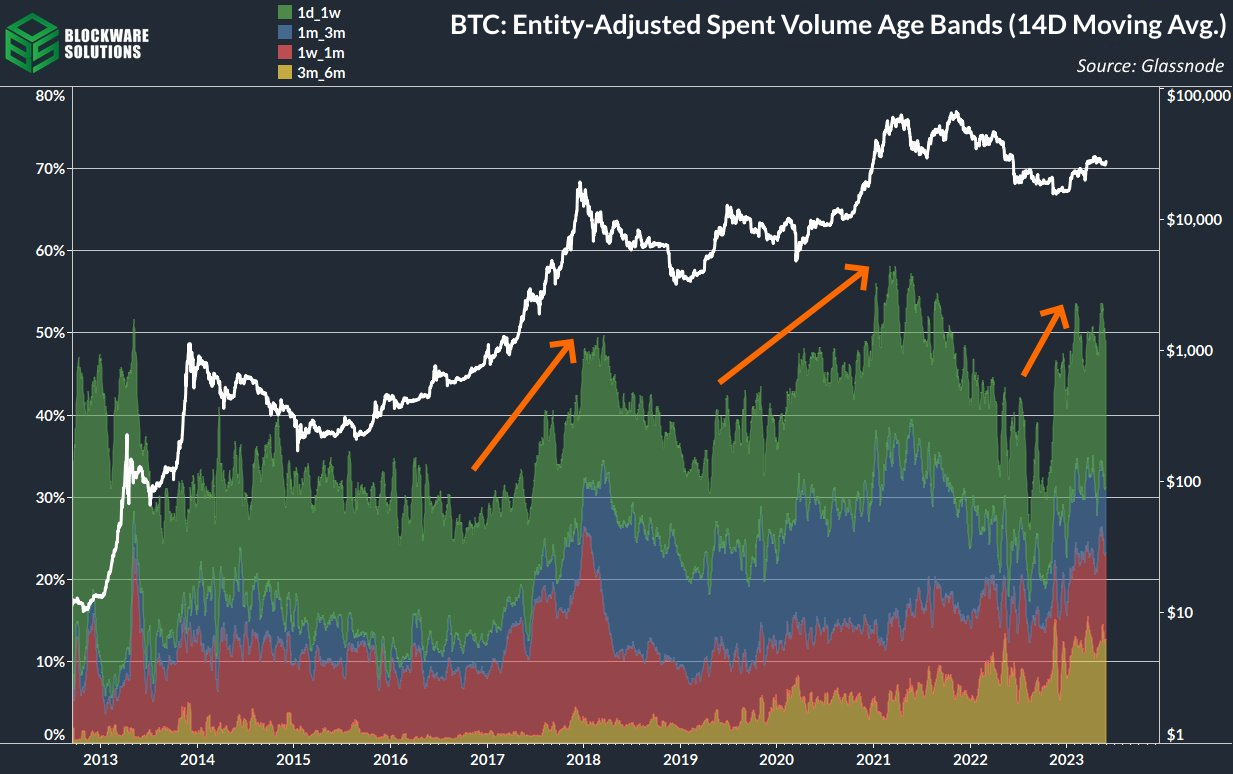

Over 50% of on-chain transactions are from short term holders, a rate on par with that of bull markets.

Total on-chain entities increases significantly due to the rise of inscriptions.

Over 50% of on-chain transfer volume comes from transactions over $1,000,000 worth of BTC.

