Blockware Intelligence Newsletter: Week 64

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 11/12/22-11/18/22

Blockware Intelligence Sponsors

If you are interested in sponsoring Blockware Intelligence email: sponsor@blockwaresolutions.com.

Blockware Solutions - Buy and host Bitcoin mining rigs to passively earn BTC by producing blocks. Purchase new S19XPs today!

Summary

US PPI came in lighter than expected, arguably signaling to the markets that inflation is beginning to cool down.

We’re continuing to see debt levels rise in the US, likely signaling to the Fed that there’s still lots of work to be done to truly curb inflation.

It’s been a quieter week for the markets, and BTC is forming an apparent bear flag.

Bitcoiner’s have taken self-custody at record levels

The conviction of Long Term Holders was tested by the FTX fallout and they have held steadfast

ETH / BTC fails a re-test of it’s pre-merge local high

Hash ribbons and mining difficulty show that total network hash rate has clearly been stagnating since late October.

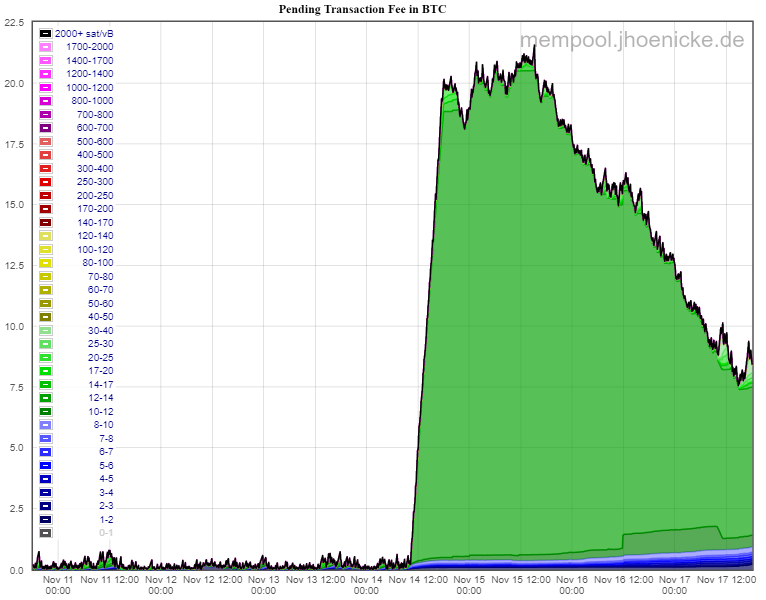

A massive spike in pending transaction fees (paid to miners) occurred four days ago.

General Market Update

After several consecutive big weeks of economic data, it’s been a relatively quieter week for the markets.

The biggest piece of data we received this week came on Tuesday with the US Purchasing Price Index (PPI) for October.

PPI is similar to CPI in that it attempts to measure inflation, with the difference between the two being the sector of the economy where inflation is being measured.

PPI uses a basket of produced goods to track their final sale prices across time, in comparison to CPI measuring the amounts spent by consumers.

For the month of October, PPI growth came in at 8.0% YoY and 0.2% MoM. This was lower than the market expectation of 8.3% YoY and 0.4% MoM.

This is potentially another signal that inflation is beginning to subside, but PPI is not quite in the same situation as CPI, as we discussed in this newsletter last week.

CPI is still seeing increasing MoM values, meaning that the declining YoY headline number is solely due to the fact that inflation was rising faster 1 year ago than it is today.

US PPI MoM Change (YCharts)

While PPI still had a positive MoM change in October, the declining rate of change for October is indicative of producer inflation beginning to cool down. As you may know if you’re a weekly reader of this newsletter, PPI is a leading indicator of CPI.

As the price of finished goods begins to rise from a production side, these higher costs spill over to the consumer at a lagging pace. Stocks trended higher on this news on Tuesday.

This week we also received data that shows that in the US, household debt rose at the fastest pace in 15 years in the 3rd quarter of 2022.

There is one main reason why this is a bearish signal for the markets. It signals that the Fed’s policy has been ineffective in affecting consumer spending behavior.

The primary goal of the Fed in 2022 has been to lower inflation by raising interest rates. Higher interest payments take money out of the hands of consumers, in order to lower demand and thus, lower prices.

Higher debt levels, largely the result of increased credit card usage and higher mortgage balances, is a signal that consumer demand remains strong in the US.

Put simply, when prices are higher, but Americans are spending at the same pace they usually do, we’ll see higher levels of credit card debt. Furthermore, higher mortgage payments increase the amount of outstanding debt in the system.

