Blockware Intelligence Newsletter: Week 90

Bitcoin on-chain analysis, mining analysis, macro analysis; overview of 6/3/23-6/9/23

Blockware Intelligence Sponsors

Stamp Seed’s DIY tool kit gives you the ability to hammer the seed words generated from your hardware wallet into commercial-grade titanium plates, using professionally designed metal stamping tools.

By hammering each letter into titanium, your words become one with the metal, meaning no loose pieces or varying materials that could fail under extreme conditions. Our plates are fire-resistant, crushproof, non-corrosive, and will not decay over time, allowing you to HODL for the long haul.

Use code BLOCKWARE15 for 15% off sitewide, valid through June 2023.

Summary:

The Securities and Exchange Commission sues Binance and Coinbase for the brokering of unregistered securities (“crypto”).

BTC Dominance soars, indicating capital flight from “crypto” into Bitcoin.

BTC price shows resilience in the face of seemingly negative news, as indicated by short-term holder realized price and realized losses.

Exchange withdrawals increase but at a rate paling in comparison to what followed the FTX implosion.

Retail sized entities smash buy the dip, yet again serving as an accurate signal for local bottoms.

The market looks ahead to next week, with May CPI/PPI and policy decisions from the Fed, ECB and BoJ.

The Canadian and Australian Central Banks both ended periods of paused interest rates by hiking 25bps this week.

Initial Jobless Claims rose to a 19-month high of 261,000 last week.

Market breadth has improved significantly this week, as the Russell 2000 indicates a shift in institutional risk sentiment.

Bitcoin’s total global network hashrate continues to increase, now sitting at 370 EH/s.

The breakeven electricity rate for a modern Bitcoin ASIC is $0.12/kWh.

At a typical hosting rate today, new-gen Bitcoin ASICs require ~$16,500 worth of energy to produce 1 BTC.

Bitcoin On-chain and Derivatives + Binance & Coinbase Lawsuit

What Happened?

The chaos that members of the Bitcoin and “crypto” markets became all too familiar with in 2022 has resumed this week as the SEC has taken legal action against Binance and Coinbase.

The two cases are different but the root issue is the same: “crypto” is a bunch of unregistered securities. Consequently, Binance and Coinbase are in hot water for selling these unregistered securities. “Crypto” tokens directly implicated as a security are highlighted in the screenshot below from the Binance lawsuit.

The primary difference between these cases is that, in addition to the offering of unregistered securities, the SEC claims Binance committed fraud against its users by wash trading; creating the illusion of high trading volume amongst the hundreds of unregistered securities trading on its platform.

Notably absent from the above list is “ETH.” However, in the Coinbase lawsuit, the SEC is seeking to restrict “ETH Staking” on the platform.

Contagion

It has been announced that Prime Trust, who was the custodial partner for Binance and a plethora of other Bitcoin and/or “crypto” exchanges, will be acquired by their rival company BitGo. This is not super surprising as Prime Trust laid off ⅓ of their staff earlier this year.

What are the implications?

A clear legal precedent has been set that any entity wishing to deal with “crypto” must be registered as a licensed security broker. Moreover, the US federal government has made a clear distinction between Bitcoin and “crypto” as asset classes. A lack of distinction by the government would not change the underlying fact that Bitcoin is a commodity and “crypto” is a security.

Exoterically, Washington, D.C. clarifying their position on this matter signals to institutional investors that Bitcoin, not “crypto”, is where they are safe to deploy capital.

Esoterically, this reveals that Washington, D.C. is fully aware of the fact that they are powerless against the Bitcoin network. As a truly decentralized and censorship resistant network, Bitcoin is immune to any constraints politicians may wish to impose upon it.

How have market participants responded?

“BTC Dominance” is a flawed metric “market capitalization” does not accurately represent the difference between Bitcoin and “crypto.” However, it can provide signal as to how capital allocators respond to news-based events.

Upon the announcement of the lawsuits BTC Dominance increased; for obvious reasons.

Bitcoin is the only digital asset safe from being labeled as a security, because it is the only digital asset that is not a security.

Anonymous founder, no CEO, no board of directors, no “product road map”, no promise of profits, no single entity capable of changing the protocol. Bitcoin is a commodity.

Bitcoin itself has held up amazingly well in light of recent events, maintaining the support level we have been observing: short-term holder realized price.

Let’s take a deep dive into how market participants have responded on-chain.

From an outsider's perspective, the announcement on back to back days of the SEC suing the two largest remaining “crypto” exchanges would seem devastating for Bitcoin. However, this is a bullish development in the long-term as it clears the muddy waters obfuscating the difference between a leaderless monetary system, and a pool of misallocated capital riding the tailwinds of a decade of ZIRP.