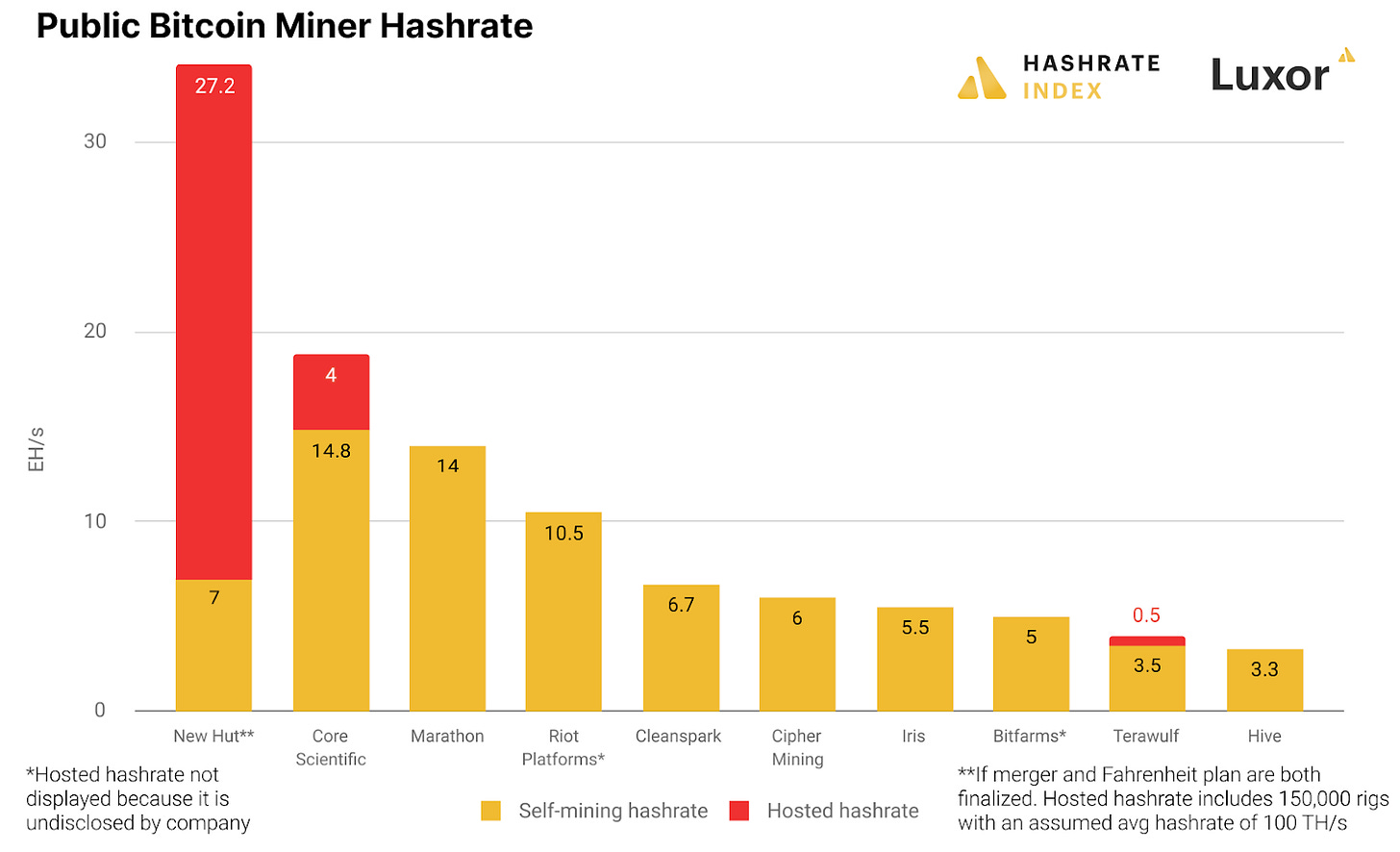

Major consolidation is occurring in the Bitcoin Mining Industry and New Hut could emerge on top.