Increased mortgage balances was the biggest contributor to rising debt levels in Q3, adding $282 billion to the debt burden from Q2. Credit card balances rose by $38 billion in the same period, and 15% from Q3 2021.

The QoQ increase in credit card debt was the largest increase in over 20 years.

In summary, this data signals to us that the Fed may have to hold interest rates at high levels for longer than expected in order to lower consumer inflation.

What’s interesting is that despite the increase in spending, consumer sentiment is declining, according to the University of Michigan’s Index of Consumer Sentiment.

August and September were both months of increasing sentiment amongst American consumers, according to the survey. But, October and November have now both seen declining sentiment, with November’s MoM change coming in at -8.7%, and -18.8% YoY.

Inflation expectations amongst consumers were essentially unchanged, coming in at 5.1% expected inflation for the next 12 months, up slightly from 5.0% last month.

On the political side, it was announced on Wednesday that in the US, Republicans officially secured control of the House of Representatives. This came after Democrats cemented their control of the Senate on Saturday.

Gridlock in Washington has historically been good for stocks. Of course anything can happen, and investing based on election outcomes is generally a losing game, but the increased balance to policy and decreased political uncertainty that comes around election years does tend to lead to folks buying stocks.

That being said, the actions of the Fed, and other large market drivers such as inflation, will still affect the markets more. Therefore, don’t expect gridlock in Washington to magically cure the markets.

This week we’ve seen equity prices cooling off a bit, consolidating the gains made over the last couple of weeks.

S&P 500 Index 1D (Tradingview)

At the moment, there is no major cause for concern from the indexes. On Thursday, the S&P retraced back to its 10-day EMA, and so far, has been able to hold it.

CBOE Equity-Only Put/Call Ratio 1D (Tradingview)

As the index has pulled back, we’ve seen a steep decline to the put-call ratio, indicating that investors are betting that the index will head back higher.

There are two ways of looking at this:

Increasing sentiment among investors could provide more buying power into the markets, driving higher prices

More buying power could result in a capitulatory move lower if prices break key uptrends

As shown on the chart of the S&P above, a break through the lower trendline would likely result in an influx of sellers.

Furthermore, we saw increased selling occur on Thursday from the Treasury market. If this is to continue, it would likely result in a continuation lower for the equity indexes.

2Y Treasury Yield 1D (Tradingview)

As you can see above, the 2Y’s yield began heading higher again on Thursday after running into sellers around 4.3% yield.

On Wednesday, the spread between the yields of the 2 and 10 year maturity Treasuries reached its lowest value of the year, and its lowest since September 1981.

2-10Y Treasury Yield Spread (FRED)

Long story short, a negative 2-10Y spread has several adverse effects on the overall economy. Put simply, a higher yield for the 2Y treasury than the 10Y indicates that investors are more concerned about short-term economic conditions than long-term ones.

For this reason, a negative spread has historically been an accurate preliminary indicator of incoming recession. That being said, the gap between the spread flipping negative and the declaration of a recession can be long.

For those who would like to learn more about yield spreads, check out this Blockware Intelligence report from April titled “Bitcoin is Certainty in an Uncertain World”.

Scroll down to the section titled “Fixed Income Markets in Uncertain Macroeconomic Environments” for a full explanation of the yield curve, yield spreads, and their potential impacts on the broader economy.

Crypto-Exposed Equities

Generally speaking, it's been a quieter week for crypto-equities, as Bitcoin consolidates the losses made the last couple of weeks.

We are seeing several of these names continue to break down into YTD lows. Some of this likely has to do with the FTX situation and the recognition of counterparty risk in the market.

For those who missed it, we discussed this concept in this section of this newsletter last week.

From a technical perspective, there isn’t much strength to celebrate this week. A couple names, such as WULF, look RELATIVELY better, but still very weak overall.

How Bitcoin performs in the coming days will certainly determine what’s to come for these stocks.

Above, as always, is the table comparing the Monday-Thursday performance of several crypto-equities.

Bitcoin Technical Analysis

As previously mentioned, it’s been a quiet week of BTC price action. At the moment, BTC looks to potentially be forming a bear flag.

BTCUSD 1D (Tradingview)

Following the double digit losses made over the last couple of weeks, it’s not surprising to see that BTC has found some support and is consolidating these losses.

Whether we break higher or lower from here is anyone’s guess. If you’re an active reader of this newsletter you’ll know that by default, we assume that price is more likely to continue to follow the trend than not.