The resilience we have seen from Bitcoin in terms of price action is incredibly bullish for the short and medium term as well.

When looking at realized losses, the price drop this week is barely a blip on the radar. It stands that the worst of the capitulation is behind us, and the vast majority of the BTC supply is in hands that are unwilling to sell.

Firstly, we are seeing a surge of withdrawal requests from exchanges.Tuesday of this week saw a record high 96,446 unique addresses withdraw BTC from exchanges.

While many withdrawal requests are being initiated, in terms of sheer volume, exchange balances are not decreasing at nearly the same rate at which they were during the FTX implosion.

While part of the Binance lawsuit is in regards to commingling of funds between Binance and BinanceUS, a majority of Binanace’s operations occurs in other nations, and will likely remain unaffected through this lawsuit.

Total exchange balance decreased slightly, with a majority of that decrease coming from Binance.

The supply of BTC held by entities with .01 - 1 BTC has had a significant increase.

Retail sized entities have accumulated on local bottoms with remarkable accuracy during the past year, and it’s likely that’s the case this time as well.

A point to note that accumulation by retail sized entities aligning with BTC leaving exchanges is not necessarily a coincidence. One might not consider this increase in the supply held by retail entities as them “accumulating” or “buying the dip”, rather, they would argue it’s just them taking self-custody. I would argue that is the same thing. Bitcoin is not considered bought until it is withdrawn from the exchange.

Frequent newsletter readers know that we have been closely following the state of leverage within the market. As we head further in time away from the mania of the bull market, we are seeing a diminishing effect of leverage on the market.

Summing total short liquidations and total long liquidations we see a clear downward trend in the total amount of liquidations during periods of volatility.

Given that Binance is far and away the most popular platform for “crypto” derivatives, it’s likely that we will continue to see the market de-leverage. Especially considering the aforementioned claims by the SEC of Binance committing fraud against its users.

Lastly, we’ve seen a non-insignificant decline in stablecoin exchange balances.

For the most part, algorithmic stablecoins have shown to be very risky, and difficult for them to maintain a 1-to-1 peg with the US Dollar. As such, centrally controlled stablecoins, backed by US treasuries, have been the favorite amongst stablecoin holders. The implication of the BUSD stablecoin as an unregistered security in the Binance lawsuit presents a problem for all stablecoins and their issuers.

General Market Update

It’s been an interesting week as we head towards CPI and FOMC next week. We’ll also receive policy decisions from the ECB and BoJ next week.

Aside from the SEC crackdown on crypto exchanges, some of the biggest news this week surrounded monetary policy decisions from foreign central banks.

Primarily, the Bank of Canada ended a 4-month rate pause by hiking their overnight by 25bps to 4.75%. This came on the back of stronger than expected economic data points, such as consumer spending.

The Reserve Bank of Australia also ended a period of paused rates when they raised their market rate by 25bps this week.

On this news, yields for US Treasuries rose sharply on Wednesday, as investors saw an increased likelihood of another 25bps hike in the cards for the Fed next week.

As we discussed in last week’s newsletter, we saw a few different labor data points come in stronger than expected, pointing towards a strengthening labor market despite higher rates.

Initial Jobless Claims, 1W (FRED)

Yesterday we saw a bit of contradicting data, as Initial Jobless Claims came in higher than expectations, at 261.000. This is the highest print for this data point since the week of October 30th, 2021.

Because claims are so volatile, it’s also important to watch the 4-week moving average of initial claims. This is showing that claims have begun to tick higher, but nothing overly significant quite yet.

The next claims release is next Thursday, the day after FOMC. This will be a much watched release, and has potential to move the markets.

In terms of the global growth outlook, the World Bank believes that global economic growth will weaken through 2024. This coincides with data released this week showing a significant decline in Chinese exports.

As we head towards FOMC on Wednesday (June 14th), it’s important to note that we’re likely heading towards a choppy period for the Fed Funds Rate.

At the moment, the market has priced in a pause for the Fed Funds Rate for next week. But as you can see above, the futures market currently foresees another hike, and cut, in the cards for 2023.

That being said, November’s rate cut is being slowly priced out. Furthermore, these probabilities are based on current expectations of future economic conditions, and will almost certainly change by the time these meetings come around.