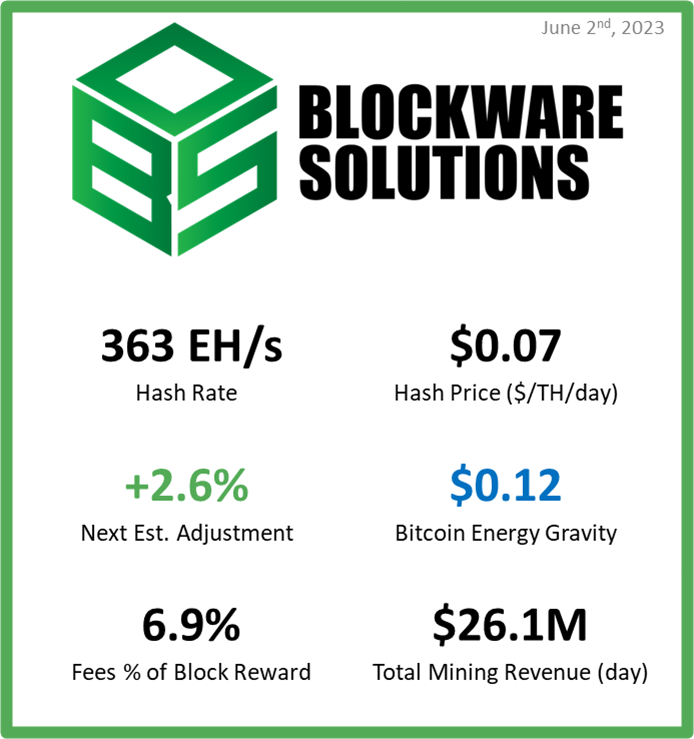

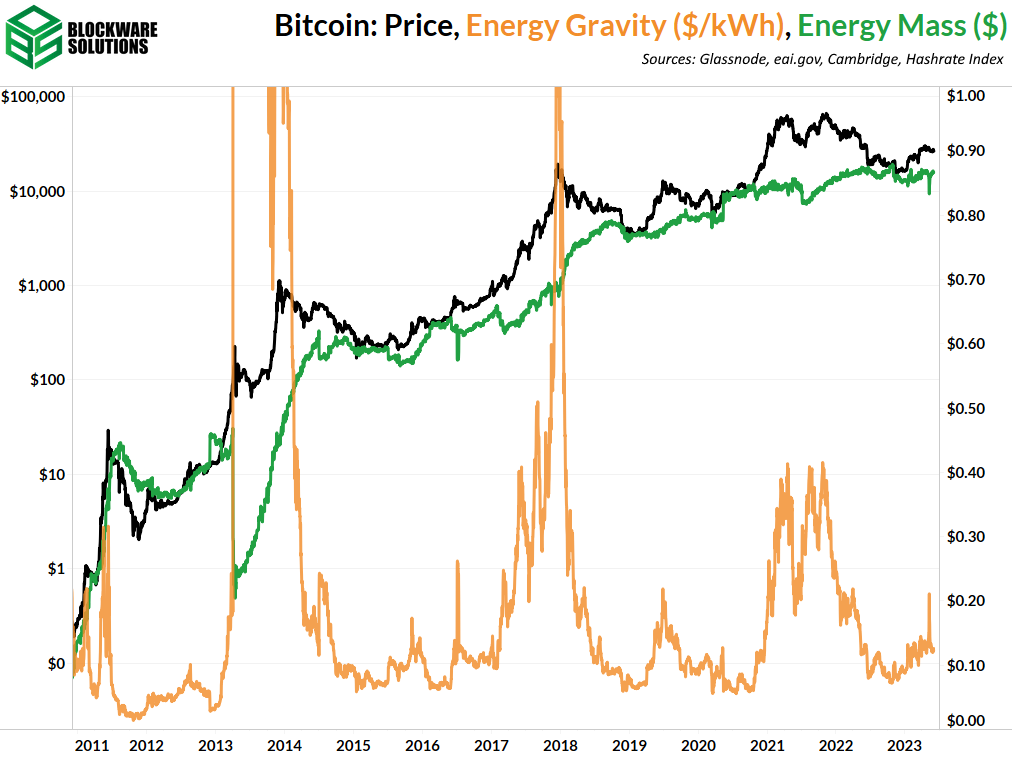

The breakeven electricity rate for a modern Bitcoin ASIC is $0.12/kWh.

At a typical hosting rate today, new-gen Bitcoin ASICs require ~$16,050 worth of energy to produce 1 BTC.

General Market Update

The big news this week comes on the tailwinds of what this newsletter discussed last week. Earlier in the week, we first received news that a deal had been made to avert potential economic disaster in the US.

Wednesday night, this proposal passed through the House with a 314-117 vote. Yesterday, the bill passed in the Senate as well, by a 63-36 margin.

Below are some of the highlights of this deal:

The debt ceiling is suspended until 2025, allowing the Treasury to issue an unlimited amount of debt to refill their general account.

Non-defense spending is to be held at 2023 levels in 2024, with a targeted 1% increase in 2025.

This deal ends the suspension of student loan payments, which have been paused since the COVID pandemic.

The unspent ~$30 billion in COVID relief funds will be clawed back (returned).

There are no tax increases.

