Blockware Intelligence Newsletter: Week 50

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 8/5/22-8/12/22

Blockware Intelligence Sponsors

If you are interested in sponsoring Blockware Intelligence email: sponsor@blockwaresolutions.com.

Blockware Solutions - Buy and host Bitcoin mining rigs to passively earn BTC by securing the network. Your mining rigs, your keys, your Bitcoin.

Know someone who would benefit from concierge service and world class expertise when buying Bitcoin? Give them one year of free membership in Swan Private Client Services ($3000 value) -- email blockwareHNW@swan.com and we’ll hook it up! (And yes, you can give it to yourself 🤣)

Be sure to check out Blockware Intelligence’s newest report titled “The Structure of Cyclical Markets: The Macro forces driving market cycles in Bitcoin and Traditional Assets”

Summary

July’s CPI data point came in at 8.5% headline YoY growth and 5.9% core.

A decline in gas prices, stemming from decreased demand, worked to offset increases in electricity, food and shelter prices to bring CPI down for the first month since April.

Despite being in a meaningless “technical bull market”, signs still point to a high probability of an extended pullback in equity prices in the coming sessions.

COIN, MARA and CLSK reported earnings this week, further illustrating the result that declining asset prices have on crypto-exposed companies.

Hash ribbons are indicating that a bottom is likely near for mining rig capitulation, as indicated by the 30-day MA of hash leveling.

Mining difficulty has also likely bottomed, which would be a second signal that validates the end of miner capitulation.

General Market Update

It’s been another wild week in the markets, with major updates to the macroeconomic landscape. This largely comes from the release of July’s CPI data point on Wednesday.

To reiterate what you probably already know, July’s CPI increased by 8.5% YoY but was down from 9.1% in June. Keep in mind that a rollover of extremely high CPI is generally a signal of a recession, not that we’re out of the water.

A decline in prices generally comes from the onset of a decline in demand. Declining demand results in declining economic activity, also known as a recession.

July’s consensus analyst estimates were for 8.7% YoY growth, and 0.2% MoM growth. Obviously, we undercut those estimates by 20bps both annually and monthly. It’s extremely important to understand that a drop from 9.1% to 8.5% is only a drop from “terrible” to “slightly less terrible”.

The moral of the story is that no secular inflationary pressures have truly been alleviated. We’re seeing relatively minor decreases in oil demand bring down CPI in the near term, but we are absolutely still in an inflationary environment.

As always, it’s important to break down the different pieces of the CPI basket in order to understand what’s driving inflation.

Above is a chart from the BLS that breaks down a few of the specific cohorts of CPI. As you can tell, energy costs still remain the key driver of >8% inflation.

Energy is an input to the production of any good you can imagine, so clearly if energy costs are on the rise, CPI probably is too. The energy cohort of CPI declined 8.7% in the month of July, from 41.6% YoY in June to 32.9% YoY.

A large driver of this decline was the cool off in gas prices we saw in July.

US Average Conventional Gasoline Price (FRED)

As you can see above, the US National Average Gas Price declined by $0.81 (16.72%) from its peak in July until August 1st. While this may appear to be a good sign at first glance, it’s apparent that this is a signal of a decline in consumer confidence and spending, which are recessionary indicators.

US Gasoline Consumption by Year (Dallas Fed/Reuters)

The decrease in gasoline prices can be chalked up to the decline in demand for gas in the month of July. This is clearly a signal that price has reached a point where Americans are simply choosing (or forced) to not drive instead of paying more at the pump.

This could be considered bullish or bearish depending on how you want to frame it. On one hand, the decline of consumer spending and confidence is likely a signal of recession, or that we’re not far from one. On the other hand, this recessionary signal means that the Fed’s policy is having its intended effect on the economy.

How you examine this data depends on which lens you view it from. From a corporate or employment perspective it’s not good, from an investor’s perspective it could be bullish.

Energy and food costs are the most volatile pieces of headline (regular) CPI. For that reason, it is also important to look at Core CPI (Regular CPI minus Food/Energy), to give us an understanding of what the foundational pieces of the market basket are doing.