As previously mentioned, May CPI is also set to be released on Tuesday next week (June 13th). Current market expectations are as follows:

Headline CPI (YoY): 4.1% vs. 4.9% in April

MoM: 0.2% vs. 0.4% in April

Core CPI (YoY): 5.2% vs. 5.5% in April

MoM: 0.4% vs/ 0.4% in April

Following the news from the Canadian and Australian central banks, yields rose sharply on Wednesday. The 2-year topped out at 4.605% and the 10-year tapped 3.801%.

At the short end of the curve, the 1 and 3-month yields headed lower, as investors sought the short-term safety associated with these bills. Yesterday, short-dated yields continued lower, and were joined by the longer maturity bonds.

This came following the Initial Jobless Claims number discussed above. Because this data showed a potential weakening labor market, it leaves the Fed with the justification to leave the FFR at 5.25%.

In the equity market, breadth has begun to broaden this week, after several weeks of complete tech domination.

Percent of Stocks Above 200 DMA, 1D (Tradingview)

Taking a look at several WTF's, we can see that small caps have had a very strong week, so far.

iShares Russell 2000 ETF, 1D (Tradingview)

The Russell 2000, which tracks 2000 small cap equities, is currently up ~2.4% on the week, following several weeks of sideways price action.

In our opinion, this is the most significant piece of price action to update this week. Historically speaking, small caps tend to lead the market off the lows of a bear market.

Watching for strong bids for small caps can provide an indication of institutional risk sentiment. As riskier and less liquid names, these are generally avoided at all costs in a bear market.

While this doesn’t necessarily mean that the bear market is over, it is an encouraging sign. Heading into next week, watch IWM’s price action to track sentiment.

Bitcoin-Exposed Equities

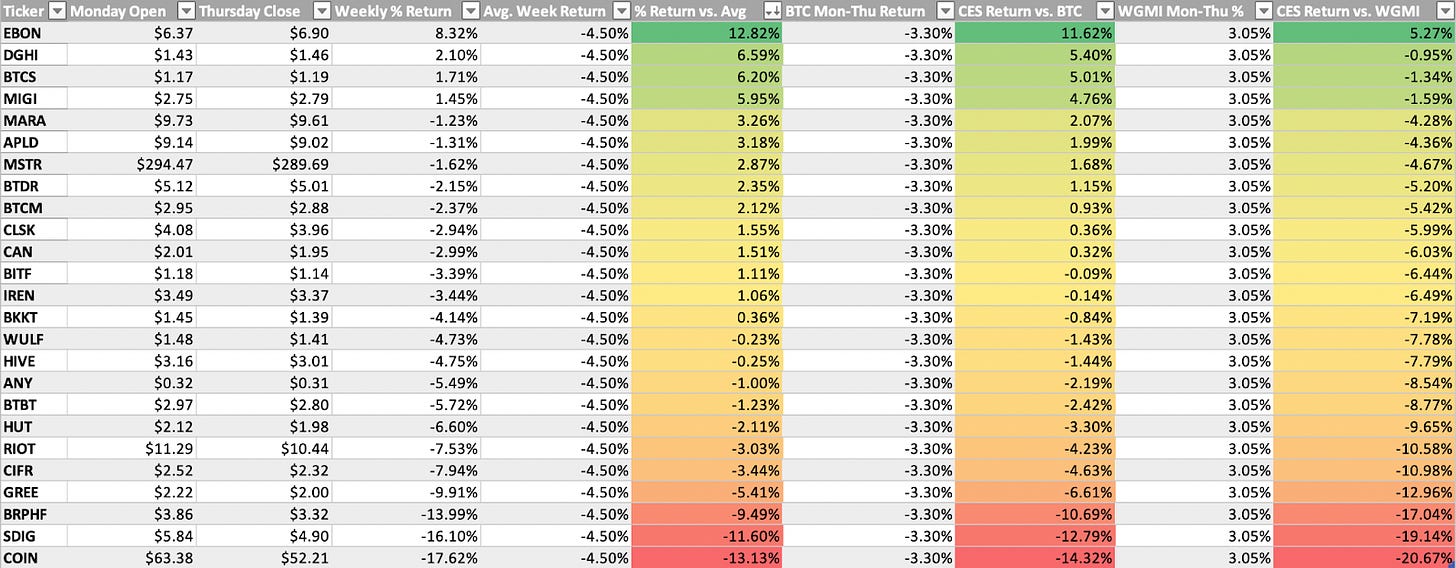

With the choppy Bitcoin price action this week, it shouldn’t be a surprise to see that we have a very mixed bag from Bitcoin-exposed equities.

Following the Coinbase news on Tuesday, it’s interesting to see the sharp recovery (so far) underway in this name.