This blocks the proposed 30% tax on energy used for Bitcoin mining.

Now that this bill has passed in the Senate, it is heading to the Oval Office to be signed into law. While this is a win for markets and the American consumer, we see this as a deal to kick the can.

The suspension of the debt ceiling until 2025 will likely extend the US’ debt-to-GDP ratio into unsustainable levels. However, it is a win for Americans that the debt ceiling can’t be further politicized heading into the 2024 election.

Whether this will cause a major liquidity crunch in the banking system is yet to be seen.

On Thursday morning we received the ADP’s employment number for the month of May. This data showed that the private sector added 278,000 jobs last month.

This number was slightly below April’s revised 291,000 jobs, but well above expectations of 170,000.

Furthermore, nonfarm payrolls were released Friday morning, which showed that the US economy added 339,000 jobs in May. This number was also above expectations of 195,000.

The Fed stated earlier in the year that employment would become a major focus for them in 2023. As the labor market has yet to materially soften, this leads many to believe that it could provide the justification needed to raise rates by another 25bps in June.

While this is not a possibility to ignore, the market doesn’t seem overly concerned.

FedWatch Tool, June 14th (CME Group)

Yields continued lower on Thursday, on the back of the debt ceiling bill passing in the House, but, at the time of writing, are bouncing higher today. Furthermore, the Fed funds futures market is currently pricing in a roughly 70% likelihood of the Fed holding the FFR at 5.25% in 2 weeks.

From the equity indices, there is no material update from last week. The Nasdaq pulled back slightly on Wednesday, but continued to move higher on Thursday.

The index remains quite extended from all major moving averages, and sentiment remains overheated. But as mentioned last week, just because something is overbought doesn’t mean it can’t become more overbought.

The S&P headed back towards YTD highs on Thursday, and the Dow also had a solid session after holding its 200-day SMA.

Bitcoin Exposed Equities

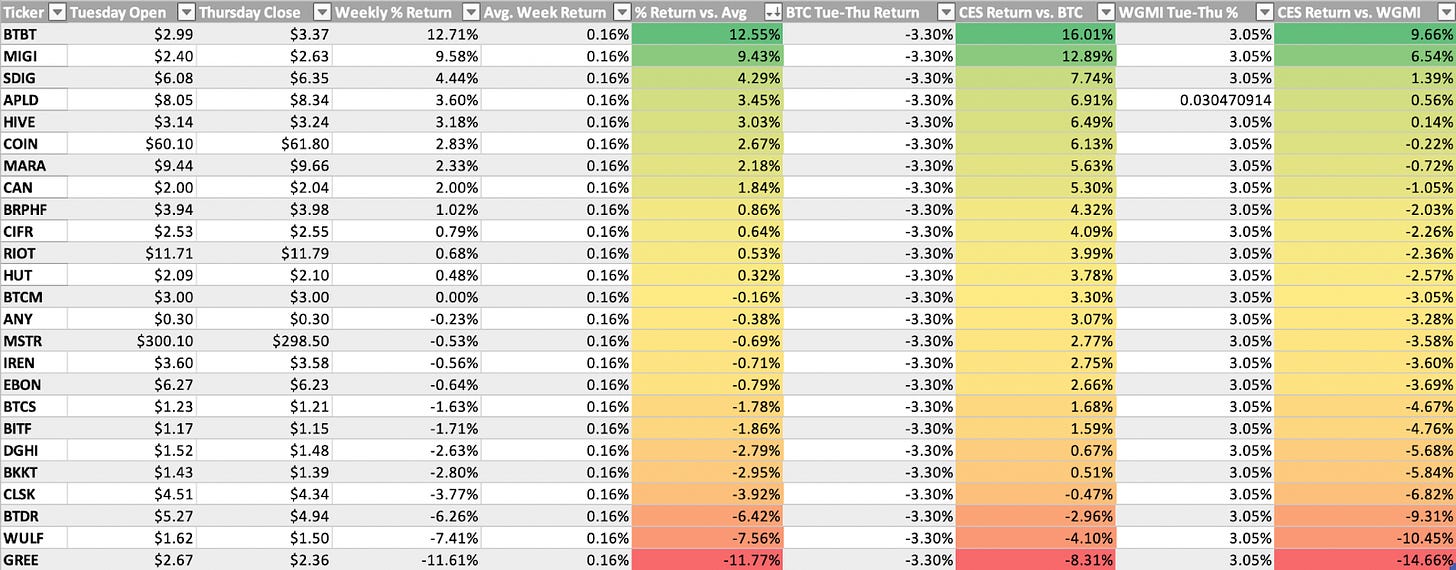

This week has been a pretty strong one for the price action of many publicly traded Bitcoin companies. Specifically, several miners have truly begun to separate themselves from the pack.