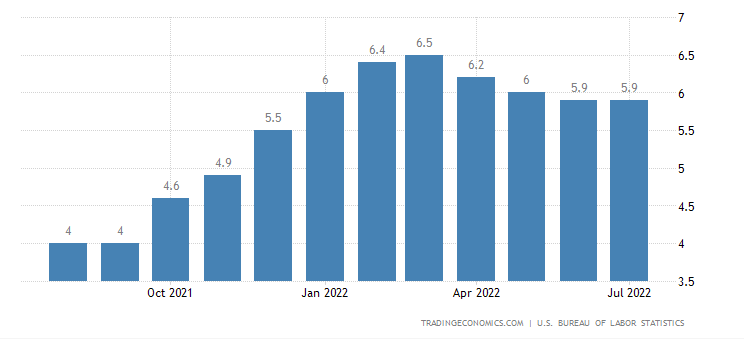

Core CPI YoY Change (TradingEconomics/BLS)

This month we saw Core NOT declining for the first time since March. This clearly signals that despite the decline in Energy costs, other components of CPI still remain heightened.

CPI Components 12-Month Change (BLS)

This chart, using data from BLS, shows us a few different components of CPI and their YoY price changes in July 2022. As previously mentioned, you can see the decline in gas and energy costs.

But still, we’re seeing electricity, food, and shelter prices rising. We’re also seeing a YoY decline in new vehicle costs, which is likely a signal of declining consumer discretionary spending.

All in all, everything previously mentioned in this newsletter can be summed up in two sentences: Inflation is unarguably still a serious issue, but declines in demand for gasoline have offset gains in other CPI cohorts, at least in the short-term. Declining CPI after making 40-year highs is potentially a good thing for investors, but a bad thing from the perspective of current macroeconomic health.

It should be noted, however, that previous inflationary environments rarely saw CPI going straight up. For example, the CPI spike from 1972-74 saw 5 total months where CPI was down. 1976-80 also had several months of declining CPI while on its run from 6% to 13%.

Producer Price Index YoY (BLS)

We also saw a decline in the Producer Price Index (PPI) in July. The difference between CPI and PPI is that CPI examines the prices paid for finished goods, while PPI measures the cost to produce those goods.

PPI serves as a leading indicator of CPI, as higher production costs eventually rollover into higher prices for consumers. PPI fell 1.5% in July, compared to CPI’s 0.6% decline.

This could be a validating signal for the narrative that inflation has peaked.

But as we previously mentioned, 8.5% CPI is still extremely bad for an economy, even if it is declining. Furthermore, what’s arguably more disastrous than an extremely high CPI would be if CPI remains elevated for a long period of time.

Having increasing prices for a shorter period of time is, of course, not a good thing. But what appears most likely, and more dangerous, is if prices remain high for many months. This simply works to drain American savings and compress corporate margins for several quarters.

Depth vs. Duration is a key relationship for many economic data points. There are strong arguments for which is more impactful on an economy, but the moral of the story is that neither is good. So far, we’ve seen large depth in the inflation category (high CPI values), but we’re also beginning to see the duration aspect take its grip on the economy.

It takes time for both consumers and companies to adjust to a new economic environment. For example, if the interest rate on your car payments are increased, you can probably afford the increased Cost of Debt for a period of time. But eventually, you’ll reach a point where you’ve drained your savings and have to cut spending on other things in order to afford the interest payments.

The time it takes for higher input, good, and interest costs to affect individual entities varies, depending on their unique financial health.

As we’ve discussed in this newsletter many times, it’s clear that higher costs are beginning to have serious effects on companies in Q3 2022. Most recently, this effect has taken the form of layoffs.

While unemployment still remains historically low, we’re seeing a continued uptick in Initial Jobless Claims and announcements of firing from large companies.

Initial Jobless Claims (FRED)

Last Saturday (Aug 6), we got the announcement of a YTD high for the number of individuals filing for unemployment benefits. 262,000 claims puts this unemployment metric at its highest value since November 2021.

Rising jobless claims is certainly significant, but arguably the most significant thing to watch right now is labor productivity. We described productivity and its role in economics in the first section of the most recent Blockware Intelligence report titled “The Structure of Cyclical Markets”.

Productivity is what drives the economy’s growth over the long-term. In periods of economic expansion, as companies have the resources to work smarter and harder, growth in productivity is what creates that expansion.

Nonfarm Business Sector Labor Productivity (FRED)

Declines in productivity are signals of a weakening economic environment. As you can see above, labor productivity from non-farming sectors is at an all-time low (or at least the lowest value since this metric was first measured in 1948).

The shaded vertical regions in the chart above are recessionary periods. Every time business labor productivity has undercut -0.7 (output/hour) in the last 74 years it was during a recession, or at most 1 year before recession (1957).

Currently, nonfarm business labor productivity sits at -2.5.

As we discussed last week, the bond market predicted peaking CPI. Yields peaked in mid-June, signaling a reemergence of demand for Treasury securities. This was a signal that investors were confident in the ability of the Fed to bring down inflation.

