Blockware Intelligence Newsletter: Week 123

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 3/2/24 - 3/8/24

🚨Buy & Sell ASICs on the Blockware Marketplace🚨

The Blockware Marketplace is the best way to start mining Bitcoin. All ASICs sold on the Marketplace are turnkey; which means you’ll be mining as soon as your Bitcoin transaction confirms on-chain.

Click here to sign up for the Marketplace and start mining Bitcoin.

Stamp Seed

With Stamp Seed’s DIY tool kit, you can hammer your seed words into titanium using professional metal stamping tools.

Titanium-stamped seeds are fire-resistant, crushproof, non-corrosive, and won't decay over time, unlike paper. Each letter is deeply stamped into a solid plate, ensuring no loose pieces.

Get 15% off a kit @ StampSeed.com with code BLOCKWARE15

ORCA VPN:

OrcaVPN is a virtual private network (VPN) service that encrypts your internet connection and hides your IP address, ensuring your online activities are private and secure.

No matter the device – Windows, Mac, iOS, Android, Linux, or Android TV, OrcaVPN stands vigilant.

Access OrcaVPN for $1.99 per month using the code: BLOCKWARE

1. Bitcoin All-Time High

After two-plus years of waiting, BTC eclipsed its previous all-time high of $69,000, albeit briefly and by the skin of its teeth. Unsurprisingly, there is a wall of sell orders at the previous high as previous top buyers looked to cash out at “breakeven.” BTC quickly dropped to right around $59,000, before equally as quickly recovering and consolidating in the ~$67,000 range. BTC made another ATH this morning, surpassing $70,000 before running into more powerful selling.

If you read the TA section in last week’s newsletter, you’ll notice that we anticipated this exact behavior. ~$59K as support followed by consolidation.

This is a great reminder that if you’re going to trade Bitcoin on short-time frames, and/or with leverage, proceed with extreme caution. Volatility wiped out leverage in both directions and now BTC will likely continue its trek upward as the brush has been cleared. You can be directionally accurate, but vicious candles like we saw on Tuesday and today can liquidate you and shake out weak hands.

2. Bitcoin ETF Flows:

The intra-day volatility on Tuesday was not in the slightest bit induced by panic among ETF buyers. In fact, Tuesday was the 4th highest day in dollarized flows since the ETFs launched; with daily flows coming in at ~$638 million. Moreover, the impact on ETF purchases does not ripple into the spot BTC market during trading hours, when the dip took place, as the authorized participants buy/sell the BTC during off-hours.

Source: https://heyapollo.com/bitcoin-etf

General Market Update

3. Bank Term Funding Program:

Can you believe it’s only been a year since the regional banking crisis? Bitcoin years feel like dog years. As it turns out, it is possible for “temporary government programs” to remain temporary. The BTFP is set to expire on Tuesday, March 12th; total usage has amounted to ~$163 billion.

It’ll be interesting to see how regional banks react to the expiration of this facility, which provided such a valuable lifeline this time last year.

4. New York Community Bankcorp ($NYCB):

New York Community Bankcorp, who acquired Signature Bank during the Banking Crisis last March, is already showing signs of distress, with a gnarly red candle on Wednesday. Investors are visibly weary of the liquidity of this regional bank, and such concerns will likely exacerbate upon the expiration of BTFP. We’ll continue to monitor the state of small and medium-sized banks as the tightening effects of “higher for longer” continue to stranglehold the financial sector.

5. US 2-Year Government Bond Yield:

Treasuries performed solidly across the board this week, with yields dropping on all maturities. The two-year yield is at ~4.503%, dropping roughly 30 basis points from its Monday high. We’ve yet to see the “re-inversion” of the 2/10y yield curve that many analysts look towards as a sign of impending recession.