HUT is a great example of a miner showing relative strength. The reason for this is quite obvious, but I’m going to make you read down to the mining section for more information there :).

HUT, 1D (Tradingview)

Hut 8 is currently up 9% on the week, and is closing in on QTD highs at $2.24. Other names that are standing out include: COIN, BTBT, MARA, RIOT, CLSK, HIVE, and APLD.

This is the longest list of good looking names I’ve been able to give in a very long time. That should say a lot about the current state of the market.

Institutions are clearly on the prowl to position themselves in this industry group as we enter the last month of the 2nd quarter. Keep an eye on price and volume and their favorite names aren’t hard to find.

Above is the excel sheet comparing the Tuesday-Thursday performance of many Bitcoin exposed equities to that of Bitcoin, and Valkyrie’s Bitcoin Miners ETF (WGMI).

Bitcoin Technical Analysis

Bitcoin has continued to float sideways-to-down as volatility contracts. This price structure will likely create strong headwinds for a move higher, but timing is uncertain.

Bitcoin / US Dollar, 1D (Tradingview)

The chart above displays the lower and upper bounds of BTC’s current range. ~$25,900 has continued to provide support for price, while the descending trend line has defined the upper bound of this channel.

As volatility more than likely continues to contract, the order book is built up above the current upper trendline. If buyers are able to hold strong at $25.9k, a strong break higher creates a crescendo of sellers capitulating to the buy side, and new buyers entering the fray.

This is the most likely scenario we see playing out for Bitcoin in the short to intermediate term. As previously mentioned, timing is unclear.

The chart above shows that we could continue to see Bitcoin move sideways well into July. That being said, a surprise from FOMC in June could be a catalyst for a break higher or lower sooner than expected.

Bitcoin On-chain and Derivatives

BTC caught a slight pump upon the (unsurprising) news that the debt-ceiling is, once again, being lifted. Other than that pump for ants, the past week has been relatively uneventful.

BTC is confidently holding above support at the aggregate cost-basis (realized price) of short-term holders. As STH RP continues its slow trend upwards, it is likely that BTC will, at a minimum, follow a similar path.

On-chain transaction volume is being dominated by short-term users. The chart below shows the % of on-chain volume based on the age of the coins being moved. Over 50% of on-chain volume is coming from coins moved in the past six months or less; a rate on-par with previous bull market peaks.

This is a solid indicator that demand for Bitcoin is increasing. And seeing such activity while the price is well beneath its previous all-time high, is a positive omen for what’s to come whenever the next bull market arrives.