This week’s CPI number worked to validate the smart-money’s hypothesis.

Equities were a little slower to absorb the bond market’s confidence. But as of Wednesday, the Nasdaq is officially in a “technical bull market”.

A technical bull market is defined as when an index is >20% off its low. As of Thursday’s close, the Nasdaq is now 20.96% off its June 16th lows.

Don’t let the headlines fool you, this means absolutely nothing.

This is the same arbitrary argument that we’ve seen twice before this year. In the same way that being 20% off your highs doesn’t necessarily signal a bear market, and 2 quarters of declining GDP doesn’t necessarily signal a recession (more on that in July 29’s letter), being 20% off the lows doesn’t necessarily mean the bear market’s over.

Nasdaq Composite 1W 2000-02 (Tradingview)

Above is a weekly chart of the Nasdaq during the 2000-02 bear market. As you can see, there were 5 “technical bull markets” in the midst of the 32-month, 78% peak to trough decline. Investors even saw a 51% rally that ultimately resulted in new lows for the index.

Past price action doesn’t necessarily dictate future performance, but it is important to note historical precedents. And yes, the economic landscape of 2000 was very different from 2022, but looking at historical bear markets can train our eye on what we might see today.

2000 simply tells us that we need to be extremely patient before getting too far over our skis.

But, obviously, there would have to be a 20% rally at the beginning of every bull market. It’s a similar idea to the follow-through day in that: not every technical bull market starts a true bull market, but every true bull market starts with a technical one.

In this newsletter last week, we discussed how mega-cap tech names and the market indexes were extended and due for a pullback. This week we got the pullback, but it wasn’t deep enough to drastically change the overheated nature of the indexes.

It is possible that the short pullback to the 10-day EMA we got on the Nasdaq and S&P was all the indexes needed to continue higher. This would be a huge testament to the strength in equities at the moment.

What’s more likely is that we’re getting ready to pull back again next week. As we’ll examine, the Nasdaq ran into resistance around a key AVWAP on Thursday.

Volume Weighted Average Price (AVWAP) is a great tool to indicate both the trend and support/resistance areas. VWAP is exactly what it sounds like, the average price that a stock has transacted at when taking into account the number of shares traded at different prices.

A simple moving average only averages the closing price of a stock over X amount of periods. It gives us an average price, but it doesn’t take into account how much volume there was at those price levels.

VWAP allows us to see the “true average” price that investors have paid for a stock, ETF, crypto-asset, etc. Anchored VWAP (AVWAP) is used by choosing a starting point for the VWAP indicator and plots VWAP beginning from the chosen point.

AVWAP is a tool used by a ton of institutional algorithms which is why it is so useful.

I won’t explain all the in’s and out’s of AVWAP, but if you’d like you can check out this video by Brian Shannon (the GOAT of VWAP).

There are a ton of key places we can anchor VWAP to. Two of the most popular are previous resistance levels, and key calendar dates.

QQQ 1D (Tradingview)

On Thursday, Invesco’s Nasdaq ETF QQQ ran into resistance right around its year-to-date anchored VWAP. YTD AVWAP tells us the average price that investors have paid for QQQ in 2022 (since Jan 3).

This is a key place we would expect to see any security run into sellers. It provides fund managers and investors with the opportunity to tell themselves (or their investors) that they were able to take profits at a level consistent with the average Joe’s cost basis, despite being in a hard-penny environment.

“I sold at the average price paid by anyone for QQQ in 2022.”

While it’s certainly possible that the bid strength many equities have been showing will be enough to swallow this supply, it would appear more likely that we see another pullback heading into next week. But, of course, we don’t have the magic crystal ball and cannot predict the future (unfortunately).

Above we’ve also highlighted a few potential support areas if the ETF (index) does continue to pullback. Also keep an eye on the 10-day and 21-day EMA’s as areas where buyers could step in.

Crypto-Exposed Equities

Some of the biggest news in the crypto-exposed equity industry group comes from Q2 earnings reports from major players.

Coinbase Revenue (COIN Q2 Shareholder Letter)

Let’s start with Coinbase (COIN). Overall, it wasn’t a great 2nd quarter for COIN. Revenue was down 31% QoQ, and resulted in a net loss of over $1B for COIN in the 2nd quarter.

Furthermore, there was a loss of 200,000 users, resulting in a $92M (30%) decrease in QoQ trading volume, and $160M (63%) decrease in the total assets on their platform.