COIN, 1D (Tradingview)

COIN gapped down on Tuesday morning, however, price reversed quickly and essentially not looked back.

It seems like this news was basically fully priced in after the Binance news hit the market. COIN had a tough day on Monday, closing down over 9% on the session.

Once their own news hit, seemingly everyone who would’ve sold due to fears about SEC crackdowns, had already done it. Price only had one direction to go, up.

Above, as always, is the excel sheet comparing the Monday-Thursday performance of several Bitcoin-exposed equities.

Bitcoin Technical Analysis

It’s been a volatile week for Bitcoin price action, largely stemming from the Binance, Coinbase, and foreign monetary policy news.

BTC/USD, 1D (Tradingview)

That being said, Bitcoin price structure is essentially unchanged from the area we discussed in this section last week. Despite the -5% day on Monday, price was able to hold these major support levels, and is now consolidating sideways (at the time of writing).

As mentioned last week, our base case is that we’ll likely see this sideways price action for some time. That being said, a surprise 25bps from FOMC next week has potential to break BTC lower.

If that’s the case, our team is looking at 3 levels for BTC to find support at:

YTD AVWAP @ ~$24,300

200-day SMA @ ~$23,450

VWAP Anchored from Nov. ‘22 Lows @ ~$21,800

Bitcoin Mining

Foreman Podcast

This week, we had the pleasure of hosting the Foreman team on our podcast, where we explored various aspects of Bitcoin mining and its future. Among the topics discussed were:

Evolution of Bitcoin Mining: We delved into the exciting realm of how Bitcoin mining is expected to evolve over the next decade. From advancements in mining hardware to the potential impact of new technologies, we explored the possibilities that lie ahead.

Energy Industry and Bitcoin Mining: One intriguing topic that surfaced was the hesitancy of the energy industry to fully embrace Bitcoin mining. We dissected the challenges and potential solutions that could bridge this gap, unlocking a wealth of opportunities for both Bitcoin and the energy sector.

2024 Halving and Miner Capitulation: As we approach the 2024 halving event, we examined the possibility of a large-scale miner capitulation. This discussion shed light on the potential effects it may have on the Bitcoin ecosystem and the strategies miners can employ to navigate these uncertainties.

Demand Response vs. Batteries: We also explored the differences between demand response and batteries, uncovering how these technologies interact with the mining industry and their implications for the future.

MicroBT vs. Bitmain: The podcast delved into the ongoing competition between MicroBT and Bitmain, two prominent players in the mining hardware industry. We explored the innovations, market dynamics, and implications of this fierce rivalry.

Intel and ASICs: An intriguing aspect we touched upon was Intel leaving the Bitcoin ASIC space. This discussion shed light on Intel's foray into mining hardware, and its potential impact on the industry.

The Growth Potential of Mining: Finally, we examined the question of how big the mining industry can actually grow. With the increasing global adoption of Bitcoin, we explored the potential scale and impact of mining operations in the coming years.

Hashrate Continues Soaring

The hashrate of the Bitcoin network continues its upward trajectory, driven by several factors.

Firstly, mining Bitcoin remains profitable, incentivizing miners to continue their operations and contribute to the settlement finality of transactions.

Secondly, older generation mining machines are being phased out, creating space for newer, more efficient machines to be plugged in. This results in an increase in hashrate for the same amount of energy consumption, contributing to the efficiency of transaction settlement.

Moreover, much of the infrastructure currently being constructed and completed was financed over a year ago, indicating a long-term commitment to Bitcoin mining. This investment in infrastructure reflects the confidence and belief in the continued growth and potential of Bitcoin as a savings technology.

Lastly, the falling prices of Bitcoin ASICs, have approached closer to their cost of production. This affordability has made mining accessible to a wider range of participants and improves the financial modeling calculations as the capital expenditure to purchase this hardware is now greatly reduced.

Bearing no significant further decline in the price of BTC and ignoring seasonality from miners enrolled in demand response programs, there is no reason to expect another wave of miner capitulations until the 2024 halving.

Texas A&M and Riot Platforms

Pierre Rochard, VP of Research at Riot Platforms, announced on Twitter that Riot and Texas A&M’s Blockchain & Energy Research Consortium have joined forces. This was after Texas A&M published research on the benefits of Bitcoin Mining and the energy grid.

Energy Gravity

The presented chart, which is based on a Blockware Intelligence Report, depicts the correlation between Bitcoin's production cost and its market price. The model facilitates the identification of overbought or oversold market conditions for Bitcoin, making it a valuable tool for visualizing price trends.

All content is for informational purposes only. This Blockware Intelligence Newsletter is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.