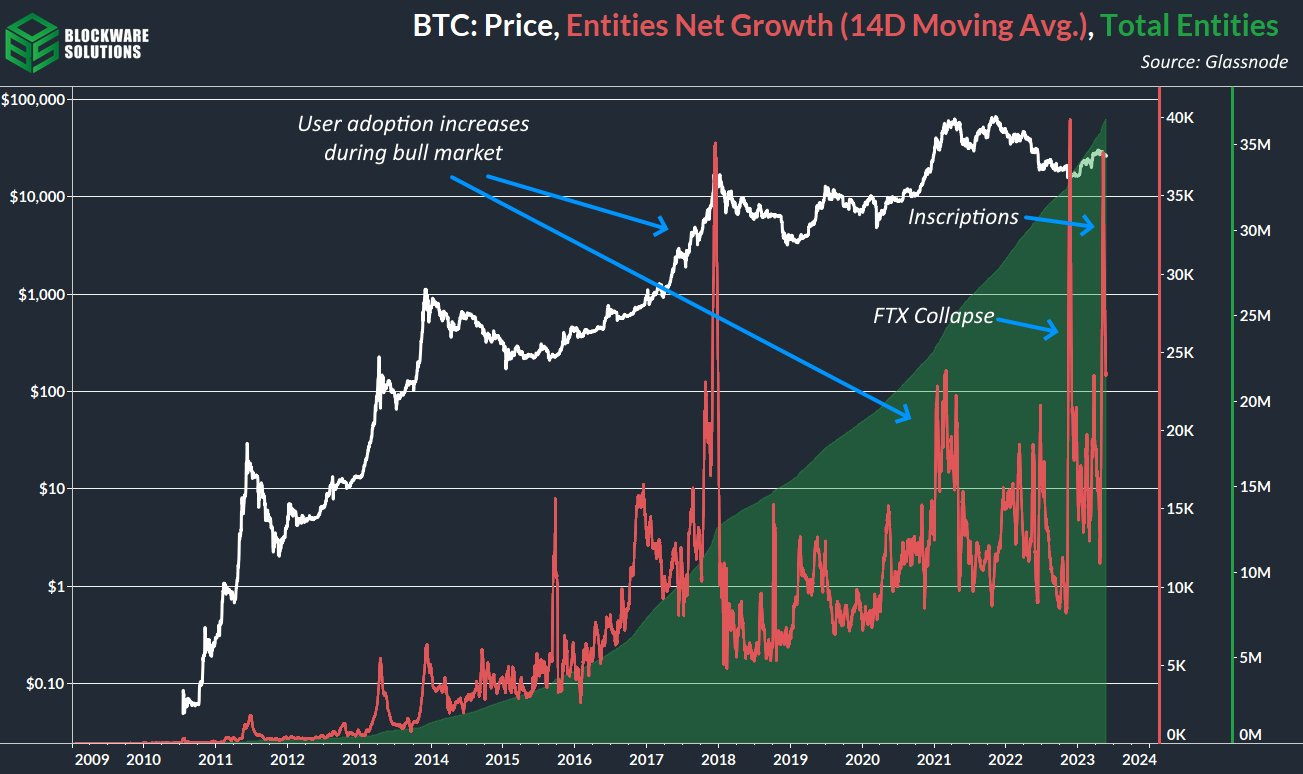

Another metric that is indicative of increasing demand, is entities net growth. While glassnode “entity” metrics are not an exact depiction of actual on-chain Bitcoin users, they are a solid estimate and can provide valuable insights into the trends and growth of Bitcoin adoption.

The significance of the chart below is that we can see three distinct points at which Bitcoin adoption has increased significantly:

Bull Markets

Collapse of Centralized Custodians (FTX)

Inscriptions

Bull markets are no surprise, “number go up” technology is Bitcoin’s most widely recognized feature. Second, the collapse of FTX made it clear why Bitcoin maximalists consistently declare “not your keys, not your coins.” This resulted in a frenzy of new on-chain users as it became clear that trusting centralized custodians to hold “your” BTC, is incredibly risky. Thirdly, inscriptions. Regardless of your opinion on the need for, or ethics of, inscriptions, this shows that people who use alternative “crypto” networks, will quickly flock to Bitcoin—the most secure and decentralized network—if features they desire are built on Bitcoin.

There’s no short term signal provided by this chart, but it’s interesting enough to share and it highlights an important point about Bitcoin.