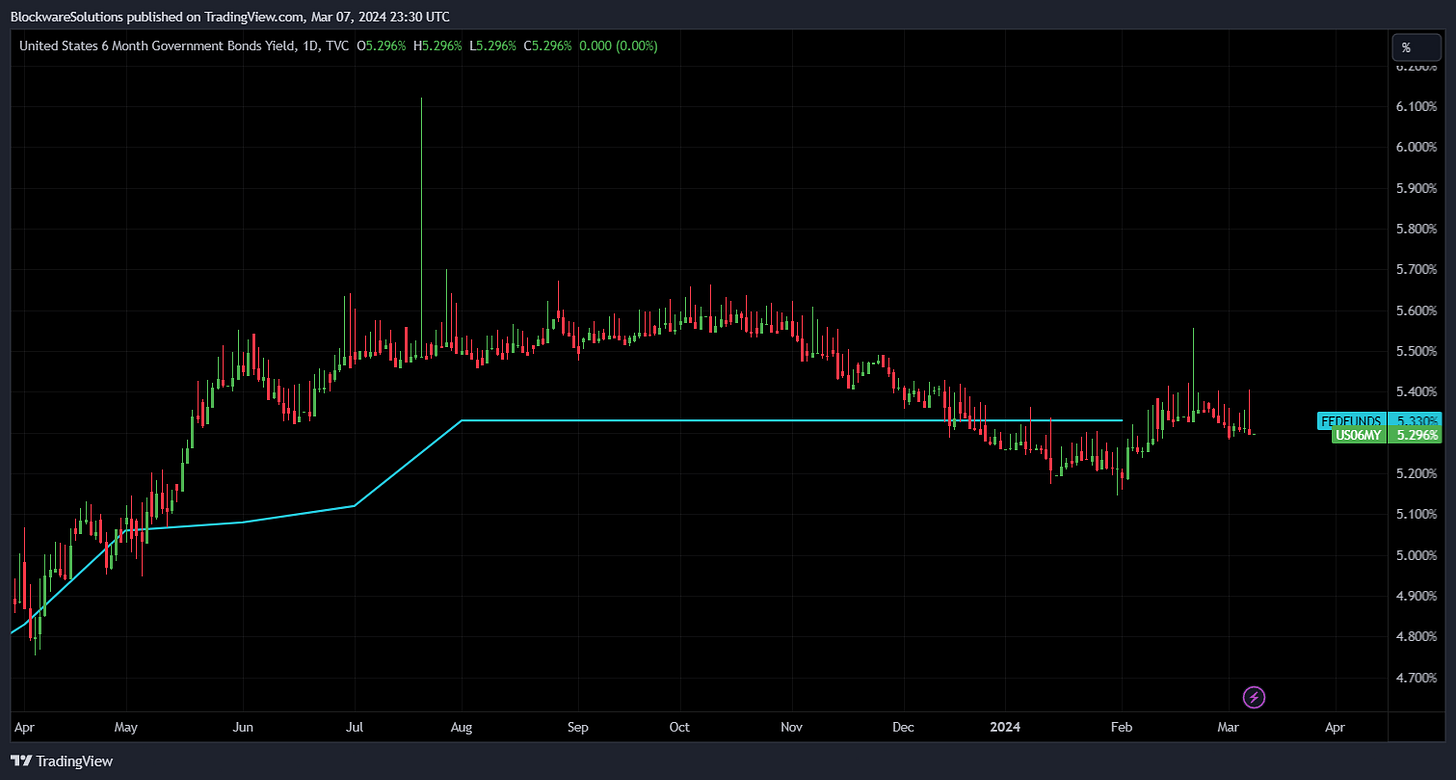

6. 6-Month Treasury Yield vs Fed Funds

As the most liquid capital market in the world, US treasuries provide a strong signal about investor expectations. The 6-month yield has been teetering above and beneath the Effective Federal Funds Rate, as investors are not 100% confident about when to expect the Fed to start cutting rates. Right now the 6-month yield sits just beneath the Fed Funds Rate, at 5.296% and 5.330% respectively.

Bitcoin On-Chain / Derivatives

9. Assets by Market Capitalization:

After recently usurping $META for the 10th largest asset by market cap, Bitcoin is now breathing down Silver’s metaphorical neck; temporarily eclipsing it during Tuesday’s breach of all-time highs. There are many dominoes left to fall as Bitcoin sets its sights on market cap parity with gold; a key milestone expected by many for this cycle.

10. BTC vs Other Asset Classes:

Bitcoin is more than just a unique asset, it’s an entirely unique asset class. As such, visualizing its potential path of monetization requires juxtaposition next to the entirety of other asset classes. Here’s where BTC is in comparison to gold, base money, equities, debt, and real estate.

BTC: $1.3T

Gold: $12T

Base Money: $30.4T

Equities: $108T

Debt: $303T

Real Estate: $326T

As you can see, we are still incredibly early. BTC grabbing merely 5% of these assets market caps will push BTC well north of $1,000,000 per coin.

In the depths of the 2022 bear market, we published a report analyzing the monetary premium of each asset class. Providing insight into the true total addressable market, should BTC become the de-facto savings technology of the world; reducing other asset classes to their utility value. Read that report here.

13. Market Cap vs Realized Cap:

While Market Cap measures the price of each coin multiplied by the circulating supply; Realized Cap does the same thing except it uses the price of each coin based on the time it was last moved, not the current market price. This allows us to view the total inflows into BTC; which currently is at a record high of ~$496 billion.

Bull markets in Realized Cap are effectively synonymous with bull markets in price; as new inflows push the market higher. Don’t fade this move in Realized Cap.

14. MVRV Ratio:

Extreme separation between Market Cap and Realized Cap shows a discrepancy between price and inflows; and may signal frothiness in the market. The MVRV Ratio is catching some steam. However, the bullish tailwinds that have propelled price up 208% year-over-year are not anywhere close to subsiding.