As you can see above, there was a $76M (62%) decline in retail assets on the platform, and $85M (63%) decline in institutional assets. But this was relatively in-line with the decrease in the overall crypto market capitalization.

In regards to the assets themselves, we actually saw an increase in the amount of Bitcoin held on the Coinbase platform.

$2M worth of Bitcoin was added to accounts on COIN’s platform, or a ~5% QoQ increase. On the other hand, there was a $4M (17%) decrease in the amount of Ethereum, and $3M (6%) decrease in the amount of other cryptocurrencies held by Coinbase users.

The significance of the increase in BTC held by COIN users shouldn’t be understated. Much of the decline in Assets on Platform can be attributed to the decline in the prices for these assets in Q2 (the total crypto market cap was down roughly 58%).

So the fact that the amount of BTC on COIN’s platform grew by 5% in Q2, despite spot price for the asset being down 56%, shows that, in aggregate, BTC holders have been buying the dip.

It’s our opinion that the blow up of the several cryptocurrencies, funds and lending platforms that we’ve seen in 2022 has worked exactly how Bitcoiner’s predicted. It further reiterated the value proposition of the only truly decentralized asset in the world.

Marathon Digital (MARA) also reported their Q2 earnings this week.

MARA reported revenues of $24.9M in Q2, which was a $26.8M (~52%) decrease from Q1. This decline in mining revenue resulted in a net loss of nearly $192M (-$1.75 EPS).

Much of this earnings decline can be chalked up to the decline in BTC’s price over the period and was “partially offset by the sale of equipment”. (AKA the miner capitulation that the Mining section of this newsletter has been discussing for months)

Furthemore, MARA mined 707 BTC in Q2, a ~44% decrease from Q1. Much of this is due to the increase in mining difficulty in Q2.

MARA also mentions that they’ve expanded their liquidity by increasing their credit capabilities with Silvergate Bank (SI). In July, they refinanced their $100M revolving credit line with SI and added an additional $100M in credit that is Bitcoin collateralized and matures in 2024.

All in all, these two earnings reports illustrate how a bear market affects crypto-related companies. Although it’s different for exchanges and miners, the squeezed margins that come as a result of lower asset prices is nearly universal.

On Thursday, we saw a lot of large downside reversal among crypto-exposed equities. This is a signal that these stocks are likely beginning to pullback from overheated levels.

Prior to Thursday’s reversal, a few of the names that have been showing strength relative to others in the industry group this week are: CLSK, HUT, IREN, MARA, RIOT, HIVE, GREE and CORZ.

CLSK 1D (Tradingview)

Cleanspark is the name that stands out the most this week, following Thursday where shares popped nearly 28% on volume that was 271% greater than its 50-day average.

This came alongside a couple news events for CLSK this week. First was that CLSK has acquired an active BTC mine in GA for $16.2M. This location adds an initial 1.1 EH/s (36MW) to CLSK’s mining capacity but the mine can be scaled up to 2.6 EH/s or 86MW.

The market clearly liked this news as most miners have been on the defensive, CLSK’s high levels of cash, and low debt, have allowed it to use the drawdown in asset and hardware prices to go on the offensive.

Also, on Thursday, CLSK announced their earnings for the 3rd quarter of their fiscal year (CLSK’s fiscal year ends on September 30th). Most significantly, CLSK announced an official pivot away from their previous operational activities (providing energy products to consumers) to being solely focused on BTC mining.

CLSK reported a $29.3M net loss in Q3, where roughly ⅓ of which can be attributed to the losses of abandoning previous operational activities.

But as you can see above, following the massive jump on Wednesday, the share price reversals across the entire mining group on Thursday hit CLSK especially hard. After gapping up nearly 12% on Thursday morning, it reversed to close inside of Wednesday’s range, at -4.68% on the day on +285% 50-day average volume.

Bitcoin Mining

66 Days into the Miner Capitulation

We are continuing to look at hash ribbons as a metric to quantify miner capitulation. The 30 day moving average of hash rate crossing below the 60 day moving average indicates that miners with old-generation/less efficient machines and/or high power costs are turning their machines off.

Hash ribbon cross-backs have historically occurred during Bitcoin price bottoms. The 30 DMA has bounced slightly this week and, while we are not out of the woods just yet, it is possible that the capitulation could be over very soon.

It is looking increasingly likely that we will see a second consecutive increase in difficulty. The next difficulty adjustment will occur in approximately five days on Wednesday, August 17th. The estimated difficulty increase for the next epoch is ~3.63%.

Two consecutive epochs of increasing difficulty is a good indication that the miner capitulation is near its end.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of a general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Miss Will's section.