That means that it’s most likely that we see BTC break lower from this range, likely to test the 2019 highs around $13.9k. That being said, anything could happen and this bear flag pattern is quite obvious.

A break below $15.8k would be early confirmation of another leg lower here, with full confirmation coming at the YTD lows of $15.5k.

On the other side, a break above $17.7k would be a good indication of a move higher from this current range.

Bitcoin On-chain and Derivatives

The trend of self-custody has continued this week. The amount of BTC held by entities with .01 - 1 BTC has exploded well past any prior time period in Bitcoin history.

Outsourcing custody of BTC to other parties has been proven time and again to be a foolish and risky approach. This lesson has been branded into the minds of anybody paying attention to the Bitcoin and Bitcoin-adjacent industries this past week.

The 30 day net change in exchange balances has reached its lowest level of all-time; given we are only 2 weeks post-FTX-collapse and this is a 30 day metric, it’s likely to reach even lower levels.

The two most bullish long-term trends for Bitcoin, in my opinion, are 1.) BTC leaving exchanges and going into self-custody. This signals an increasing level of the market’s overall understanding of Bitcoin as well as diminishes the quantity of liquid supply. And 2.), increasing Hash Rate because the development of mining infrastructure represents a very low-time preference approach to Bitcoin with a serious financial commitment.

We have seen both self-custody and hash rate trend in the right direction this year.

Throughout this bear market we have been highlighting the conviction of long-term holders. One of the primary metrics for observing this behavior is the Supply of BTC Last Active 1+ Year(s) Ago.

It has officially been just over a year since the all-time high and 67% of the supply of BTC has not moved since. Thus far, the only major capitulation by this cohort was during the initial drop to $20k over the summer.

In the wake of the FTX fallout, capitulation from long-term holders has been more or less non-existent. A slight negative reading was recorded in the 1-week change of Supply that Hasn’t Moved in 1+ Year(s). This distribution from Long Term Holders was short-lived and certainly does not signal any sort of change in the conviction of the cohort as a whole.

New Entity Momentum compares the 30D moving average of new entities with the 365D moving average. When the former is greater than the latter, that indicates an increasing appetite for BTC; thus, momentum.

The 30D moving average has seen a recent uptick and if it can cross the 365D that will serve as a bullish signal.

ETH/BTC has failed a re-test of its pre-merge high.

This pairing has been trading sideways for the past-year and a half. Uncertainty looms surrounding ETH as the timeline regarding when users can withdraw staked ETH has become indefinite. Juxtaposing that with the increased demand for self-custody, and the ease with which that can be done with BTC, creates a clear distinction between the two assets.

Bitcoin Mining

Hash ribbons and a potential miner capitulation

Over the past few weeks, there has been significant talk about a potential upcoming miner capitulation. Core Scientific, Argo Blockchain, Stronghold Mining, Iris Energy, Northern Data, and other prominent public and private players have shown serious financial stress since this summer, but most still remain solvent and almost all have many of their assets operating (mining rigs and mining infrastructure).

With that said, it will be interesting to watch the next 3-6 months play out, especially if the price of BTC does not rebound soon. Since October 24th, mining difficulty has remained relatively flat even under dire conditions for mining BTC (low BTC price and rising energy costs). There certainly have been rigs turning off, but new rigs getting plugged in has been enough to offset that drop in hash rate.

If the price of BTC remains flat going into and through the winter it’s very likely that difficulty growth will continue to slow and potentially another wave of miner capitulation could commence. In the end, the weak miners will continue to be purged and only the strong miners will remain.

Bitcoin’s Mempool

The mempool is where unconfirmed Bitcoin transactions are stored by nodes until a miner includes them in a block. It’s a pool of pending Bitcoin transactions. Of course, there is a block size limit, to ensure anyone can run Bitcoin Core and store the entire blockchain on a fairly inexpensive computer. This block size limit prevents these transactions from confirming all at once.

Four days ago, we saw a large number of transactions broadcasted and added to the mempool. This led to a quick jump in pending transaction fees from all unconfirmed transactions. Total pending transaction fees jumped from ~ 0.4 BTC to 20+ BTC in a matter of hours. On-chain analysts have attributed much of these transactions to Binance, who is actively consolidating UTXOs and potentially preparing to implement some form of Proof of Reserves.

Below you can see the sheer size of the increase in pending transaction fees relative to the previous 365 days. The second largest pending transaction fees spike this year was back in May when Bitcoin sharply fell from ~ $40k to a local low of ~ $25k.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Great analysis as always. Thanks. :)

Thank You!