We’ll continue to analyze this metric during the bull market to gauge whether or not BTC is getting overheated.

15. Futures Liquidations:

Tuesday’s volatility, expectedly, induced a wave of liquidations, both shorts and longs. However, total liquidations amounted to insignificant numbers relative to the mania of last cycle’s bull market. Clearly, degenerate retail is sidelined at the moment, and more sophisticated and disciplined market participants are behind this rally.

15. Old Coins on the Move:

Some coins mined in 2010 were moved to an exchange address this week; presumably to be sold. This is price discovery in action. Given that the production of BTC cannot increase in response to demand, the only way for new buyers to find supply is to bid the price higher. Further price appreciation will be necessary to incentivize HODL’d supply to sell.

Source:

https://twitter.com/PlebSignalBTC/status/1765063288151580915

Bitcoin Mining

13. World Economic Forum Switches Tune on Bitcoin Mining:

The WEF published a video on their Instagram page highlighting the benefits that Bitcoin mining has brought to a community in Eastern Congo. In this video, they cited the job opportunities created by the project as well as its utilization of hydroelectric power. The WEF has previously published hit pieces on Bitcoin Miners and their energy usage. Just as Wall Street changed its tune on BTC as a financial asset, the establishment/mainstream narrative surrounding Bitcoin mining is moving in the right direction.

14. Hut 8 Facility Closure:

Hut8 is closing down its Drumheller mining facility, citing increasing energy costs as the primary catalyst for this decision. The overarching theme of Bitcoin mining in the future is the never-ending quest for the lowest-priced energy. Right now there are ~1.35 million BTC left to be mined. As competition to mine these coins increases, the need for low-cost power to profitably mine will increase.

When people say that Bitcoin miners raise energy prices for everyone else, they misunderstand this fundamental piece of information. Bitcoin miners don’t drive up energy prices. Bitcoin miners FLEE from high energy prices.

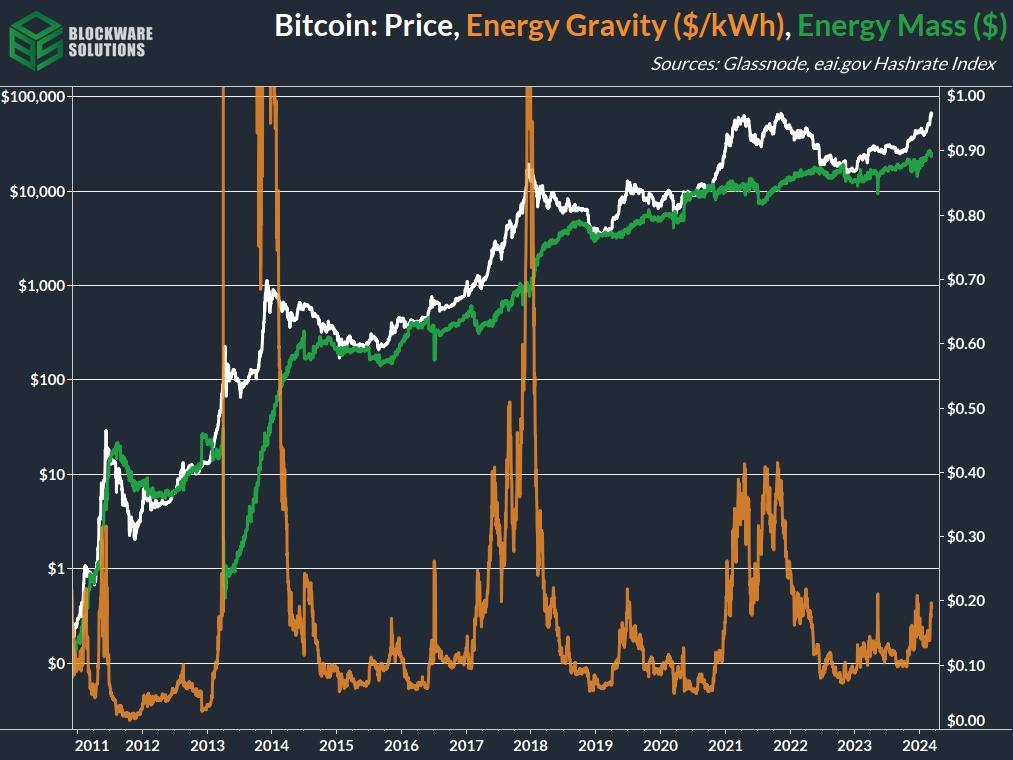

15. Energy Gravity: At a typical hosting rate today, new-gen Bitcoin ASICs require ~$25,464 worth of energy to produce 1 BTC.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Great information! Hopefully y'all never find yourselves in a situation like Hut8 🥲