Calm before the storm

Weekly On-Chain overview of 7/9-7/15

Dear readers,

Hope all is well. Here are the high-level takeaways from this week:

- On-Chain activity is flat

- Volatility tightening

- 9.94% of Bitcoin’s money supply has moved between 31K-35K, 17.55% of Bitcoins money supply has now moved in this 31K-40K range

- Price continues to diverge from on-chain flows as re-accumulation continues:

* Another move up in Liquid Supply Ratio

* Exchange flows continue downtrend (-4,859 this week, -44,883 since highs in May)

* Miners accumulating

- Whale holdings are sideways since the big move up we looked at last week (no major selling or major buying from whales this week)

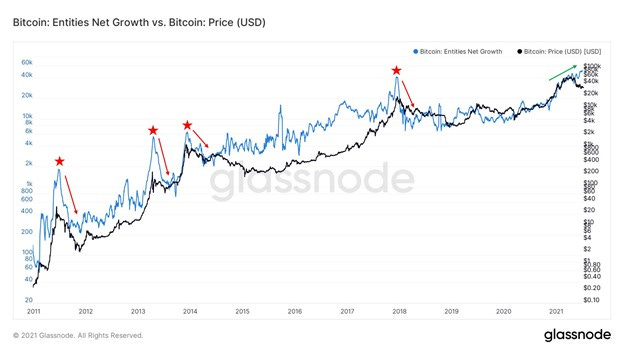

- More ATHs in net user growth, continues to grind higher

It’s now been 8 weeks of ranging. Volatility and volume have both dried up significantly. Using an indicator to identify volatility squeeze set ups from my good friend John Wick (pseudonym), you can see the Bollinger Bands tightening significantly as well as the orange shading from the indicator. (chart below) This orange shading is telling you that there is a big move coming. The last two of these squeezes occurred during the following times: July 2020 that propelled us to all-time highs, as well as in April 2021 that pushed us back down off all time highs. Each time, these squeezes took 1 to 3 weeks to resolve, so theoretically we could be looking at this big move in the next few days but could take up to those full 3 weeks. (doubt it) So what is there to take away from this? Big move is coming, but this does not give us information on the directionality of the potential move. For that answer, I think on-chain can provide us a lot of clues.

To tag on, another chart of the Bitcoin historical volatility index. Vol looks ready to show back up here as well.

An on-chain way to monitor exchange activity, transfer fees have gone flat and continue to trend down. Futures volume has been choppy trending downwards, while futures open interest has crept back up since lows on June 28th by $600M, although general trend has been sideways since May.

So, we’re watching for a big move, but what clues can on-chain offer as to the directionality of that move? Let’s first look at exchange flows, which have been a good indicator of broader trend shifts in accumulation behavior. One of the big narratives pushed at the beginning of this bull run was the depletion of coins off exchanges. This reversed from April to mid-May as waves of coins began flowing back onto exchanges to be sold and posted as collateral. Exchange inventories rose by 144,001 BTC in that time. Since May 18th, their collective balance is down by 44,883 BTC, with most of that drop occurring over the last 3 weeks specifically. This is a clear trend that has been going on for almost 2 months now, including this week with exchange inventories down 4,859 BTC.

A more qualitative way of looking at accumulation, we can analyze the spending behavior of the entities that those coins are flowing into. To do this, for a while we had been looking at Glassnode’s illiquid supply change metric, which is the 30-day change. This is the liquid ratio Willy helped me create(data from Glassnode of course): a bit more reactive and looks at the real-time movement of coins to or from illiquid entities. Yet another leg up in the ratio showing even stronger absorption of coins from speculative traders to long-term investors over the last week. Supply shock is still in play in my opinion.

Next up we have liveliness. This is a great metric for identifying broader trends. This looks at a ratio of coin days destroyed to coin days created. Here’s an easy way to think about coin days destroyed: 2 Bitcoins are sent into a wallet and don’t move for 5 days, 5 coin days accumulated. Then they are spent, 5 coin days are now destroyed. Looking at liveliness (ratio between coin days destroyed and coin days created), you can see a downtrend; showing accumulation. This downtrend has occurred during a few different market structures. This has marked the beginning of bear markets post-2011, post 2013, and post 2017. However, this also took place between 2013 double pumps as well as before the bull run began last year.

A third way to view accumulation, here is a look into the balances of miners. They continue to add to their BTC holdings again, up 3,280 BTC since lows in June.

Here is a distribution profile of UTXOs at different price levels. Between $31K-$35K, 9.94% of Bitcoin’s money supply has moved, whilst in the broader range between 31K-40K, 17.55% of its money supply has moved. A huge base of capital continues to form here at these levels.

Lastly, we have net entity growth. This has been grinding to new all time highs, exactly the opposite of what it has occurred (dropping off a cliff) while transitioning from each bull to bear market. A lot of talk lately about active addresses. Yes, that is trending down, because wallets create new addresses when they transact. So, by default, active addresses trends down when on-chain activity is flat. Entities and addresses are not the same thing. Entities uses blockchain forensics and proprietary Algorithms from Glassnode to cluster and identify what appear to be unique users.

In conclusion, a divergence of on-chain accumulation behavior just continues to grow stronger against sideways bearish price action. Now 8 weeks into this re-accumulation band, I suspect that we are getting close to this reabsorption of coins completing. That’s also why I’m closely watching the resolution of this volatility squeeze.

Recording tomorrow with David Puell for the podcast. I’m extremely excited about this, someone who’s deeply insightful and knowledgeable about on-chain and the Bitcoin market in general. Talk soon, cheers.

SPONSORED BY: Masterworks

What’s The One Thing in Hedge Fund Titans Portfolio That You’re Probably Not Investing In?

A-R-T. In fact, 84% of ultra-high-net-worth individuals collect art and collectables according to a 2019 Deloitte survey. It makes sense—contemporary art prices outgained S&P 500 returns by 174% from 1995 through 2020

And with the total art market expected to grow from $1.7 trillion to $2.6 trillion by 2026, it’s no wonder that the price of paintings has risen. But unless you have a cool $10 million lying around to buy a Picasso yourself, you've been locked out of this asset class.

Until now...

Masterworks has fractionalized investments in multimillion-dollar masterpieces by Basquiat, KAWS, and more—and you can be a part of it. If you're looking for a bespoke, nearly uncorrelated asset class, check out Masterworks. Recently, they sold their first Banksy work for a 32% annualized return for investors.

What about liquidity? They've got that too, a round-the-clock secondary market for your art shares. Start investing like the .01% today.*

*See important disclaimer

Really informative and clear. Great stuff, thanks Will!

I love how this post had explanations that would be beneficial to all levels of readers and learners. I took a way A LOT as I am in Bitcoin Kindergarten, Will. Thanks so much.