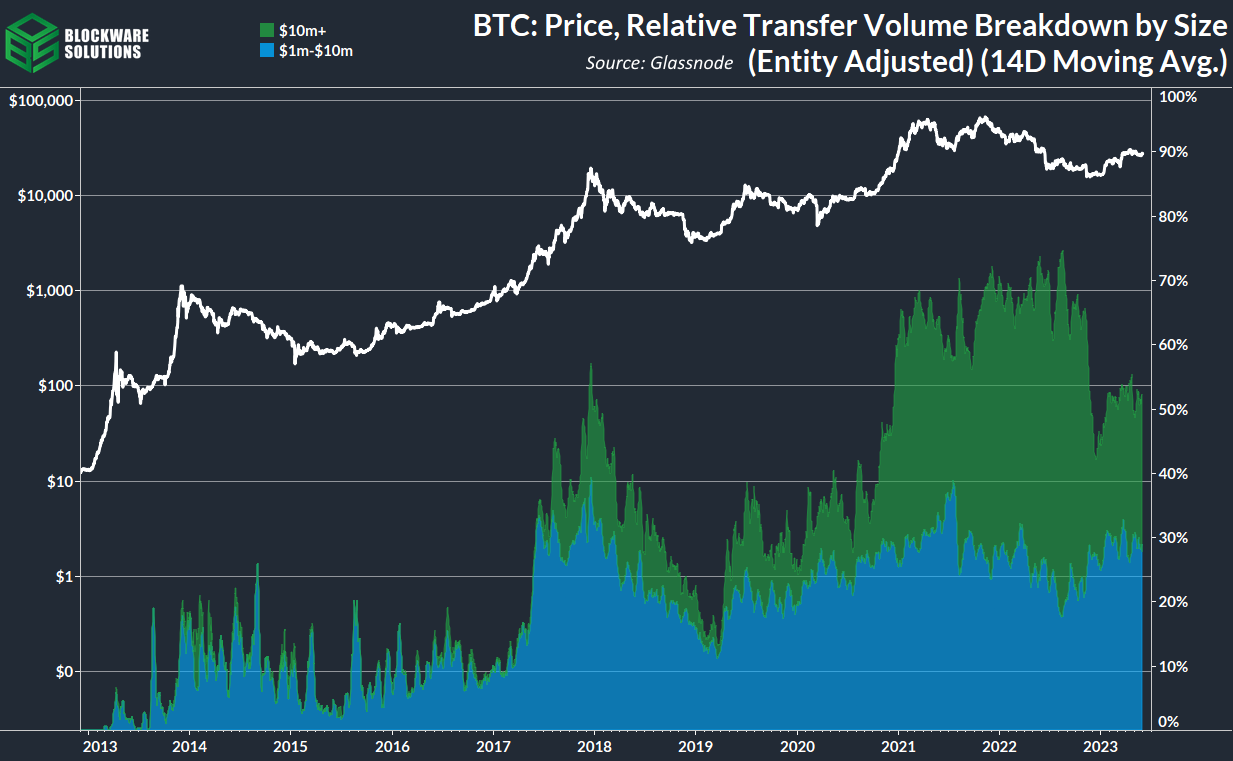

Over 50% of the transfer volume settled on the Bitcoin network consists of transactions of $1,000,000 or more.

This illustrates an important value proposition about Bitcoin as a means of global settlement. There is no other system in the world in which you could send millions of dollars worth of value across the world, at any time, to anyone, have final settlement occur within an hour, and only pay a few basis points worth of fees.

For businesses conducting global trade, it’s an absolute no-brainer that they should be using Bitcoin as the means with which to settle transactions. Even if they don’t want to HODL, merely using the rails of Bitcoin to move value is far and away the simplest and most cost-effective way to transact.

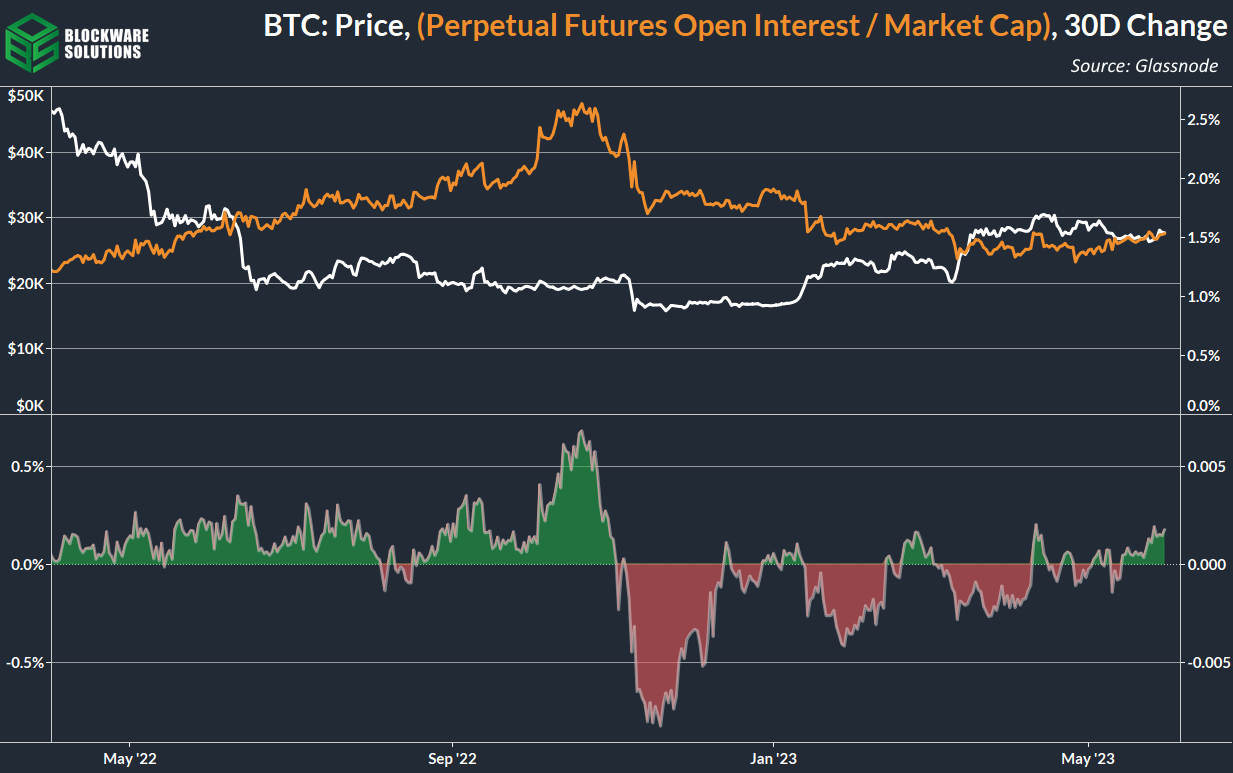

To close out this section we’ll take a look at derivatives.

Frequent readers know that, to gauge how leveraged a position the market is in, we like to look at perpetual futures open interest as a % of the total BTC market cap.

As BTC moves sideways with minimal volatility, non-expiring futures contracts can begin to accumulate as positions are not being liquidated. There has been a net-increase in open interest relative to market cap over the past month, the largest build up year-to-date. However, open interest still represents just ~1.5% of the total market cap, and, as such, the market is not vulnerable to a massive liquidation event at the moment.

Bitcoin Mining

Crushing Anti-Bitcoin Mining Legislation

Dennis Porter (@dennis_porter_), CEO and Co-Founder of Satoshi Action Fund, participated in an enlightening discussion on the Blockware Intelligence Podcast, shedding light on the demise of two significant pieces of anti-Bitcoin mining legislation.

Notably, these bills were intended to impose restrictions on Bitcoin mining activities, with one proposed at the federal level and another at the state level. However, both bills failed to gain traction and ultimately met their demise. Mr. Porter's insights provide valuable perspectives on the factors contributing to the defeat of these legislative measures, thus offering a comprehensive understanding of the current regulatory landscape surrounding Bitcoin mining.

View full episode here.

New Hut

The Bitcoin mining industry is currently experiencing significant consolidation during this bear market. Notably, Celsius, a bankrupt company, is undergoing the process of selling off its assets. Surprisingly, the highest bidder in this process is the Fahrenheit Group, whose name adds an ironic twist to the situation. US Bitcoin, a prominent investor in the Fahrenheit Group, is poised to acquire approximately $500 million worth of crypto assets, along with around 12EH/s worth of state-of-the-art Bitcoin ASICs.

Furthermore, this development builds upon the earlier announcement of a merger between US Bitcoin and Hut 8 in February 2023. If both of these deals successfully conclude, the resulting entity, dubbed "New Hut," will emerge as the largest publicly traded Bitcoin mining company worldwide. New Hut will operate a substantial hashrate of approximately 34.2 EH/s, constituting roughly 9% of the global network hashrate. This consolidation marks a significant milestone in the industry, consolidating resources and positioning the new entity as a dominant player in the Bitcoin mining landscape.

For more details read coverage on the HashrateIndex.

Energy Gravity

The presented chart, which is based on a Blockware Intelligence Report, depicts the correlation between Bitcoin's production cost and its market price. The model facilitates the identification of overbought or oversold market conditions for Bitcoin, making it a valuable tool for visualizing price trends.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.